In this latest View from Burgundy, Canadian equities Portfolio Manager David Vanderwood advocates for the importance of considering trade-offs when solving complex problems, as he explores the ongoing dialogue around environmental, social, and governance (ESG) issues. David investigates the risks of applying ESG factors too narrowly and offers insight into Burgundy’s holistic approach, which balances E, S, G with a string of other characteristics (the A, B, C, and D attributes).

Q3 2021 hedge fund letters, conferences and more

In recent years, ESG (which stands for environmental, social, and governance) has become a singular focus among many investors, and while we recognize the potential positives of this development, we also believe that, if applied too narrowly, it can expose companies, investors, and the entire economy to unforeseen risks.

In investing, ESG has come to mean the application of mainly non-financial metrics based on environmental, social, and governance topics, which are used to assess the risks and opportunities of a potential investment. “Socially conscious” investing is already a trillion-dollar global asset class, helped by the broad appeal of “doing well by doing good.” Unfortunately, many market participants are applying ESG analysis very narrowly by only looking at the issues from one point of view.

Complex problems can only be solved by widening the lens. As we shall see, economic growth, which creates the resources needed to fight climate change and other ESG issues, is an important consideration. Whether you are a policymaker, a Chief Executive Officer (CEO), or an investor, identifying and managing trade-offs is the key to finding the best solutions. Burgundy’s approach respects the importance of trade-offs and chooses to integrate potential ESG exposures into a more holistic analysis of investment risks and opportunities. Indeed, it is not just about E, S, and G. It is about A, B, C, and D as well.

To explore how we incorporate trade-offs into our ESG thinking, we will start by identifying these other letters – the A, B, C, and D factors – and explaining how we use them to evaluate our companies. Next, we will examine a company case study to show what balancing trade-offs looks like in action. Finally, we will widen the scope to study how all of this ties into the dominant environmental issue facing the world today.

A, B, C, And D Attributes

Our purpose at Burgundy is to conserve and compound our clients’ wealth. This has best been done historically by owning a stake in businesses that grow earnings and value over very long periods of time. We call these types of businesses quality companies, and we will refer to them as such in this discussion. Borrowing from today’s vernacular, though, “sustainable companies” may be another appropriate name for them.

“Using our integrated approach, we evaluate and qualitatively grade each potential investee company on a variety of important investment characteristics, including E, S, and G.”

How do we identify quality companies? Using our integrated approach, we evaluate and qualitatively grade each potential investee company on a variety of important investment characteristics, including E, S, and G. Before we get to those, we want to touch on some of the other important criteria that we use when evaluating companies: the A, B, C, and D.

When it comes to applying these attributes, there are three points worth expanding on.

A IS FOR ALLOCATION.

First, we determine how well the company has allocated or invested its capital historically. Next, we attempt to anticipate how well the current management team will allocate or invest its capital in the future. Higher returns on capital are better, but lower are often okay if they are persistent and predictable.

B IS FOR BALANCE SHEET.

When one’s time horizon is forever, having no debt or even net cash is obviously preferable to being overly leveraged. The phrase “100-year storms” can be misleading. These come more often than you might think.

C IS FOR COMPETITIVE POSITION.

Burgundy defines quality companies as those that have a sustainable competitive advantage and a low likelihood of being disrupted. The world is getting more competitive, and having structural factors that limit competition and the risk of disruption (including brand names, network effects, and the ownership of exclusive licenses) is key. Competitive advantage often shows up as stable industry market shares and profit margins. High market share and high profit margins are strong signals of a strong competitive position.

D IS FOR DIALOGUE.

Since the ideal investment holding period is forever, Burgundy identifies quality management teams as those that treat owners like partners. The dialogue between CEOs and shareholders should be transparent, allowing for an open discussion of both the positive and negative factors affecting the business.

First, a poor grade on even one of these attributes excludes most companies from consideration. If we see poor capital allocation, over-indebtedness, a weak competitive position, or a lack of transparency, we will rule out most potential investment opportunities. We are only looking for the best.

Second, a company’s given grade falls on a continuum that can shift with time, both from management actions and from outside forces. Ongoing vigilance is required to ensure that our portfolios are filled with quality businesses.

Third, management’s most important duty is to navigate the tension between the various attributes of the business in a way that best creates long-term shareholder value. This often requires a trade-off. For example, an allocation decision may be appropriate if it enhances both return on investment and competitive position, even at the expense of weakening the balance sheet in the short term. This is where judgement comes in, and it is what separates great CEOs from the rest.

Managing Trade-Offs

As investors, we are constantly managing trade-offs when deciding whether to own a business. We triangulate between a given company’s score on all the attributes, assuming it meets our minimum criteria on all, and its valuation. Using our approach, companies with higher grades can justifiably be owned at a higher valuation and vice versa. Those with a lower grade will only be owned at a cheaper level.

“As investors, we are constantly managing trade-offs when deciding whether to own a business.”

So, there are two tensions being managed. The first by the respective management teams, who are making decisions that can move grades on each individual criteria for their business, such as competitive position and balance sheets. And the second by us as investors, where we are triangulating a potential investee company’s collective grade with where the company is valued in the market to decide whether the business should be owned.

These Attributes In Action: Canadian Pacific Railway

Canadian Pacific Railway Ltd. (“CP”), a company we bought during the Global Financial Crisis in March 2009 and again during the pandemic market meltdown in 2020, is a great example of weighing trade-offs in our research.i After a tumultuous management change in 2012, the company now scores even higher on all the discussed attributes. On allocation, the numbers speak for themselves. Return on capital employed (profits divided by the capital invested in the business) increased to the mid-teens from the mid-single-digit level prior to the management change, and profit margins (earnings before interest and taxes divided by sales) have more than doubled over the same period, from the 20% level to over 40% today. The new management team, led first by the late Hunter Harrison and then by his protégé Keith Creel since 2017, has hit it out of the park. The balance sheet is also in good shape, better today than when the management change occurred in 2012.

These large “Class 1” railways have very strong competitive positions.ii Given the insurmountable difficulties obtaining permits as well as challenges around land assembly, no one is going to build another transcontinental railway. And as far as disruption risk goes, as long as real physical goods need to move from where they are made or sourced to where they are used or consumed, the services of Class 1 railways will always be in demand. It is also important to note that, as with Hunter Harrison, Keith Creel has always played it straight in his dialogue with investors. Risks and opportunities have been outlined clearly, and investors have felt confident that they are in a true partnership with the CP management team.

The conclusion from our scorecard is obvious: CP is a quality company, where management has successfully navigated the attribute trade-offs in their business to create long-term value. And this management tension is on public display today.

Keith Creel is pursuing a large acquisition of The Kansas City Southern Railway Company to further expand CP’s rail network south from Kansas City into Mexico. The trade-off being made is that this allocation decision will boost the combined company’s competitive position, so much so that even with the temporary boost in debt, and thus lower attributed balance sheet grade, it will create long-term value for owners. In our judgement, this excellent management team has earned the benefit of the doubt, and we feel the trade-off is worth it, assuming regulators eventually approve the deal.

“Humans are comforted by the familiar, and we do not easily challenge our past conclusions. But things can change. Without ongoing vigilance and a watchful eye on reductive conclusions that are held past their best-before date, investor capital destruction may result.”

With this example, we have seen our scorecard in action and witnessed how CEOs manage the trade-offs inherent in running a business. As investors, we must weigh the increase in the competitive position against the temporary decrease in the balance sheet strength, and both collectively against where the company’s shares are being valued in the market. This is the tension that Burgundy needs to judge.

While this trade-off sounds simple, it is rarely easy. One large caveat for investors is being human. We are all at risk of falling prey to reductive and totalizing conclusions. For example, a given company may score high on many attributes, leading to the consensus among market participants that it is a “great” company that is safe to own. Once this opinion is formed and shared by many, it can hold – even long after one or more of the company’s attributes has declined or even as the valuation becomes so rich that only a low probability and overly optimistic future is discounted in the share price.

Humans are comforted by the familiar, and we do not easily challenge our past conclusions. But things can change (for instance, a company’s attributes and/or valuation). Without ongoing vigilance and a watchful eye on reductive conclusions that are held past their best-before date, investor capital destruction may result.

Returning To ESG

Let’s now turn to E, S, and G. As stated earlier, just like other important investment attributes, we integrate each of these attributes into a holistic analysis of any potential investee company. As with the other attributes we discussed, failing to meet our minimum grade for any of these criteria disqualifies a company from being a potential Burgundy investment. And similar to A, B, C, and D, our grades are qualitative and fall on a continuum where they can shift over time.

Since we have written about governance at length for 30 years (and much of the A, B, C, and D attributes above tie into governance), we will focus our discussion on E and S (without the G). While there are a great many E and S issues (economic inequality, spiraling health-care costs, diversity, home affordability, nuclear threats, terrorism, the sourcing of resources from demagogue-controlled countries with poor human rights records, overfishing, etc.), these topics exceed the scope of this essay.

We will focus on the issue that is dominating our generation today: climate change. The “tensions” here are being managed by policymakers at the behest of the public (just as those trade-offs discussed above are managed by CEOs and us as investors). Predicting how these tensions manifest into policies, regulations, and changing consumer preferences is key to grading these attributes for each potential investment opportunity. We are looking to anticipate future costs and risks as well as potential opportunities. Let’s start by exploring CP Rail’s relationship with these trade-offs.

Canadian Pacific Railway And Climate Change

CP Rail is a great example of teasing out the trade-offs in the climate change discussion. Since its locomotives are large emitters of carbon emissions, many might call for a simple outlawing of rail operations. But what are the facts, and what can they tell us about the trade-offs?

Since rail is more fuel efficient than shipping via trucks, it emits far less carbon per tonne of freight shipped, and this advantage increases along with trip length. A single-unit train keeps 300 trucks off highways and is four times more fuel efficient. While CP scores points on our environmental attribute for steadily reducing emissions (fuel efficiency has improved 40% since 1990 and the company is investigating new technologies and renewable fuels), society as a whole also benefits to the degree that rail takes market share from trucks. This is an important trade-off to appreciate, and it helps us determine CP’s “E” attribution grade. Let’s now widen the lens and look at the bigger picture.

THE CLIMATE IS CHANGING

For over 100 years, we have known that more carbon in the atmosphere means higher temperatures. Like a greenhouse, the carbon lets in the sun’s energy but blocks some of the earth’s heat from escaping. Carbon emissions are caused mainly by burning fossil fuels. The amount of carbon dioxide in the atmosphere is up 40% from 1750 when industrialization began.

The cumulative effect of prior emissions is why solving climate change is so hard. What matters is the total amount in the atmosphere. That grows every year, even while about half of the growth is absorbed by the oceans, forests, and soil. So, even if we reduce emissions, the amount of carbon dioxide will still go up and the earth will get warmer.

How much warmer? According to the Model for the Assessment of Greenhouse Gas Induced Climate Change, which is used by the UN’s panel of climate scientists, if things continue as they have in the past, at the end of this century, temperatures may be about 4 degrees Celsius warmer than they were in 1750.iii That is way too much. The challenge is indeed huge, prompting a tremendous amount of publicity, work, and investment. It has also spurred international agreements (such as the 2015 Paris Agreement) that are focused on slowing down the temperature rise. There are also costs from climate change that will hurt economic growth. This is important because economic growth creates the resources needed to not only improve human well-being, but also to fight the many E and S issues, including global warming.

“Economic growth creates the resources needed to not only improve human well-being, but also to fight the many E and S issues, including global warming.”

Looking Backwards And Moving Forward

Anyone going back in time a few hundred years would find life nearly incomprehensible. As Thomas Hobbes wrote in 1651, life was “poor, nasty, brutish and short.” After millennia of flat living standards for the average person, the staggering economic growth that started with the Industrial Revolution and has continued through the current so-called “second machine age” has been miraculous. The quality of life most of us in the developed world, and many in the developing world, now enjoy, including access to decent and reliable food, health care, education, as well as entertainment and other valued services, is orders of magnitude greater than that experienced prior to the Industrial Revolution.

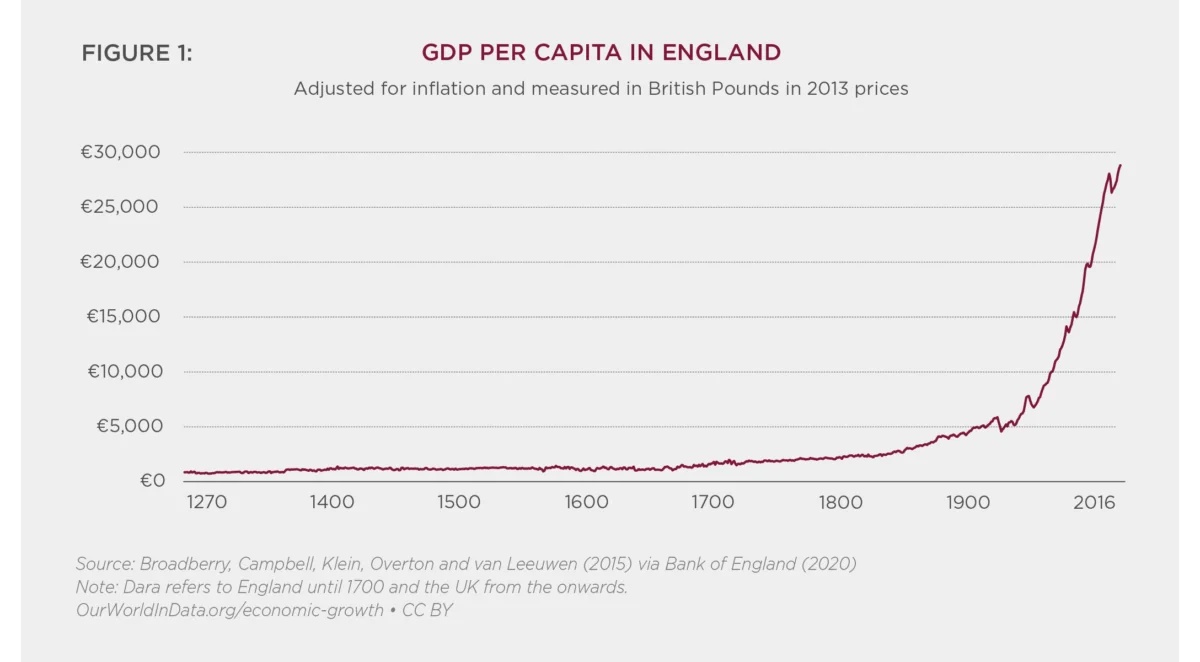

Since the historical data for this leader of the Industrial Revolution goes back a long way, we will use England’s gross domestic product (GDP) per capita as a proxy for quality of life in the developed world. As we can infer from Figure 1, after eons of a flat standard of living, the parabolic increases of the last century or two have been astounding and brought about by a combination of capitalism, technology, and government policy championing property rights, corporations with limited liability (which encourages risk taking and innovation), and trade. And it has run on cheap and reliable energy, starting with coal. As English economist William Jevons wrote in The Coal Question in 1865, coal “is the material energy of the country – the universal aid – the factor in everything we do.” Oil soon followed, sowing the seeds of the current global warming challenge.

Consider China. Fifty years ago, the average Chinese citizen had less access to electricity than today’s poorest inhabitants of Africa. Since that time (as our chart of England demonstrates, but in a much shorter time), China’s economic miracle has seen 800 million people emerge from poverty as GDP/capita increased over 70 times. How? Capitalism “with Chinese characteristics,” as Deng Xiaoping referred to it, and initially (just like England) with coal.

The absolute level of suffering and hardship, first in the developed Western world, and then in such late bloomers as China, has plummeted. Looking back 200 years ago, 90% of earth’s people lived in extreme poverty. Today, that number has decreased to 9%. And this progress continues. Currently, it is estimated every day over 100,000 people are being brought out of extreme poverty. The challenge then is how to tackle climate change while continuing to encourage economic growth. Economic growth creates the resources that can be used to fight global warming and other E and S issues. Fortunately, there are reasons for cautious optimism.

Reasons To Be Cautiously Optimistic

As MIT’s Andrew McAfee outlines in his 2019 book More from Less, the developed economies are “dematerializing,”iv having been helped by the switch in our collective consumption from material items to digital bits and services and aided by capitalism’s powerful forces (real materials have costs that profit-seeking capitalists try to minimize), rapid technological advancements, and progressive government policy. For the past couple of decades, these developed economies have been using less of almost every resource per unit of GDP growth, including energy, and less in absolute terms of many of these real inputs as well. For example, the “energy intensity” of the U.S. economy (or the amount of energy needed to power GDP growth) has halved since 1983.v

This means that what was once a direct trade-off between economic growth (which drives human well-being) and resource use (which drives pollution, including carbon emissions) is no longer a linear relationship. Therefore, this trade-off is evolving in the right direction. As this evolution continues, and eventually spreads to the developing economies, the future looks a little brighter.

The second reason to be cautiously optimistic is because significant progress has been made in making clean energy generation more cost effective. According to former central banker and current Head of Impact Investing at Brookfield Asset Management, Mark Carney, about 60% of current carbon emissions can be abated with commercially viable technologies.vi More progress and innovation are needed (especially in energy storage as many sources of clean energy, such as wind and solar, are intermittent). Nevertheless, this is a good start.

Trade-Offs In The Fight Against Climate Change

According to Climate Watch at the World Resources Institute, energy and power generation contribute 73% of annual greenhouse gas emissions. This is where the biggest impact can be made.vii Sub-dividing this broadly, we find that 24% of energy generation is used by industry, 18% by buildings, 16% for transportation, and 15% in other areas. Therefore, the most impactful way to slow emissions is to vastly increase clean energy generation while simultaneously building out the world’s electrical infrastructure so that industry, buildings, transport, and other energy users can access this green electricity. With the so-called “electrification” of our energy infrastructure being the best path forward to effect meaningful change, this allows us to tease out some trade-offs.

There is a path forward, but it is massive and costly, involving a fundamental transition of the entire global economy. Energy generation, electricity grids, batteries and other energy storage solutions and chargers all need to be developed and installed. In recent years, about US$300 billion per year has been invested in the development of renewable power generation around the world. It is estimated that the annual investment needed to achieve net-zero carbon emissions by 2050 is US$3.5-5 trillion dollars per year. This means that up to US$150 trillion dollars will need to be invested over the next 30 years. The size of the needed investment is staggering and suggests some obvious trade-offs.

The first trade-off is simple: Resources expended on electrification are not available to fight the other significant E and S issues, such as today’s extreme wealth inequality, the never-ending rise in healthcare costs, etc. While climate change is happening fast and is easy to catastrophize, it is not the only issue. Policymakers around the world face this trade-off daily. There are only so many dollars to go around.

For capital earmarked to fight global warming, the second key trade-off involves questions about where and how to invest these resources. If we accept the premise that economic growth creates the resources that can be used to help fund the fight against global warming and other E and S issues, then the investment in electrification may hurt those causes if it results in weaker GDP growth than would otherwise be the case. This is the trade-off that policymakers must consider.

Fortunately, there are many examples where investing in green energy generation and increased electrification leads to economic growth. These include many new build projects near windy or sunlit geographies, where energy demand is growing rapidly. These win-win opportunities result in both improved quality of life and lower emissions. This low-hanging fruit is being picked aggressively today. Ideally, there are enough of these opportunities to pursue in the near term as well as opportunities for innovation and technological improvements in things such as energy storage to eventually boost the proportion of carbon emissions that can be abated economically.

Given the immense pressure to reduce carbon emissions, one risk is that government leaders and policymakers make poor choices that hurt economic growth. They will need a thorough understanding of the trade-offs (and a strong backbone) to resist encouraging investment in capital-destroying projects just for the appearance of trying to solve the climate crisis quickly.

Another example of where a trade-off lens can help is in the setting of an appropriate carbon tax. Most agree that a carbon tax is the right tool to compensate for the “market failure,” where the costs of carbon emissions are borne by all, yet the benefits accrue only to the emitter and the direct consumer of whatever products the emitter makes. While carbon taxes are effective, the level of tax should be carefully calibrated to ensure it works to reduce emissions without damaging the economy. Striking the right balance is key. Deciding to implement a carbon tax, and setting an appropriate level, is another trade-off that will challenge governments in the years ahead.

We have seen that the transition to cleaner energy will take decades and trillions of dollars of investment to effect significant change. Indeed, the challenge is so great that, like the Great Depression for those who lived in the 1930s, and the fear of a nuclear World War III in the 1950s through the 1980s, global warming may remain the dominant narrative of our lifetimes. So this issue, with all its accompanying trade-offs, will remain front and centre for both company management teams and us as investors.

Context Is Everything

While the challenges facing humanity are great, we remain optimistic. There are plenty of good places to start, but solving the climate crisis will take time, and it will require us to balance the risks against the opportunities. Understanding the trade-offs will benefit both policymakers and the public that guide them.

Fortunately, humanity has a trump card. Humans have come to dominate the earth because of a powerful skill: our ability to adapt. Humans have always successfully adapted, and this has enabled our species to survive many extreme challenges – including wars, depressions, and diseases – and eventually go on to thrive. Life for the average human on the planet has never been better, and extreme poverty is lessening daily. We will need to draw on this ability to adapt as we collectively work to solve global warming. It never pays to bet against human ingenuity.

Many tend to look at the issues surrounding the current ESG narrative from only one perspective. At Burgundy, we believe that only by taking a wider view can we tease out trade-offs inherent in these and other complex challenges. Understanding trade-offs is the only way to solve challenging problems. That is why the best CEOs use a trade-off framework to optimize decisions and why trade-offs are central to Burgundy’s integrated approach, which takes a holistic view of all the risks and opportunities facing a potential investee company, ESG included.

In the face of this overarching global challenge, how does Burgundy judge the risks, assess the potential exposures, and look out for potential opportunities with investee companies? We keep a vigilant eye on policymakers and for potential changes in regulation and consumer preferences while operating with the knowledge that for most businesses, their risk and return potentials will be driven more by the other attributes, including A, B, C and D discussed above. This sentiment was echoed by the Intergovernmental Panel on Climate Changeviii, who stated that: “For most economic sectors, the impacts of drivers such as changes in population, age structure, income, technology, relative prices, lifestyle, regulation, and governance are expected to be large relative to the impacts of climate change.”ix This is why Burgundy uses an integrated approach, which considers all aspects affecting a potential investee company. Context is everything.

i. We no longer own this company, having sold it in September 2021 on a valuation basis.

ii. As defined by CN Rail, a Class I railroad in the United States, or a Class I railway (also Class I rail carrier) in Canada, is one of the largest freight railroads, as classified based on operating revenue. Smaller railroads are classified as Class II and Class III. The exact revenues required to be in each class have varied through the years, and they are now continuously adjusted for inflation. The threshold for a Class I Railroad in 2006 was $346.8 million.

iii. Intergovernmental Panel on Climate Change, Climate Change 2014 Synthesis Report, 2014

iv. McAfee, Andrew, More from Less, Scribner, 2019

v. US Energy Information Administration, Today in Energy, August 2021

vi. Brookfield Renewable Partners Investor Day Presentation, September 20, 2021, page 11

vii. Brookfield Renewable Partners Investor Day Presentation, September 20, 2021, page 18

viii. The Intergovernmental Panel on Climate Change is an intergovernmental body of the United Nations

ix. Intergovernmental Panel on Climate Change, Climate Change 2014: Impacts, Adaptation and Vulnerability, Top-Level Findings from the Working Group II AR5 Summary for Policymakers, 2014

Article by Burgundy Asset Management