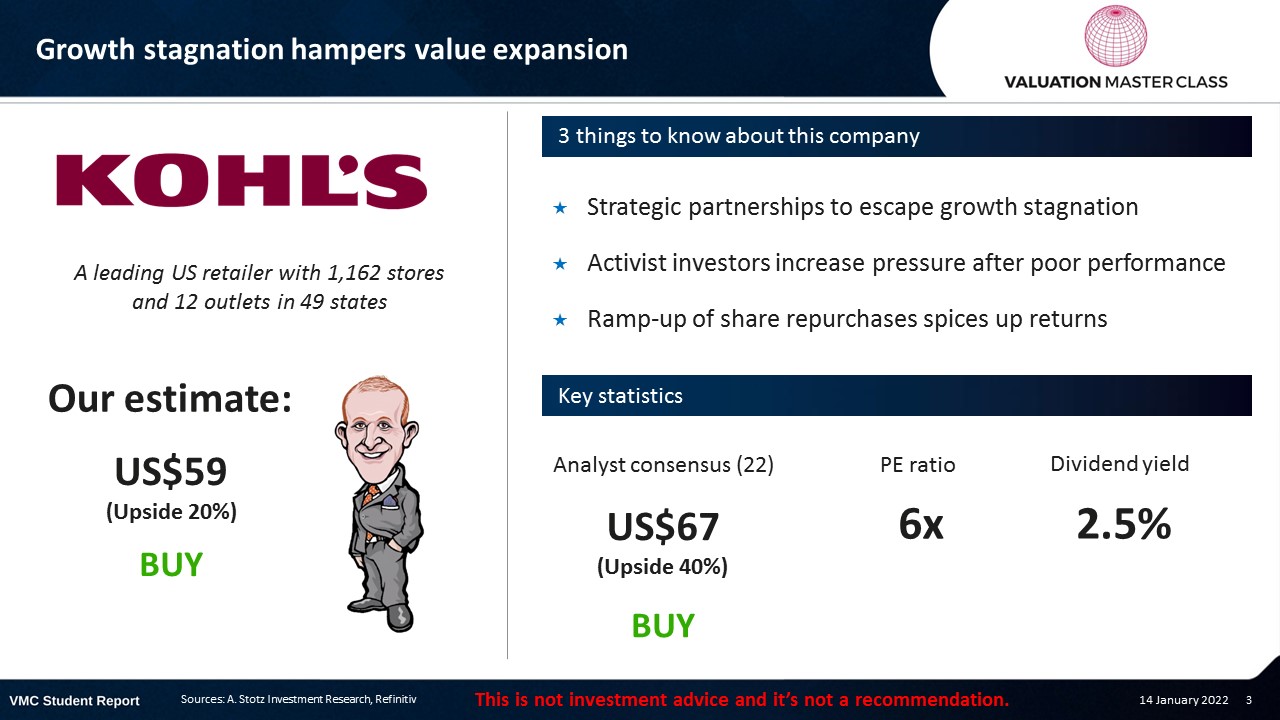

Growth stagnation hampers value expansion

The post was originally published here.

Highlights:

- Strategic partnerships to escape growth stagnation

- Activist investors increase pressure after poor performance

- Ramp-up of share repurchases spices up returns

Q1 2022 hedge fund letters, conferences and more

Download the full report as a PDF

Price signal unclear, volume is bearish

- Share price has been flat for years

- Recently, the 50 DMA has fallen below the 200 DMA

- Both lines converged leaving an unclear signal

- The RSI-Volume stayed below the 50%-line which suggest a bearish signal

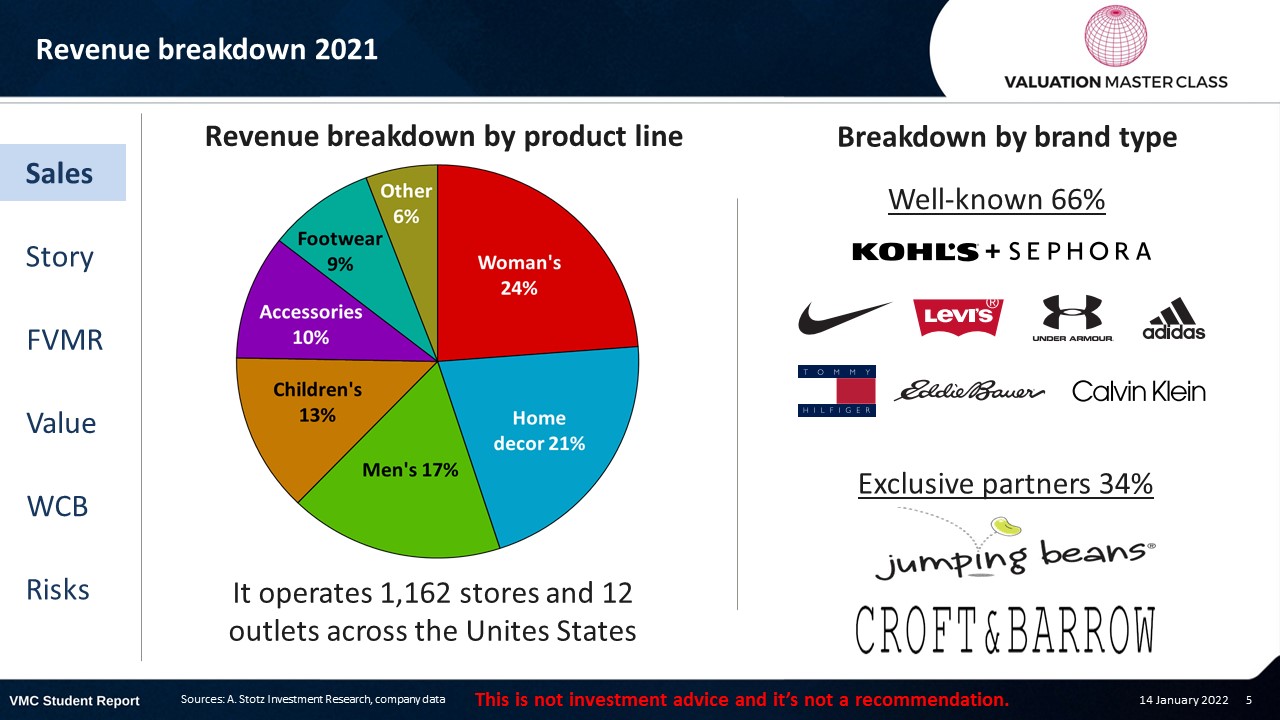

Kohl’s revenue breakdown 2021

Strategic partnerships to escape growth stagnation

- Kohl’s entered a partnership with largest US specialty beauty retailer, Sephora

- The agreement moves Sephora’s shops to Kohl’s locations

- With a 25m customer base, Sephora could bring more traffic into Kohl’s stores

- 200 Sephora stores already opened with an additional 400 planned by 1H22

- The partnership could bring Kohl’s revenue back to over US$20bn

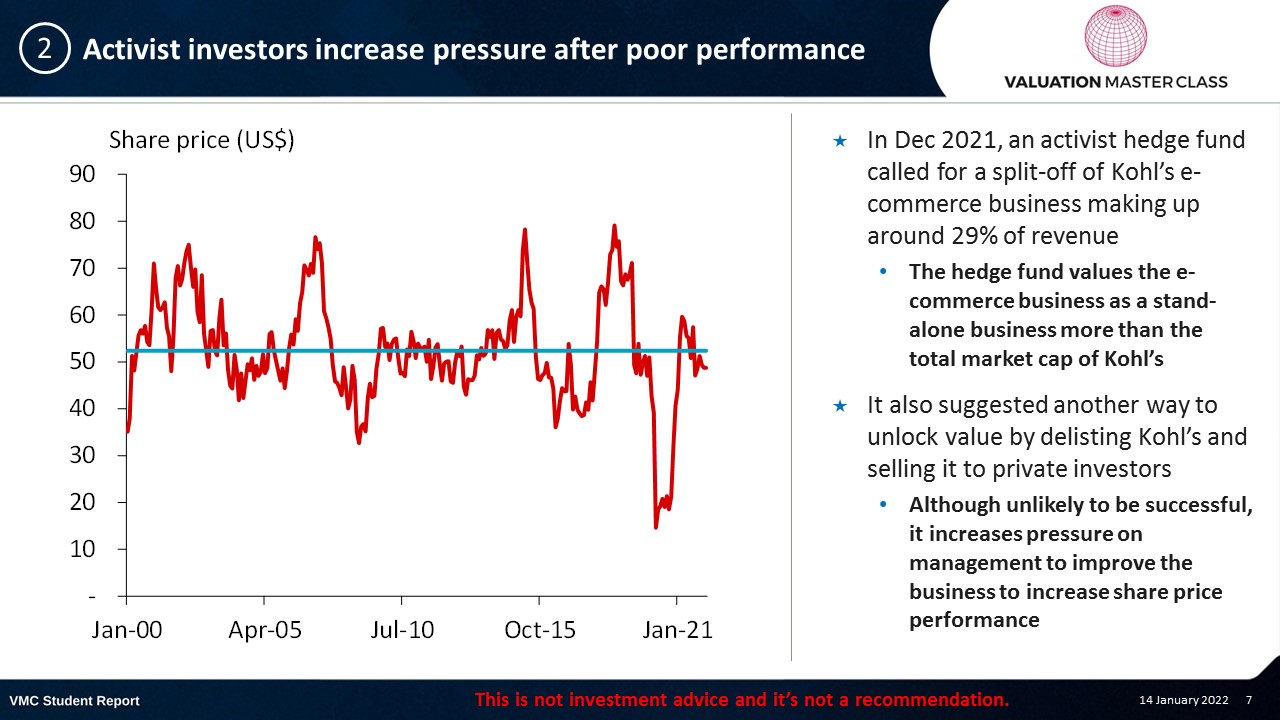

Activist investors increase pressure after poor performance

- In Dec 2021, an activist hedge fund called for a split-off of Kohl’s e-commerce business making up around 29% of revenue

- The hedge fund values the e-commerce business as a stand-alone business more than the total market cap of Kohl’s

- It also suggested another way to unlock value by delisting Kohl’s and selling it to private investors

- Although unlikely to be successful, it increases pressure on management to improve the business to increase share price performance

What is an activist investor?

- Activist investors are an individual or group of investors with a significant stake in a company, who aim to influence or make material changes to how the business is run. Changes like:

- Board composition

- Share repurchases and dividends

- Advancing ESG issues

- Privatization of the business

- Spin-off of business segments

- Divestitures of inefficient segments

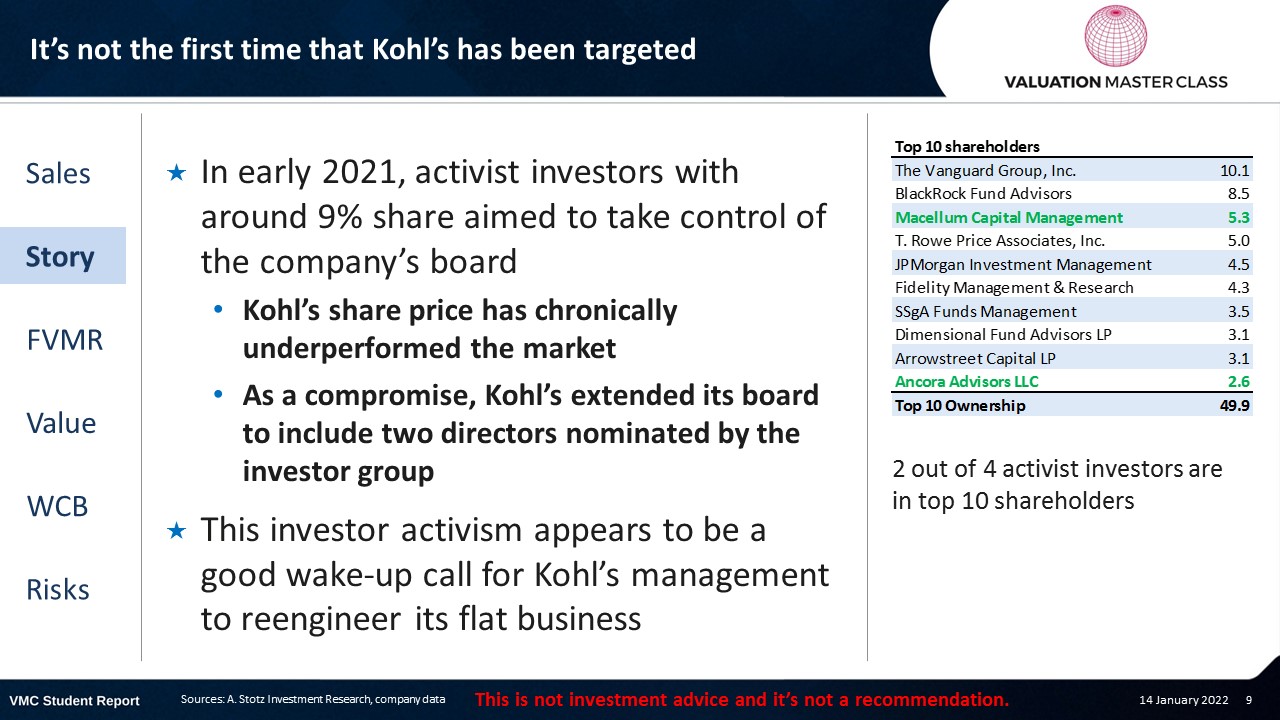

It’s not the first time that Kohl’s has been targeted

- In early 2021, activist investors with around 9% share aimed to take control of the company’s board

- Kohl’s share price has chronically underperformed the market

- As a compromise, Kohl’s extended its board to include two directors nominated by the investor group

- This investor activism appears to be a good wake-up call for Kohl’s management to reengineer its flat business

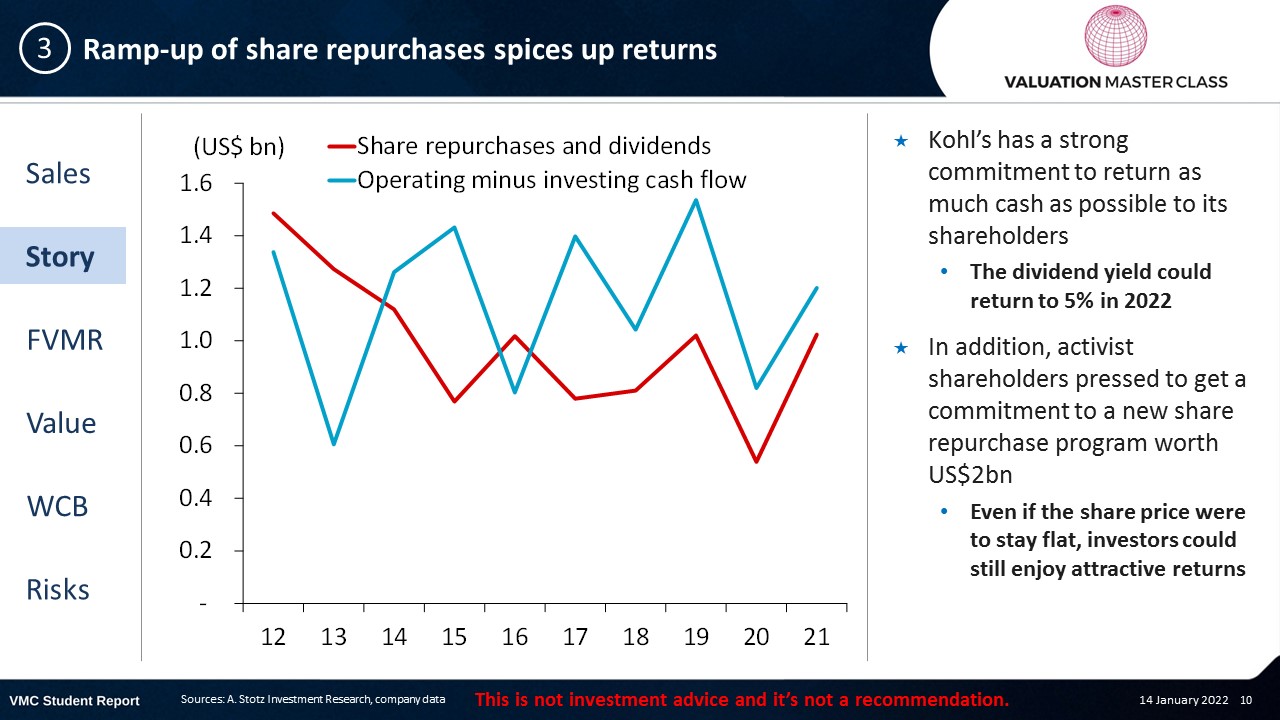

Ramp-up of share repurchases spices up returns

- Kohl’s has a strong commitment to return as much cash as possible to its shareholders

- The dividend yield could return to 5% in 2022

- In addition, activist shareholders pressed to get a commitment to a new share repurchase program worth US$2bn

- Even if the share price were to stay flat, investors could still enjoy attractive returns

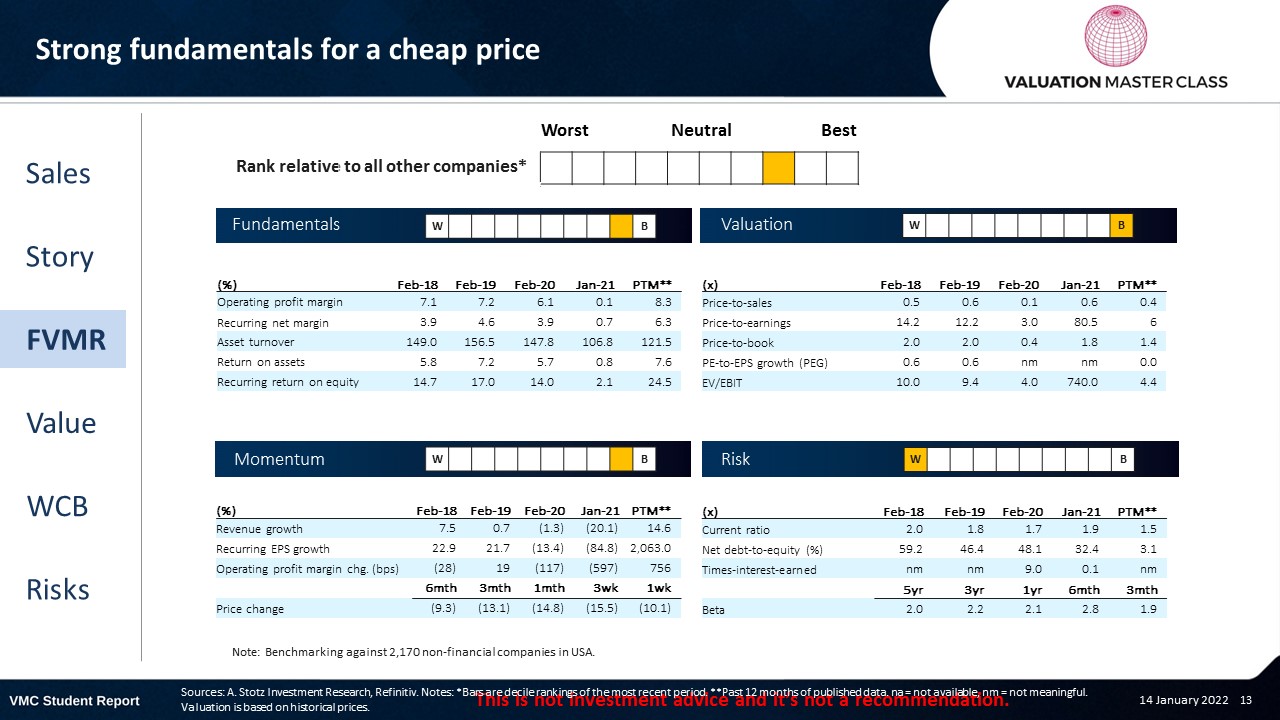

FVMR Scorecard – Kohl’s

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus remains cautious but sees upside

- Most analysts still have HOLD recommendations

- The poor share price performance over the past two decades has made analysts skeptical

- They forecast that the increased profit margin is likely to fade over the next two years

Get financial statements and assumptions in the full report

P&L – Kohl’s

- Net profit has a strong rebound and exceeds its pre-pandemic level

- The strong bottom-line is mainly driven by the margin expansion

Balance sheet – Kohl’s

- As of 2021, the company holds a record US$2bn in cash which it will distribute to its shareholders over time

- The company continues its massive share repurchase program which is the main driver of increasing EPS over time

Cash flow statement – Kohl’s

- Strong operating cash flow allows the company to pay out dividends which are in line with its pre-pandemic policy

- We expect that the dividend yield over the near-term to range between 5-6% like in 2019 and 2020

Ratios – Kohl’s

- After the revenue rebound in 22E, we assume revenue growth to normalize

- Going forward, we see poor revenue growth potential between 2-3%

- EBIT margin expansion in 22E probably only short-lived

- Going forward, we see the EBIT margin to range between 7-8%

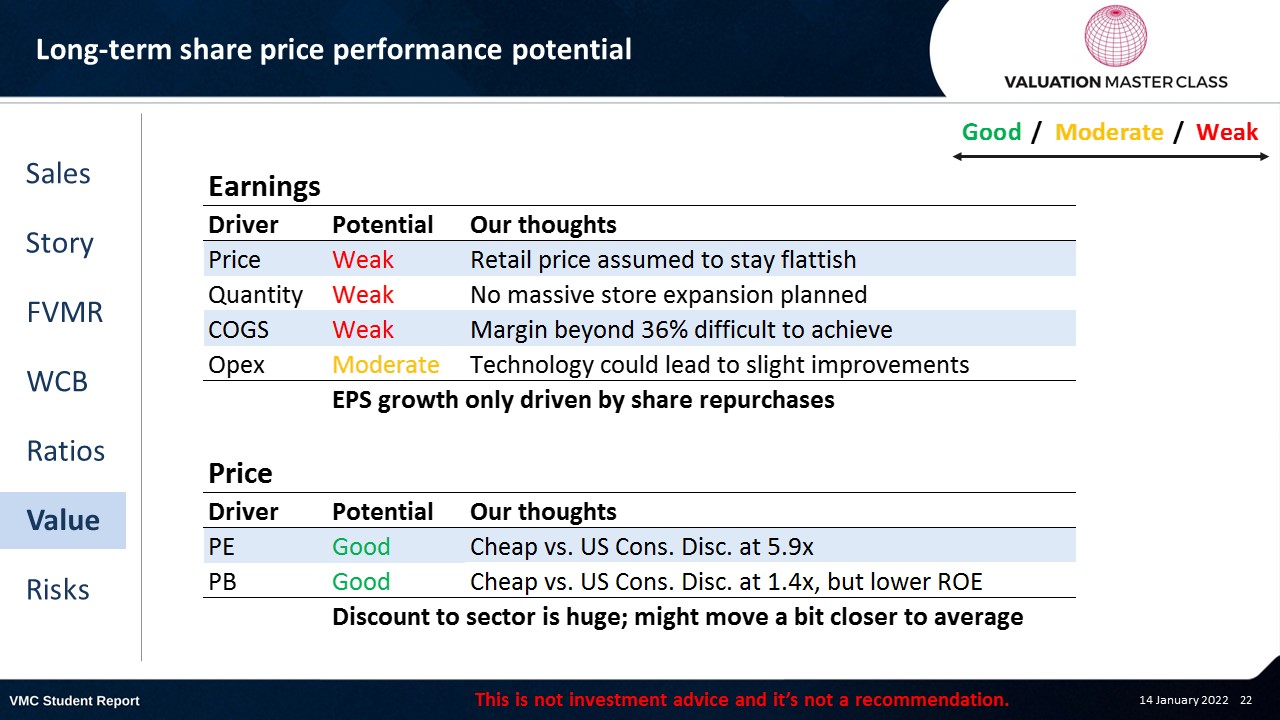

Long-term share price performance potential

Free cash flow – Kohl’s

- Strong cash flow generation is crucial for returning cash to shareholders

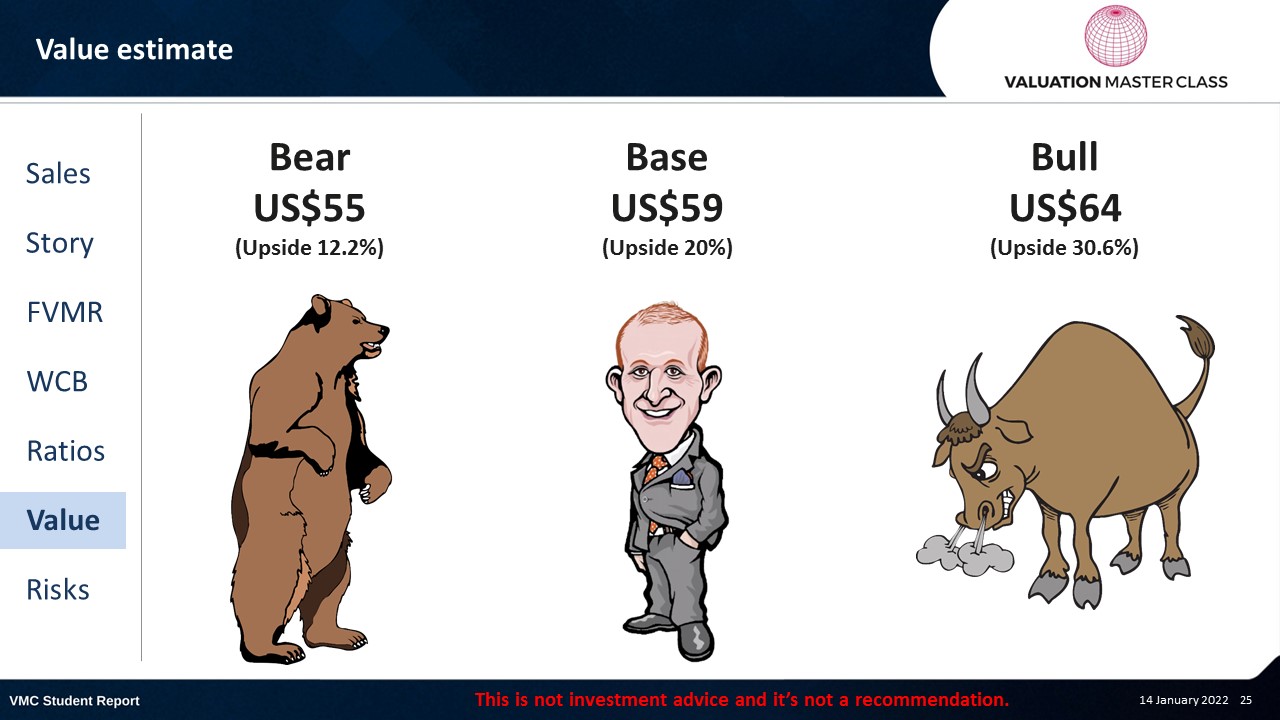

Value estimate – Kohl’s

- Like consensus, we expect a slightly stronger margin compared to the past

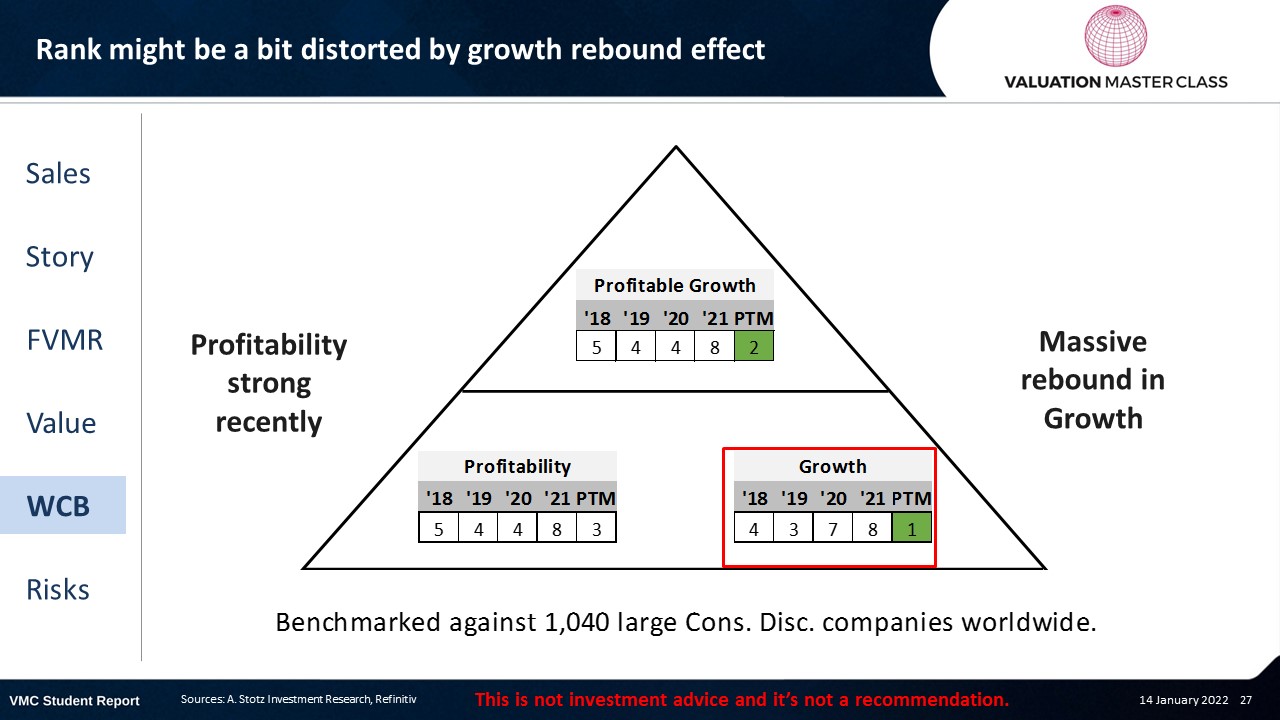

- The revenue growth CAGR is distorted by growth rebound in 2022

- Expect lower growth 23E onward

World Class Benchmarking Scorecard – Kohl’s

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is falling behind in online sales

- Activist investors might not decide in favor of the long-term future

- Increased transportation costs and worsening of inventory management

- Failure to keep up with e-commerce could lead to lost of market share

Conclusions

- Don’t expect high growth, but price discount offers upside

- Intervention of activist investors could be accretive

- Attractive dividend yield and share repurchase program can be satisfying enough

Download the full report as a PDF

Article by Andrew Stotz, Become a Better Investor.