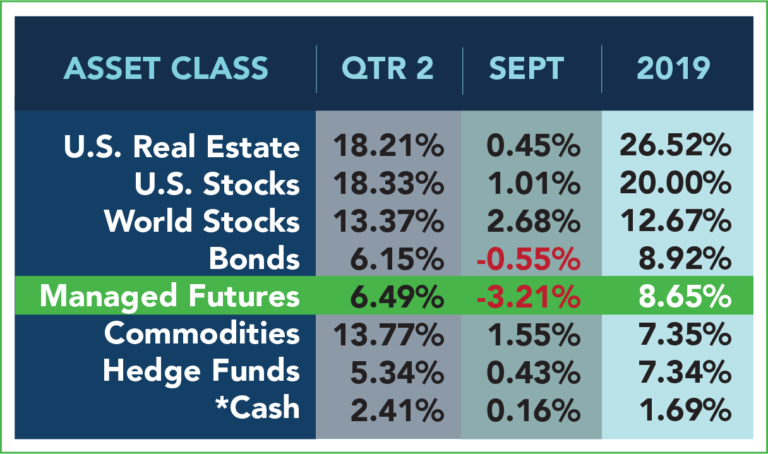

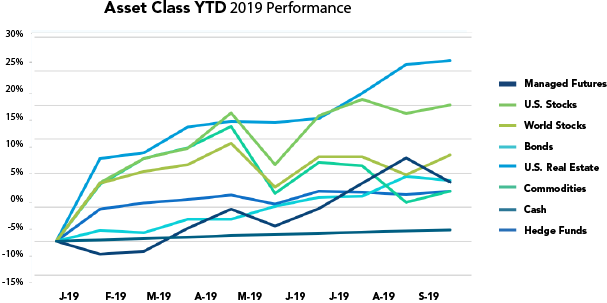

Is anyone going to be able to stop U.S. Real Estate and US Stocks? Yeeeeshh, those two classes rebounded big time in Sep, to get back into the 20%+ club. In the world of MF, there was a classic reversion to the mean after a big August, causing managed futures to drop a couple spots, while commodities went positive following a big Oil move in the wake of attacks on Saudi infrastructure. With one quarter to go…

Q2 hedge fund letters, conference, scoops etc

Past Performance is not necessarily indicative of future results.

Past performance is not necessarily indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:BND),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:QAI)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:GSG);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:IYR);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:ACWX);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:SPY)

All ETF performance data from Yahoo Finance.

Article by RCM Alternatives