The post was originally published here.

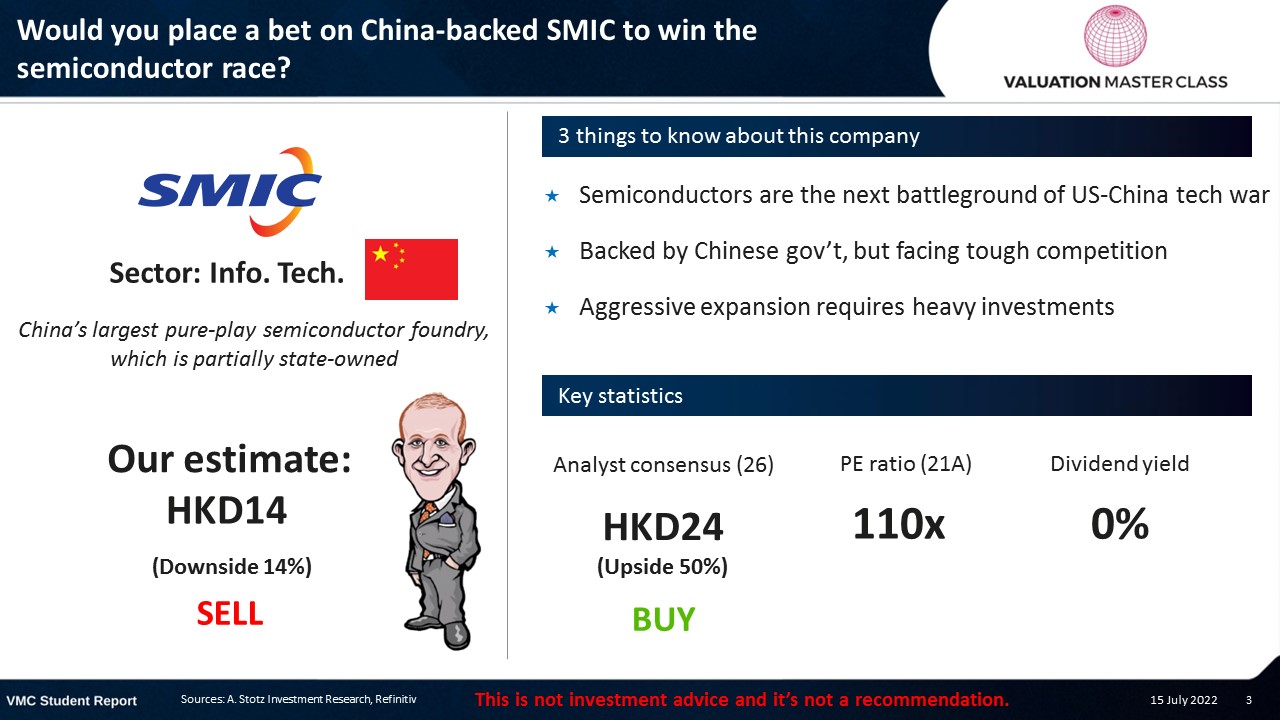

Highlights:

- Semiconductors are the next battleground of US-China tech war

- Backed by Chinese gov’t, but facing tough competition

- Aggressive expansion requires heavy investments

Download the full report as a PDF

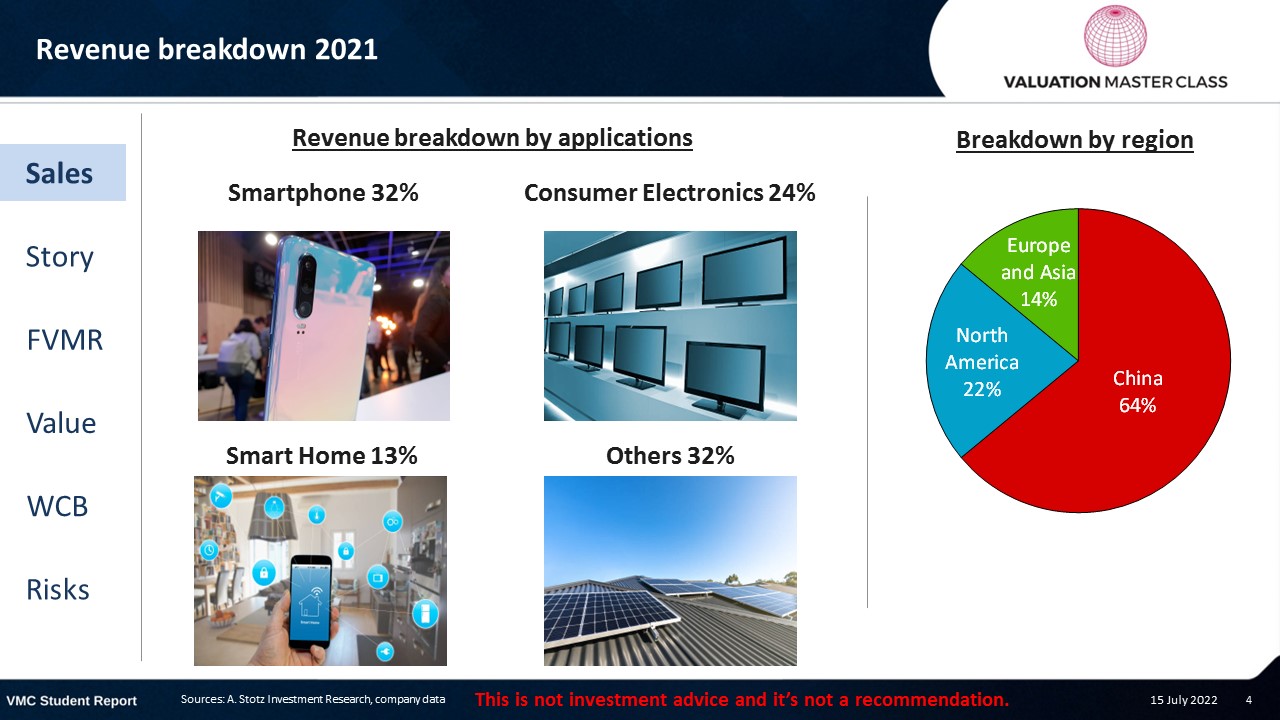

Revenue breakdown 2021

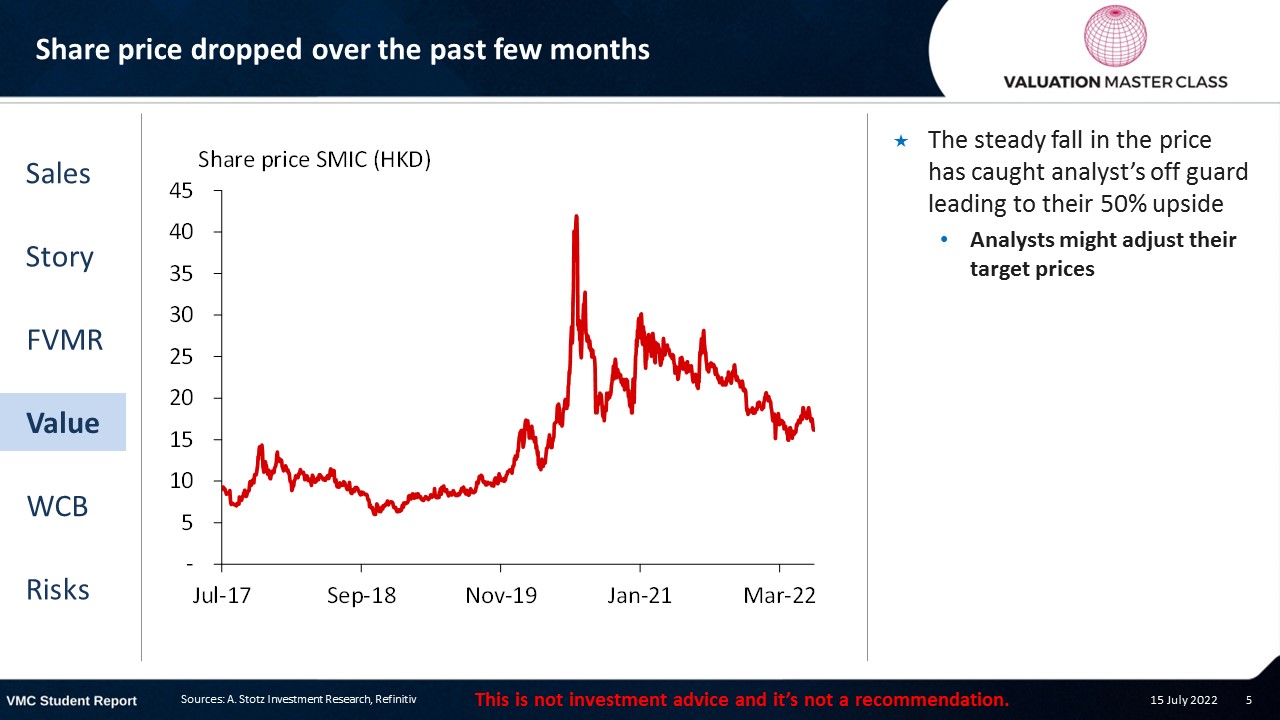

Share price dropped over the past few months

- The steady fall in the price has caught analyst’s off guard leading to their 50% upside

- Analysts might adjust their target prices

Semiconductors are the next battleground of US-China tech war

- In 2020, the US gov’t placed SMIC on the Entity List, which bans the export of US technology to the companies on the list

- Former US Secretary of Commerce Wilbur Ross said

- “We will not allow advanced US technology to help build the military of an increasingly belligerent adversary”

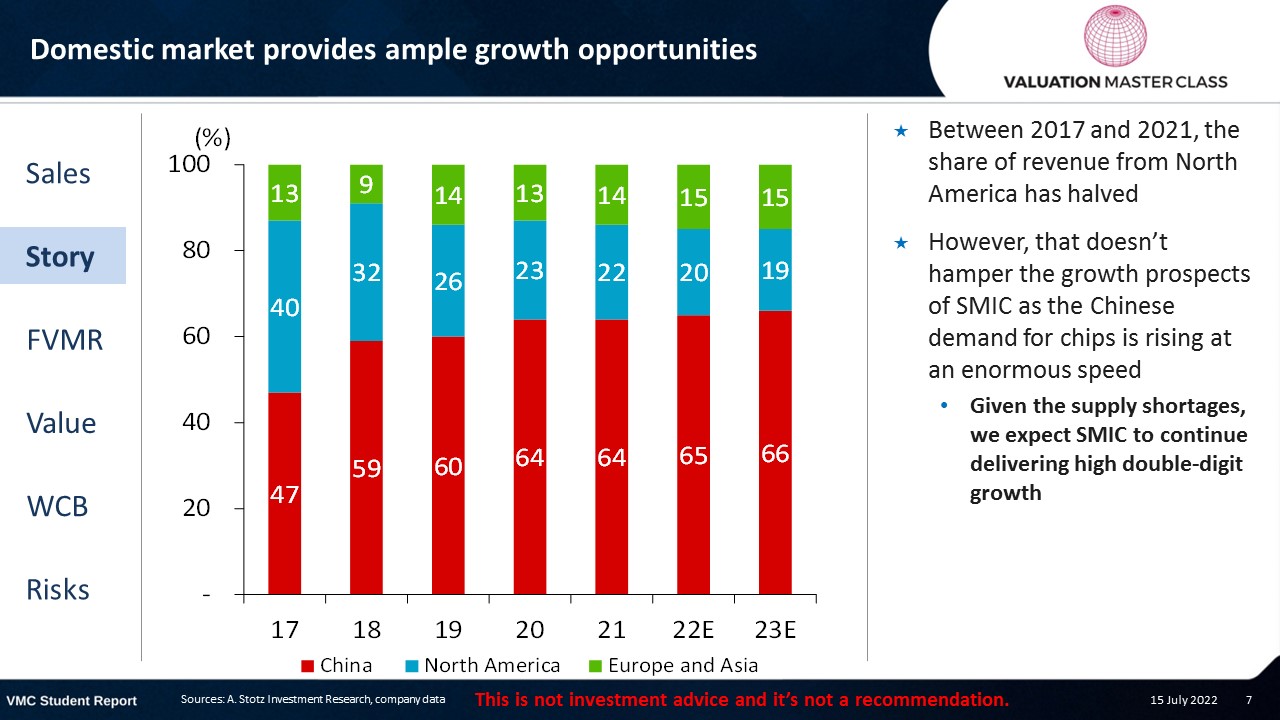

Domestic market provides ample growth opportunities

- Between 2017 and 2021, the share of revenue from North America has halved

- However, that doesn’t hamper the growth prospects of SMIC as the Chinese demand for chips is rising at an enormous speed

- Given the supply shortages, we expect SMIC to continue delivering high double-digit growth

Backed by Chinese gov’t, but facing tough competition

- China attempts to become self-sufficient in semiconductors for domestic consumption

- It aims to ramp up self-sufficiency rate to 70% within the next 5 years (currently 20%)

- To reach that goal, SMIC secured several fundings from the gov’t to accelerate the rollout of new factories

- On top of that, China granted a corporate income tax break for 10 years

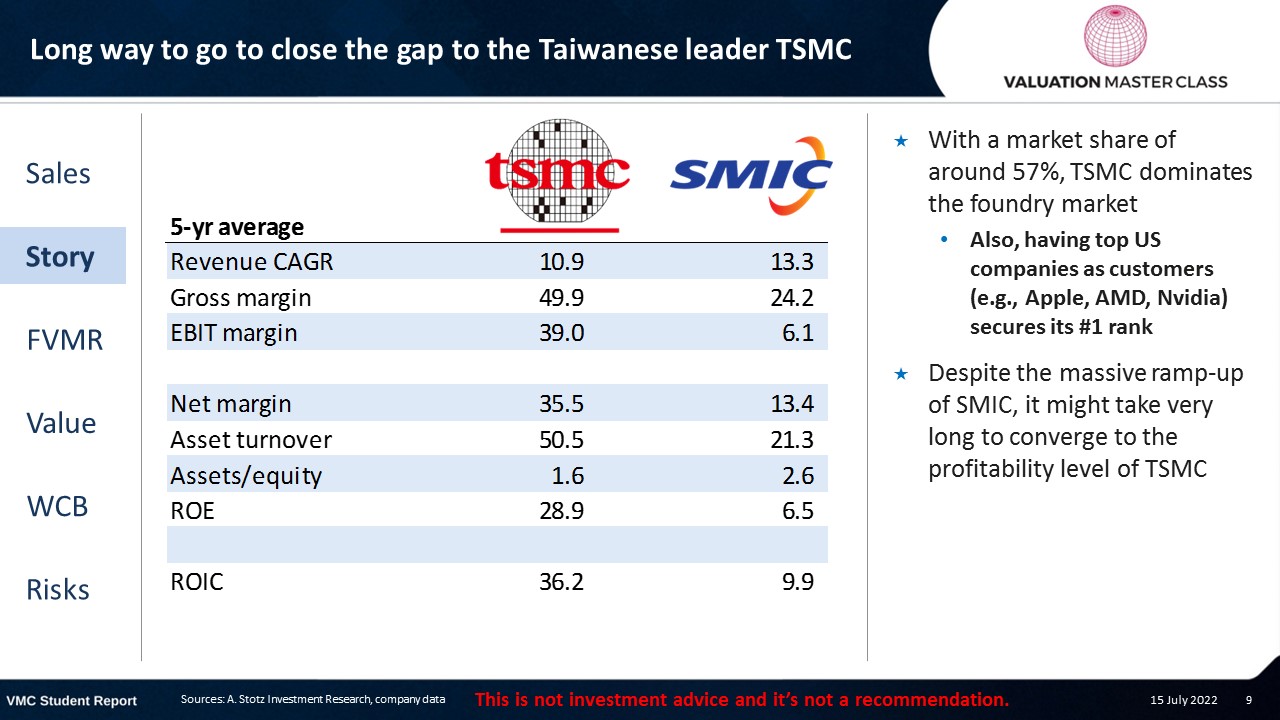

Long way to go to close the gap to the Taiwanese leader TSMC

- With a market share of around 57%, TSMC dominates the foundry market

- Also, having top US companies as customers (e.g., Apple, AMD, Nvidia) secures its #1 rank

- Despite the massive ramp-up of SMIC, it might take very long to converge to the profitability level of TSMC

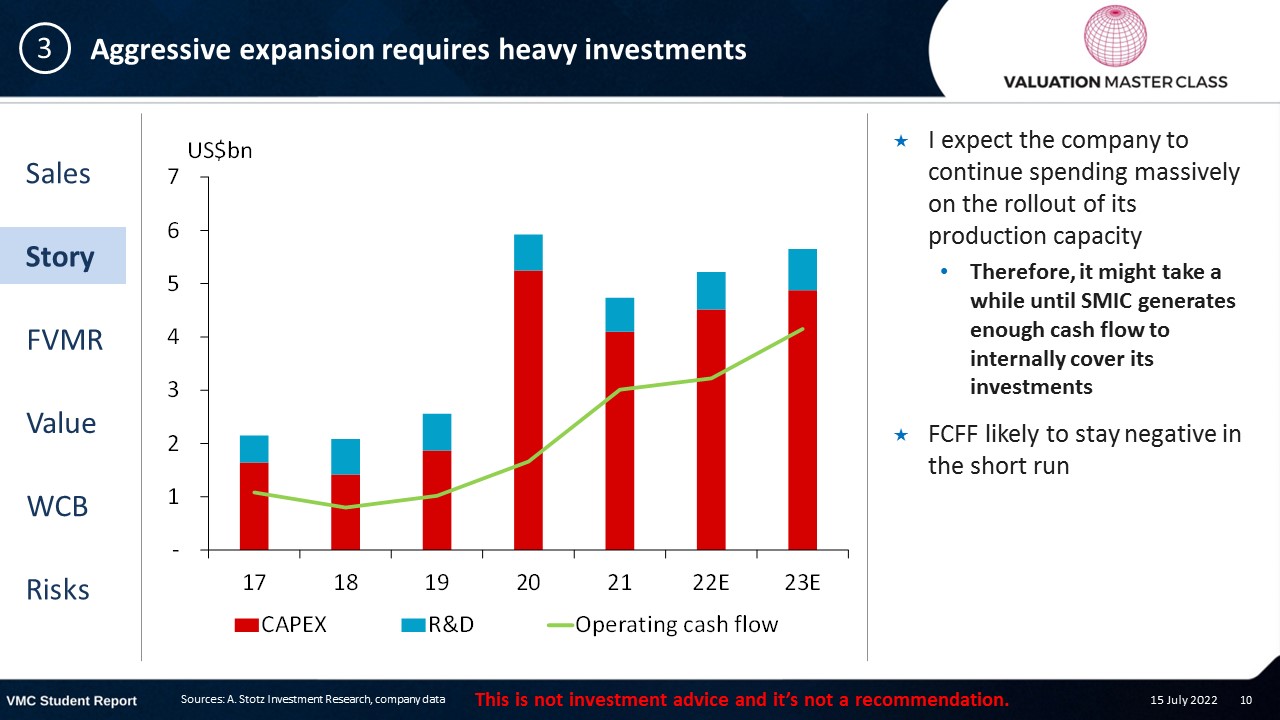

Aggressive expansion requires heavy investments

- I expect the company to continue spending massively on the rollout of its production capacity

- Therefore, it might take a while until SMIC generates enough cash flow to internally cover its investments

- FCFF likely to stay negative in the short run

Consensus is divided

- While 13 analysts have issued a BUY recommendation, many analysts stay cautious on HOLD

- Analysts predict stronger gross margin but a decline in net margin

- This is in line with our forecast due to increasing R&D expenses which are captured in SG&A

Get financial statements and assumptions in the full report

P&L – SMIC

- Despite strong revenue growth, we are likely to see stagnant net profit due to an increase in R&D and SG&A

Balance sheet – SMIC

- Net fixed assets continue to grow at a rapid pace as SMIC expands aggressively

- SMIC has moderately low leverage and being backed by the Chinese gov’t means financial risk is low

Cash flow statement – SMIC

- Rising dividends following the management’s announcement to increase dividend per share

Ratios – SMIC

- The effective tax rate continues to stay low as the company was granted tax exemptions in the context of China’s race for self-sufficiency

- The company holds 1/3 of its assets in cash, making the net debt-to-equity ratio negative

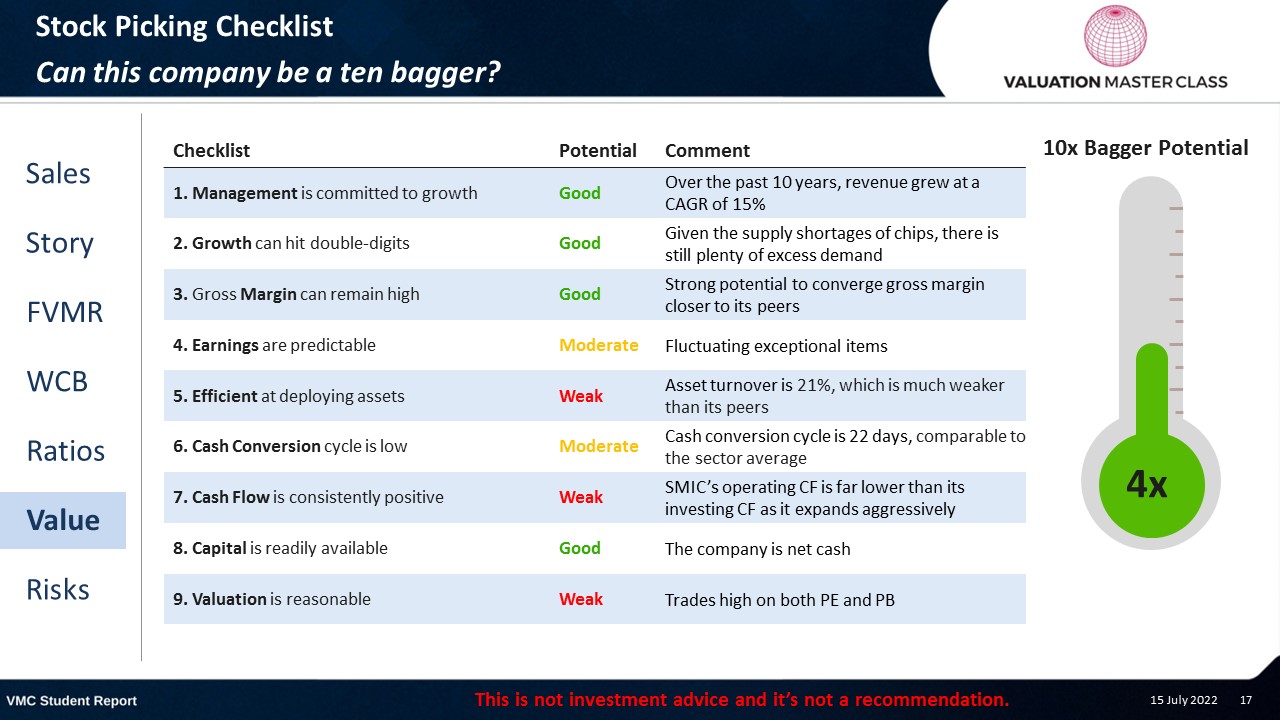

Stock Picking Checklist

Can this company be a ten bagger?

Free cash flow – SMIC

- Heavy CAPEX requirements means that the company is likely to continue seeing negative FCFF

- However, I think that the company can deliver a positive FCFF in 2024 for the first time

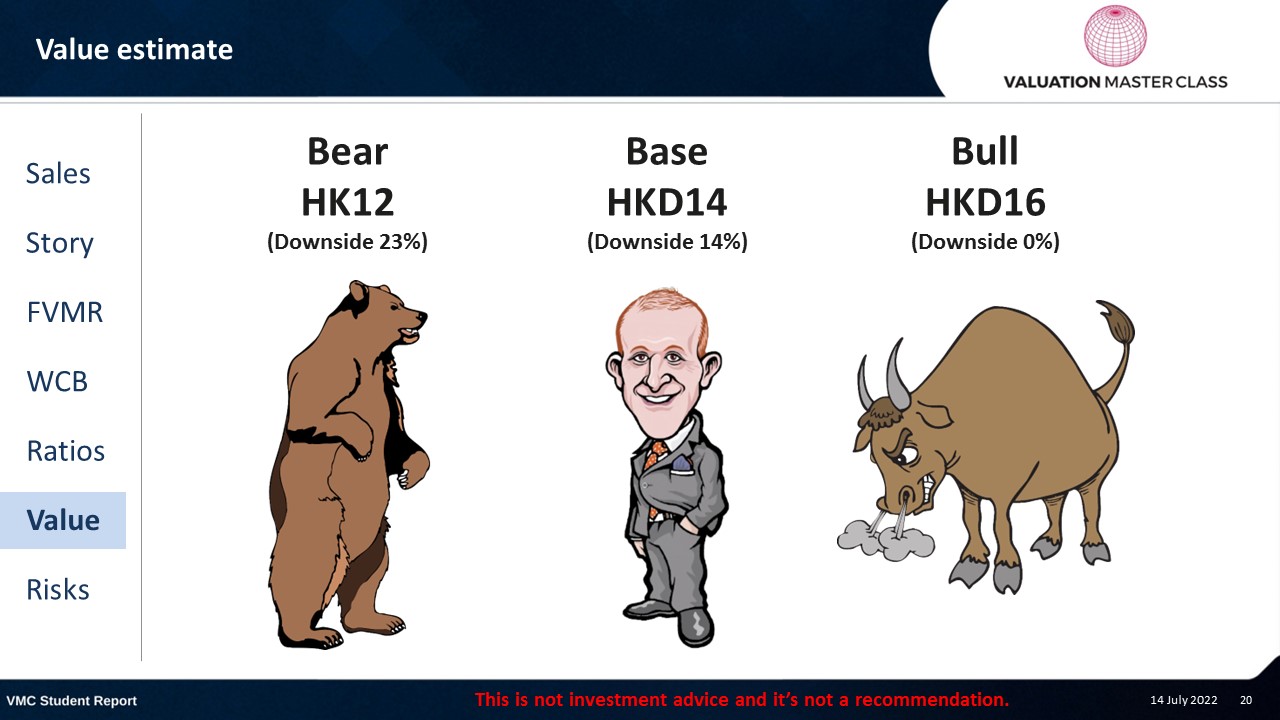

Value estimate – SMIC

- Similar to consensus, I expect that SMIC can realize its growth potential

- Plus, I assume that SMIC can increase its ROIC to 20% from 7% over the next decade

Key risk is geopolitical conflict

- Geopolitical situation may put the company’s access to raw materials and equipment at risk

- Change in preferential tax policy could adversely affect the company’s bottom-line

- Failure to keep up with technological changes and falling behind competitors

Conclusions

- Double-digit growth and backing from the Chinese gov’t

- Aggressive expansion plans could lead to ongoing negative FCFF

- Placing a bet on SMIC might turn out fruitful but it’s risky

Download the full report as a PDF

Article by Andrew Stotz, Become a Better Investor.