In this week’s Weekly S&P500 #ChartStorm we look at the developments in the banking sector, how it ties into the broader market, how weakness in the tech sector is interrelated with the SVB issue, and why this is all a logical progression of things. In the bonus chart section I include a couple of charts on global bank stocks, and thoughts on the next steps for global equities…

Q4 2022 hedge fund letters, conferences and more

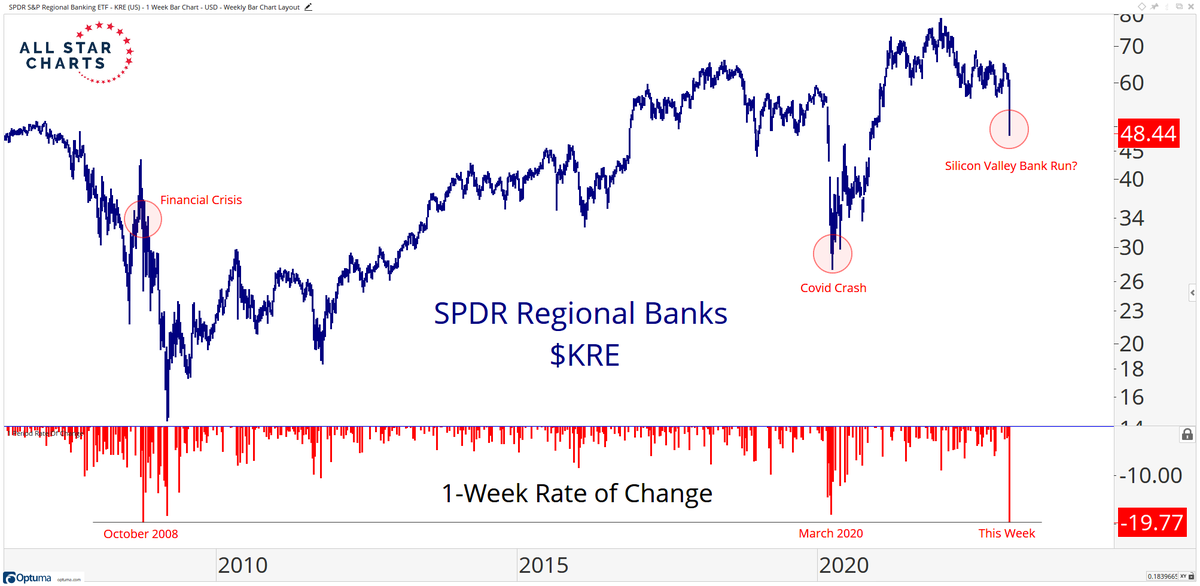

1. Banks Runover: At the risk of stating the obvious, the biggest development last week was the crash in regional bank stocks as Silicon Valley Bank went belly up. It is a story of both idiosyncratic risk (overexposure to one sector, poor risk management, repetition of past banking industry mistakes) and a sign and symptom of the wider macro cycle (inflation, monetary tightening, economic slowdown). On the latter aspect I regard this in the same light as the failure of FTX — in the wake of the 2020 global liquidity tidal wave a procession of bubbles were blown (tech stocks, crypto, SPACs, meme stocks, alternative assets), and it is only logical to expect a procession of bubble bursts as the monetary tides go back out, this is just another stone on the road.

Source: @sstrazza

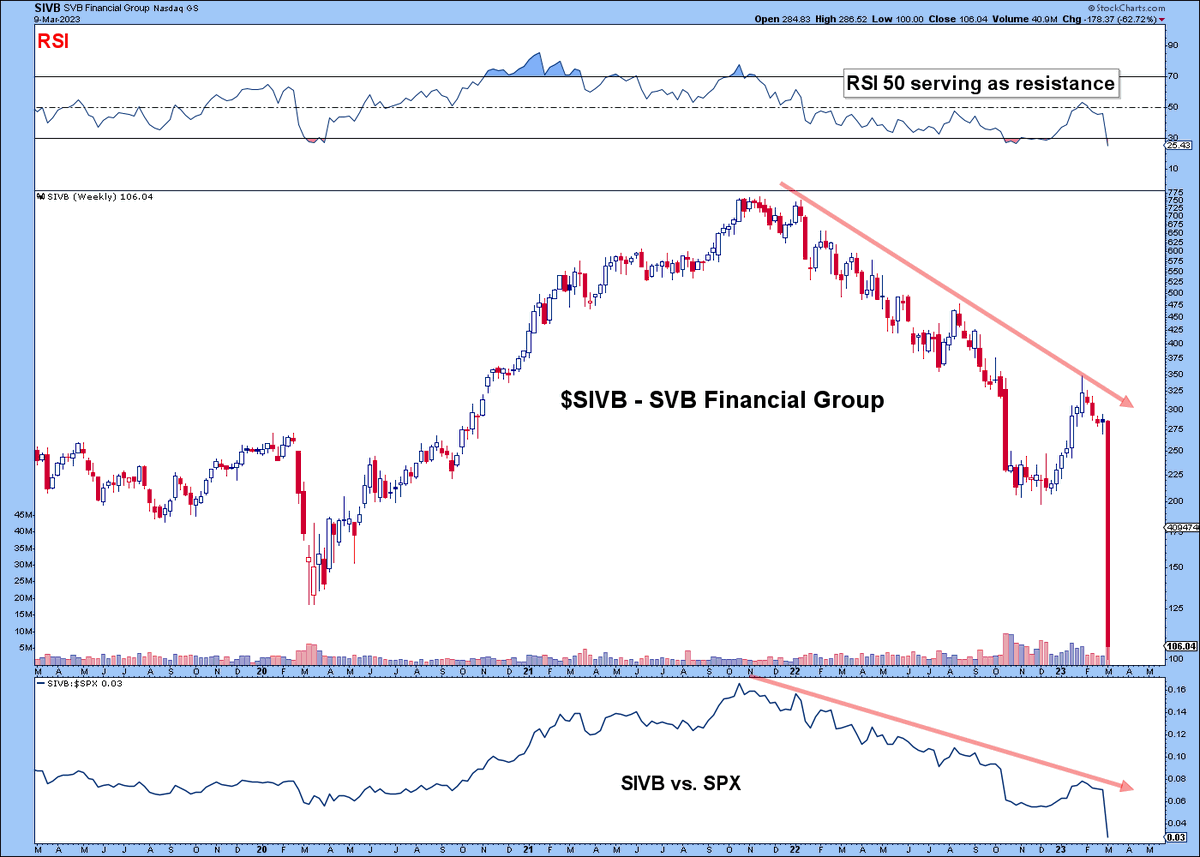

2. In The Price: I have to admit, I never followed this bank, nor frankly had I even heard of it, and when I learned about their business model I was actually shocked (long ago I did a masters in banking, I wouldn’t say I’m an expert, but I know enough about the history of the banking industry to know that you can’t reinvent the wheel — and crypto won’t solve it either!). But anyway, the curious point in this chart is that price would have told you just about all you needed to know! And again, we can basically track the monetary tides coming in on the way up and going out on the way down. If you know the technicals and the macro, you know probably about 80% of what you need to know!

Source: @HostileCharts

3. Disrespecting Support: Probably not surprising then to see all 4 supports taken out on Friday. The amount of GFC PTSD will mean most investors will be very skittish right now, and I’d expect to see further risk shedding… and hence probably we make a foray back to at least the June lows if not eventually all the way back to retest the October low. A rescue deal (most likely we will see some sort of arranged marriage and depositor liquidity plan within the next 24-48 hours) will probably be good for a bounce, but I think the damage to investor confidence is already done, and meanwhile the Fed is still on a hiking path.

Source: Topdown Charts @TopdownCharts

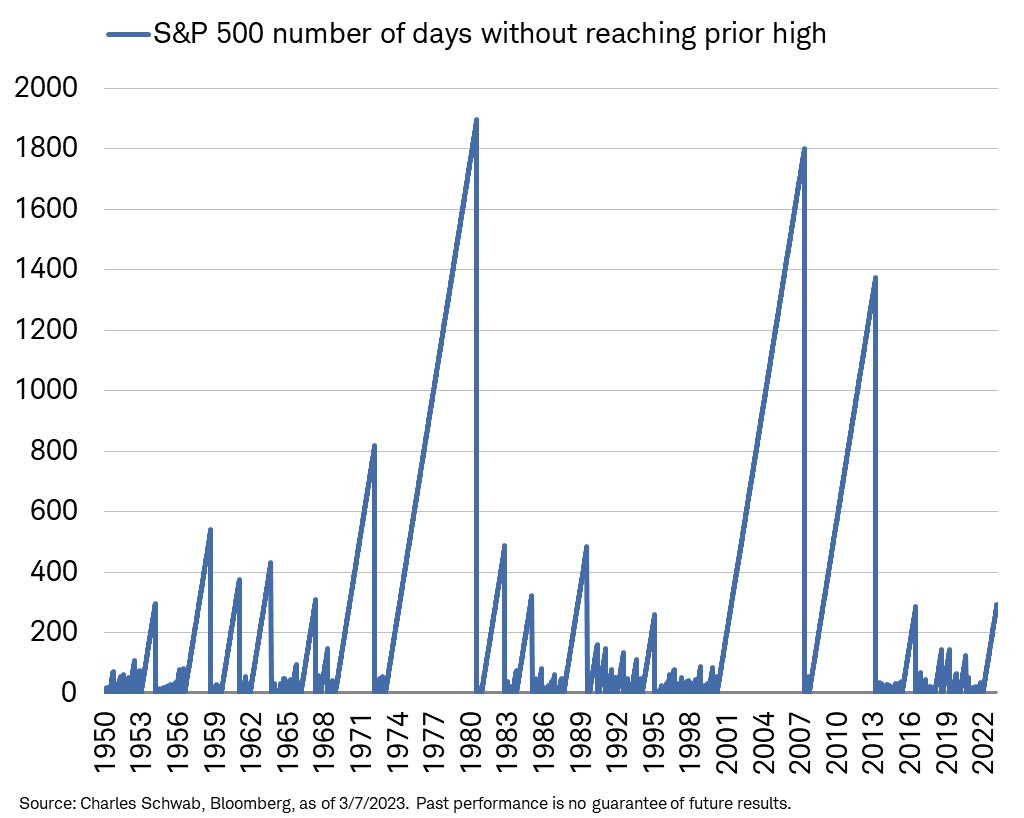

4. Bearings: Afterall, the macro/market dynamics are still consistent with bear market, and this chart presents a good illustration of how long and drawn out these things can be (chart shows how long it took for the market to reclaim previous highs).

Source: @LizAnnSonders

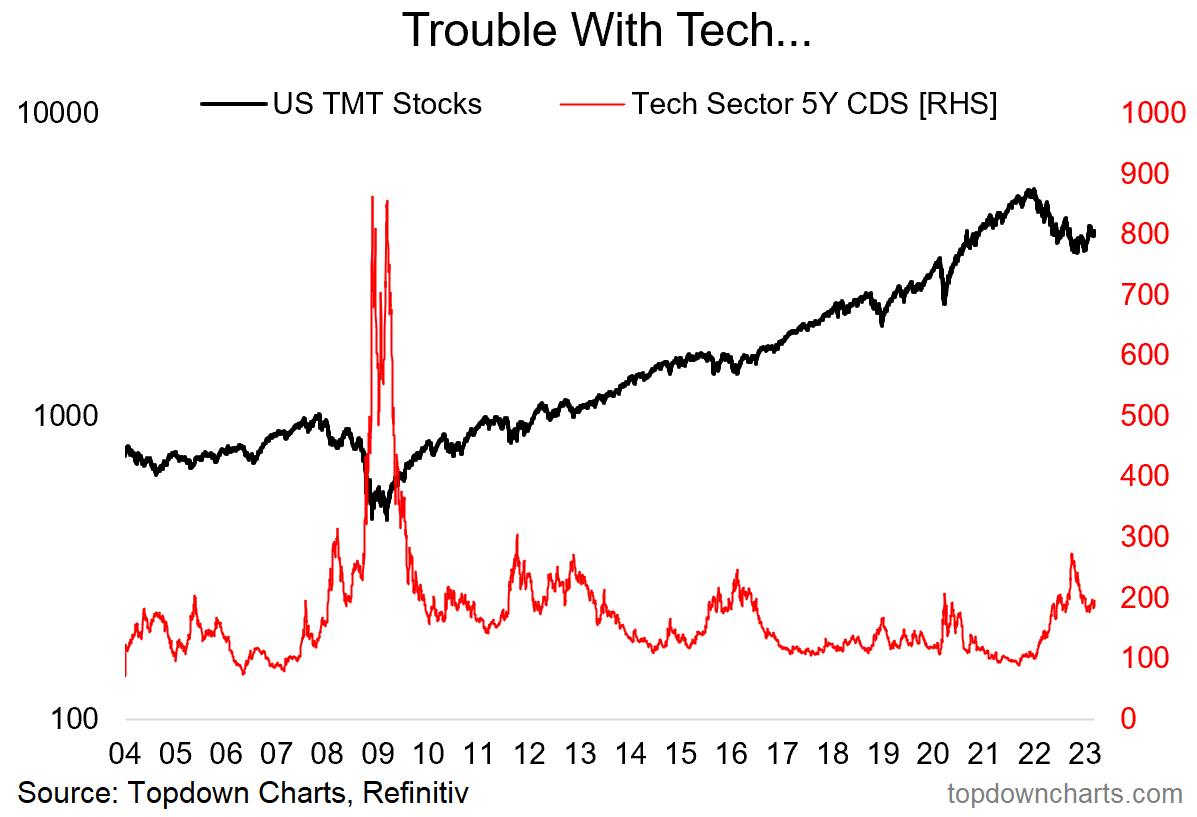

5. Technical Issues: One of the issues with SVB was its intentional strategy of focusing more or less exclusively on startups/tech sector. The tech/startup “ecosystem“ was one of the prime beneficiaries of the decade of cheap and freely available capital. With the transition from panic easing in 2020 to panic tightening in 2022, the rate shock has sent ripples across the tech sector, bursting tech bubble 2.0, and it’s probably not over yet.

Source: Topdown Charts @TopdownCharts

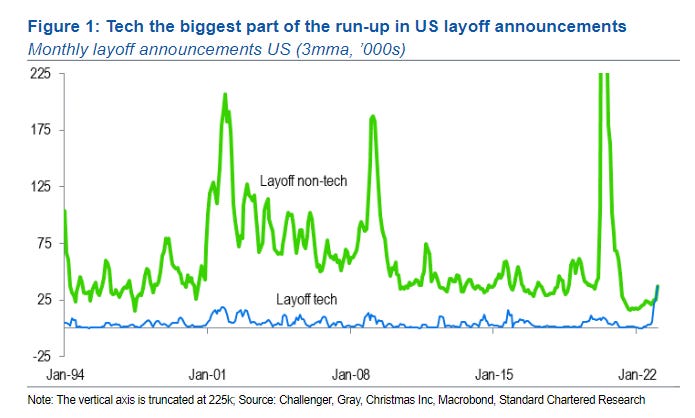

6. Tech Troubles: This chart is kind of shocking, while it is only one side of the story (doesn’t track hirings), the surge in tech layoffs is historically unprecedented. As alluded to above, the tech/startup ecosystem has not been tested by higher rates and a weakening economy. For a while there, tech stock earnings growth was almost independent of the economic cycle as market share expansion and tech adoption/disruption drove “structurally higher” earnings growth. But at a certain limit you can’t outgrow the macro… especially after the tech sector banked a one-off pulling forward of growth during the pandemic as stay-at-home force-accelerated a bunch of trends around tech adoption.

Source: @TheStalwart

7. Real Yields Real High Real Quick: One of the issues for macro and markets has been the sharp run up in real yields, which was almost twice the move seen during the taper tantrum in 2013 (and the current level is about twice the average of the ex-negatives period). Tech has been one casualty, but it’s not the only one…

Article by Callum Thomas.