“It’s ‘pretty obvious’ the Fed is moving to the whims of the markets.” – Art Cashin, Managing Director, Director of Floor Operations, UBS Financial Services Inc.

“It is impossible for Jay Powell to be more dominated by market-world than he is today. Even in his word choice and structure, he is now channeling Bernanke and Yellen. Authority/Credibility to speak firmly to the market-world has been totally lost.” – Ben Hunt, Epsilon Theory

“Unless Chairman Powell goes out of his way to dismiss this, the Fed baseline characterization in markets will return fully to the uber-dovish concept of the ‘Fed put’ being in the money — a massive U-turn from just a few months ago.” – Mohamed A. El-Erian, Chief Economic Advisor, Allianz

Q4 hedge fund letters, conference, scoops etc

As I write this week, I have to tell you what began as a discussion about this week’s Fed surprise went in a direction I didn’t expect, leaving me feeling very proud. I re-watched President Ronald Reagan’s final speech and it moved me just as it did years ago. Maybe even more so this time as we seem to sit at a somewhat divisive period in time, which I hope and pray is just a short stop along the way to brighter place.

My great-grandparents, and I imagine yours as well, came to America with no money and few possessions. But they came with dreams, determination, a spirit of risk and an unending work ethic. They worked as tailors in Philadelphia, later opened their own shop and put their children through school. Their children grew to be lawyers, doctors and business owners.

If you’ve read Neil Howe’s book, The Fourth Turning or Ray Dalio’s A Template For Understanding Big Debt Crises, both research cycles with the common theme between the books is the challenges that present at the end of long-term debt accumulation cycles. The last occurred in the mid-1930s. You can imagine the risks then and see how the economic challenges may have contributed to enabling those horrific times. Now I’m not saying that is how the current period will unfold. I am saying it’s a concern. Currently, we seem to be less tolerant of our differences and moving in a direction that is in need of a much brighter light.

Ultimately, like any great sports team, it requires exceptional leadership. Not just from the head coach, but also from the more senior players on the team. To which, I conclude this week’s missive with a link to President Reagan’s speech in the personal section below and I have to tell you openly it brought a tear to my eye. It’s five minutes of fantastic leadership – “An Observation on a Country Which I Love.” I hope you too enjoy it.

The Powell Put

The Federal Reserve Open Market Committee has had a material impact on the markets this week so let’s take a look at what transpired. In short, people expected the Fed to be dovish, but not this dovish. Mohamed El-Erian called it “a massive U-turn.” Chairman Jerome Powell suggesting the pace of rate hikes will slow and Quantitative Tightening may be near its end was just what the bulls wanted to hear.

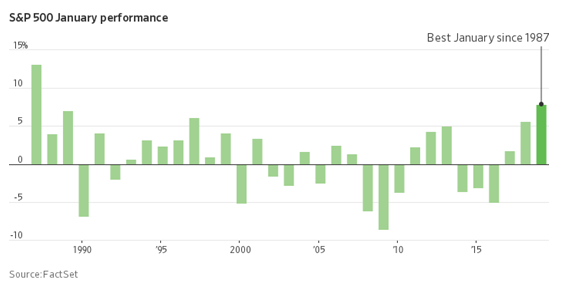

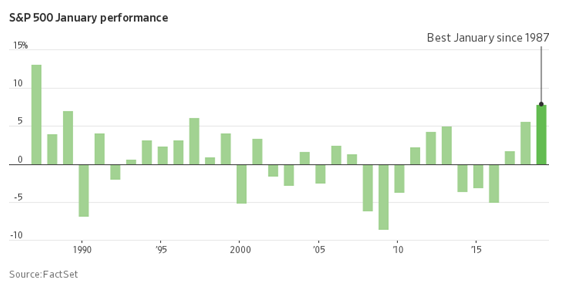

The S&P 500 gained more than 1.5% while the NYSE FANG+ Index spiked up 4%. For the month, the major indices were up more than 7%. It was the best January since 1987. I find myself both happy and stunned. Following are some observations I hope will get you centered on what happened and factor into your forward thinking.

For what it’s worth in terms of forecasting 2019’s returns, note that last January was the best January since 1989 yet the SPDR S&P 500 Index ETF lost 6% for the full year.

Back to Chairman Powell. The following is from good friend, Peter Boockvar, in his recent note titled, “Fed Candy and Jobs Report.”

- The Federal Open Market Committee barely changed its economic assessment and only tweaked its inflation comments.

- Citing “financial developments” as a reason to hold off on more rate hikes, when those same developments are the reason for the rate hikes, reflects a committee that continues to chase its own tail.

- The Fed’s balance sheet size, which at the peak quintupled since 2007, is now only 10% smaller. That the Fed still has cold feet about further reductions is a threat to its credibility.

- The FOMC said nothing about where the balance sheet will end up because it really doesn’t know.

- Like other central banks, the Fed is now trapped in a never-ending easy-money trap.

One of my favorite macro specialists is the fun, witty and edgy Rene Javier Aninao of Evercore ISI. He wrote a piece yesterday about the #FedShock titled, “Jam It In, Jerome.” He was referencing a January 1988 basketball game between Pitt and Providence where Pitt’s Jerome Lane jammed home a slam dunk that was so powerful it broke the glass backboard.

Rene’s main conclusion: “despite a ‘solid’ U.S. economy, bazooka policy mix was still unleashed—Fed’s reaction function has changed.”

I enjoyed this from his missive: During the post-meeting press conference, notice the look on Fed Chairman Powell’s face upon hearing the DJIA was up over 500 points.

If you’d like to follow Rene, shoot me an email and I’ll reach out to him. I’m not sure if he only sends his note to professional advisors. Happy to check in with him for you.

Less noticed – Government borrowing needs of $1.2 trillion per year for the next 10 years

This from Philip Grant of Grant’s Interest Rate Observer, “But a less discussed, yet potentially more impactful, long-term policy event also took place yesterday: The Treasury Borrowing Advisory Committee presented its quarterly recommendations to help tackle Uncle Sam’s ever-expanding financing needs.

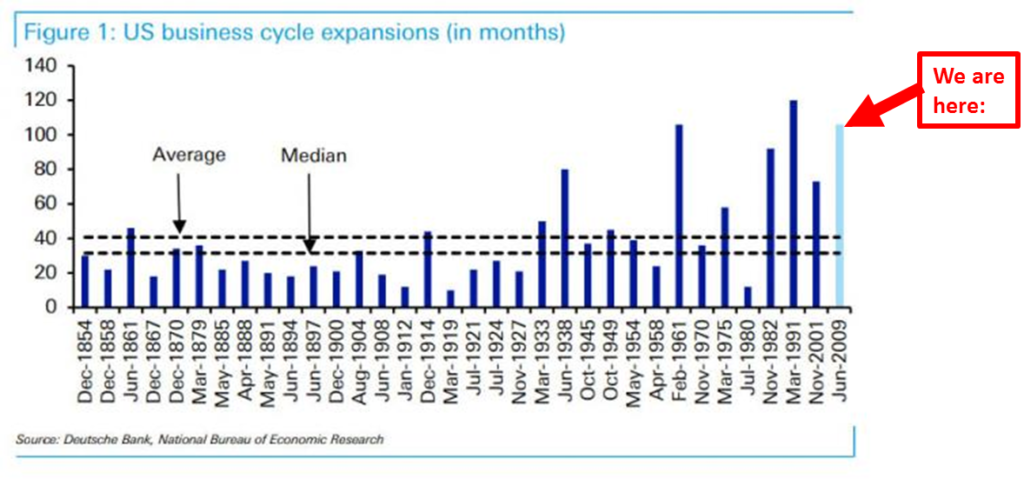

The committee estimates Treasury’s borrowing needs at more than $12 trillion for the next decade, assuming no recessions during that stretch (that $1.2 trillion annual average compares to an average $875 billion during the eight, recession-free years from 2010 to 2017, a 38% increase). The current business expansion stands at 115 months (now 116 months at January 2019 month-end, next chart) and counting, the second-longest in history behind the 120 months logged between 1991 and 2001.”

Grant added, “When the music stops, we can expect issuance to ratchet even further: The Treasury Borrowing Advisory Committee notes that recessions typically increase the size of the deficit by between two and five percent of GDP.” Let’s do the math.

Total U.S. GDP was $19.485 trillion in 2017. When we get the official 2018 numbers, it will be just north of $20 trillion. Here is the recession math:

- $20 trillion times 2% equals $400 billion

- $20 trillion times 5% equals $1 trillion

- $400 billion plus $1.2 trillion (annual borrowing needed to fund government deficit) equals $1.6 trillion

- $1 trillion plus $1.2 trillion (annual borrowing needed to fund government deficit) equals $2.2 trillion

That fact that this has alluded investors in the short term is par for the course. I’m confident it will become apparent soon enough.

My two cents

I could argue that the stock market’s October-December decline of just under 20% in the S&P 500 and more than 30% for a handful of sectors drove the Fed’s decision, but I’m not entirely confident in that reasoning. What I do know is the Fed always lowers interest rates because of economic decline. I also know that the stock market is an outstanding leading economic indicator and the Fed must know this.

The U.S. remains the strongest economy in the world and, while a tick lower, it remains in pretty good shape (see Recession Watch charts in Trade Signals). The global economy is a different story with much of the developed world near or in recession. Everything is connected. The Fed sees this.

116 months of economic expansion is a long time. Debt north of 350% relative to GDP (what a country is earning) is where we sat in the mid-1930s in many countries and where we sit today. The end game at the end of long-term debt accumulation cycles is different than what you and I have experienced (recessions) every one or two times each decade since 1950. The economy is late cycle. Last year was bumpy. It will continue to be bumpy on our way to figuring out how we collectively (the major developed countries) monetize our debts.

As for Chairman Powell, I believe the U-turn is wise. The global economic recession is worsening. The U.S. will not be immune. I expect continued economic decline into 2020. I like how Peter phrased it above, “Like other central banks, the Fed is now trapped in a never-ending easy-money trap.” Expect more to come…

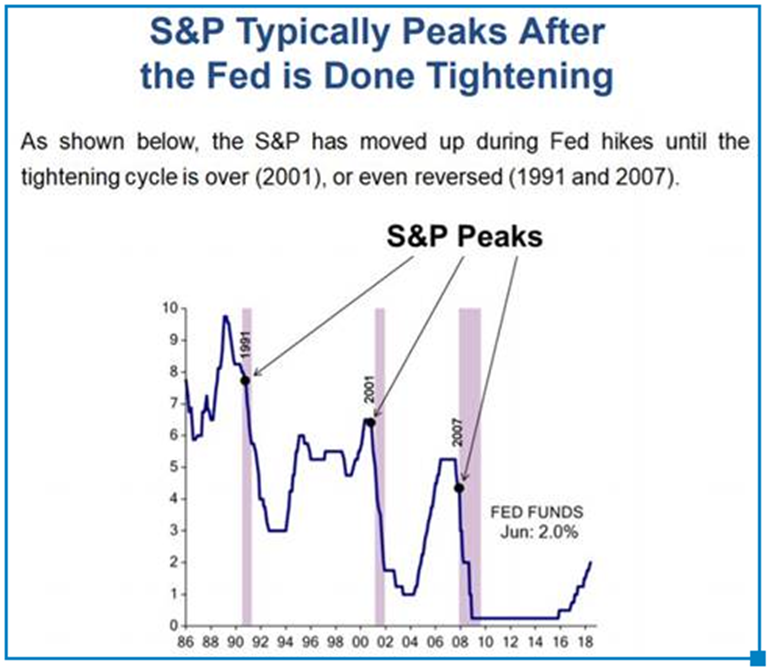

Grab that coffee and find your favorite chair. You’ll find a great chart from Ed Hyman showing us that the S&P typically peaks after the Fed is done tightening. We’ll take a quick look at the U.S.-China trade war negotiations and you’ll also find the link to the most recent Trade Signals post… Of note, the Zweig Bond Model triggered a buy, signaling lower interest rates ahead. One last update, I had hoped to have the Recession Watch (several are based on month end data) to you this week. I’ll share them with you next week. Thanks for reading!

♦ If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here. ♦

Follow me on Twitter @SBlumenthalCMG

Included in this week’s On My Radar:

- S&P Typically Peaks After The Fed is Done Tightening

- U.S.-China Trade War Negotiations Step Center Stage

- Market Commentary and Outlook by PJ Grzywacz, President, CMG Capital Management Group

- Trade Signals – The Zweig Bond Model Turns Bullish, Equity Markets Testing Resistance (200-day MA)

- Personal Note – An Observation on a Country Which I Love

- S&P Typically Peaks After The Fed is Done Tightening

- U.S.-China Trade War Negotiations Step Center Stage

- Market Commentary and Outlook by PJ Grzywacz, President, CMG Capital Management Group

- Trade Signals - The Zweig Bond Model Turns Bullish, Equity Markets Testing Resistance (200-day MA)

- Personal Note - An Observation on a Country Which I Love

S&P Typically Peaks After The Fed is Done Tightening

I feel this next chart is worth sharing with you. While we get excited about the Fed’s “U-turn,” we should note that the S&P 500 Index peaks after the Fed is done tightening and changes paths and not before. This next chart from Ed Hyman shows us that the last Fed interest rate hike is always the mistake. It shows us that markets peak after the Fed is done tightening and reverses course.

Perhaps we have reached that point in time with Chairman Powell’s abrupt “U-turn.” Let’s keep zeroing in on the Recession Watch charts (updated weekly/monthly) in Trade Signals.

U.S.-China Trade War Negotiations Step Center Stage

From this morning’s WSJ:

Washington and Beijing moved closer to settling their trade dispute after two days of high-level discussions.

Mr. Trump said he expects to meet again with Chinese President Xi Jinping. The Chinese delegation proposed that Mr. Trump meet with Mr. Xi after the U.S. president’s planned summit with North Korean leader Kim Jong Un in late February.

Washington’s top China trade negotiator, U.S. Trade Representative Robert Lighthizer, said the March 1 deal deadline remains intact.

We’ll soon learn more…

Market Commentary and Outlook by PJ Grzywacz, President, CMG Capital Management Group

CMG’s PJ Grzywacz wrote the following quarter-end commentary. I bit of a review of 2018 and thoughts around major trends:

What an end to the year. After reaching all-time highs during the year, it was remarkable to witness the fear and panicked selling that characterized the fourth quarter for global equity markets. More than one market veteran had flashbacks of the financial crisis or the crash of ‘87. The quarter was in many ways like a hurricane: coming ashore in October, the calm eye of the storm in November and then a resumption of the destructive onslaught in December. When the clouds passed, the decline in December ended up being the second worst on record. The worst: 1931 during the Great Depression and what was a decidedly different economic environment. Furthermore, there were few places to hide during the quarter with the exception of cash. It was the first time since 1972 that all major asset classes had returns below zero and not one returned more than 5%. The best performing assets for the entire year were cash or cash like proxies that benefited from a surge in short-term interest rates on the back of tighter monetary policy. These are not the normal characteristics of a strong economy or a bull market.

The decline at the end of 2018 has a silver lining for 2019: markets look a lot cheaper on a valuation basis then they did 3 months ago, thereby making forward looking returns slightly more attractive (assuming earnings growth remains on path). Add in the fact that pessimism had reached extreme levels in recent months there is opportunity for upside in 2019. The bad news is that there remain risks that are not easily quantified or managed, namely of the political variety. After much criticism, the Fed has finally signaled that it is willing to slow down its pace of tightening. Chairman Powell may also well have been looking to deflect some of the political pressure coming from the White House. If so, it may prove to be a shrewd move as the focus will now turn to the administration’s trade negotiations with China as the primary market driver over the next quarter in the absence of activity from the Fed. If the administration fumbles, it will be much harder to push the blame back to the Fed. Rate hike prospects have declined with the median expectation of FOMC members falling from three to two for this year while investors, via futures markets, are signaling none at all. [SB here: Since this week’s U-turn, futures market have gone from expected rate increases to a 17% change for a rate cut in 2019.]

Despite strong economic growth in the past year, there remains an anxiety about this market that is keeping equity markets from moving higher. That the source of those concerns is political and difficult to quantify continues to unnerve global markets. It feels like markets could move to new highs or fall to multi-year lows depending on which way things break on a few issues we highlight below. The risk of recession has risen in the EU and China and the U.S. is at risk of a slowdown as well. The uncertainty of these outcomes has increased volatility as investors have less clarity about the direction of markets. Below we break down some of key events that will impact markets in 2019.

The Art of Not Wanting a Deal

After a year of sabre rattling and tit for tat tariffs, the U.S. and China are sitting down to negotiate a trade deal. The stakes are high and the expectations, or more appropriately the hopes of investors for a positive 2019, are even higher. The outcome of these negotiations more than any other event this year may determine whether the global economy expands or declines, potentially into a recession. The success of the negotiations will be determined by the most mercurial politician of recent times. Recent signs from the administration that it is considering removing some tariffs to hasten a trade deal are encouraging. Additionally, Trump is besieged by negative news on all sides and a deal with China would allow him to positively affect the news cycle. The real question is will he take a deal? Aside from immigration, trade and China are the other big issues that Trump cares about. Both issues are the core of his message to a base that has narrowed after losses during the midterm elections. Will that core group of supporters remain energized in the absence of these fights? There is no doubt that a trade deal would be a positive for markets irrespective of the substance of the deal. In fact, the renegotiation of NAFTA yielded little of substance other than a more complicated acronym but markets saw it as an obstacle removed and hence a bullish sign. The ultimate outcome of the negotiations with China may end up looking similar. That’s not necessarily a bad thing.

BREXIT

The Economist has it right on the cover of its recent edition: the mother of all messes. The start of 2019 has not been kind to Prime Minister Theresa May. After surviving a no-confidence vote from her own party last year, May had her Brexit deal rejected. The scale of the loss was staggering: 432 votes to 202 with her own party members voting against the proposal by three to one. It is the largest defeat for a ruling party on record, a long record at that. Subsequently, May barely survived a full parliamentary no confidence vote (325 to 306) in her government and narrowly avoided a snap election. In a twist of fate, the same members of her party who voted against her Brexit deal helped keep her in power. You can’t make this stuff up. May has spent the last two years negotiating with the EU and the current deal is the best that can be made of trying to, as Boris Johnson put it, “have your cake and eat it too”. There is now not enough time to negotiate a new deal and two things are likely to happen: Britain will ask for an extension to avoid leaving with no deal at the end of March and the calls for a second referendum will grow louder. It is the right thing to do as Brits are extremely divided on Brexit and have been misled on the cost of leaving. Only a second referendum where the specifics of a Brexit deal are presented to voters will move this forward. Will May still be in power to oversee such a referendum? To say her leadership has been uninspiring is an understatement but is there really anyone who wants to take on this impossible task?

Dollar Down

Last year was a good year for the dollar, but after rising 7% against a basket of currencies, it might have peaked. Strong economic growth and rising interest rates drove the dollar higher over the past several years. Both factors are likely to have a neutral or negative impact on the dollar’s value this year. As mentioned earlier, the Fed has indicated that it is close to its interest rate targets and has signaled more dovish overtones since the hike in December. Other developed economies, namely Europe and Japan, are well behind the U.S. with respect to tightening monetary policy. The reason has been lackluster growth compared to the U.S. A resolution to the trade war between the U.S. and China could be the spark for growth in Asia and other emerging markets. The EU and Japan benefit more than the U.S. from emerging market demand. Stronger growth would push interest rates up (or remove accommodative policy) and give a lift to the Euro and the Yen. Clarity on Brexit may well lift the pound off its lows as well. Of course, a deal with China could fall apart, economic growth stumbles and the dollar remains elevated and overvalued in the short- to intermediate-term (although the Yen and Swiss Franc would likely benefit more during a flight to safety). Finally, another trend is reducing demand for the dollar (albeit on a relatively small scale right now) and bears watching: divesting from the dollar in foreign reserve holdings. In response to sanctions, Russia sold $101 billion worth of dollar holdings, moving into the euro, yen and yuan. Russia’s yuan holdings, at about ten times the average for global central banks, is a clear outlier. I have discussed for several quarters the slow moving impact of America First policies. This is one of them. An acceleration of these types of shifts is another side effect if the negotiations with China do not bear fruit.

Business Confidence and Consumer Sentiment

After giving Trump the benefit of the doubt during his first year in office, consumers, investors and business leaders are now showing reduced confidence. Sentiment indicators remained high in 2017 on the heels of several bullish signs from the new administration: less regulation and a corporate tax cut helped push markets to new highs. However, in 2018 these positive factors were negated by fears of rising interest rates and trade wars. Sentiment readings are reflecting anxiety about these changes as evidenced by the most recent consumer sentiment reading which declined to the lowest level since Trump was elected. The magnitude of the decline was a surprise relative to estimates and reflects concerns about the volatile fourth quarter for stocks, the ongoing trade war and the government shutdown. The next several readings of the index will be critical in assessing whether this negativity is temporary or the sign of something more substantial. Sentiment amongst global business executives, in contrast to consumers, has been negative for most of the past year. McKinsey’s December survey of global executives resulted in the least-positive views on the economy in over a year. Fewer executives expect economic conditions and growth rates to improve over the next 6 months, a dramatic reversal from the start of 2018. Emerging economy respondents in particular have become more apprehensive: in developed Asia for example, half of respondents now say economic conditions have worsened. Three months earlier only 27% felt that way. The most cited threats to growth persisted all year: most respondents see changes to trade policies (53%) and geopolitical instability (46%) as the biggest threats. A resolution to the trade war with China would help raise spirits amongst both consumer and business leaders. A failure to secure a deal or draw a truce will entrench negative sentiment further and increase the probability of a recession.

Trade Signals – The Zweig Bond Model Turns Bullish, Equity Markets Testing Resistance (200-day MA)

January 30, 2019

S&P 500 Index — 2,663

Notable this week:

I wrote the following on December 26, 2018, “Daily Investor Sentiment is the lowest since 1995. It’s lower than anytime during the Great Financial Crisis. This is as extreme as it gets. Expect a rally.” Then the S&P 500 Index stood at 2,351. Today it is at 2,663. Investor sentiment is now neutral. Neither too optimistic (which is bearish for stocks) nor too pessimistic (which is bullish stocks, as it was on December 26).

You’ll see in today’s post that the stock market indicators on the Trade Signals dashboard remain bearish. The dominating directional trend is bearish. The major indices are testing overhead resistance. As for the bond markets, the CMG Managed High Yield Bond Program remains in a buy signal and the Zweig Bond Model, after many months is a sell signal, just triggered a buy signal, suggesting a move lower in yields and a rally in high quality bonds, bond funds and bond ETFs. Gold has had a nice rally and remains in a buy signal.

Risk of global recession remains high, while there’s currently low risk of recession in the U.S. though we believe risk is rising. We’ll continue to remain data dependent (recession watch charts below). The recession data updates monthly. I’ll share the January month-end data with you in next week’s post.

Click here for this week’s Trade Signals.

Important note: Not a recommendation for you to buy or sell any security. For information purposes only. Please talk with your advisor about needs, goals, time horizon and risk tolerances.

Personal Note – An Observation on a Country Which I Love

An Observation on a Country Which I Love, by President Ronald Reagan. Click on the photo to listen to Reagan’s final speech as president. I hope it moves you as much as it moved me.

Watch the video here.

Florida is up next. I fly to West Palm Beach next Saturday for the Inside ETF’s Annual Conference. Golf is planned that afternoon with an industry partner and one of my long-time clients. Then we are headed to Miami Beach on Saturday evening for dinner. Brianna will be joining us and we’ll be celebrating her birthday. Utah follows Feb 27 – March 1. It’s conference season with some fun added in.

I hope you are weathering the cold. I’m looking forward to Sunday’s Super Bowl though I do wish the Philadelphia Eagles were in the game this year. I hope you have a team in the hunt. Sorry to my friends in New Orleans. That may go down in history as the most consequential miss call in all of sports. Enjoy your weekend and I hope you find time to enjoy the game with family and friends.

Speaking of conferences, I hope you can join me in Dallas this year for the 2019 Mauldin Strategic Investment Conference May 13-16. It is the single best conference I attend each year. President Bush is going to present on his debt initiative. I hope to see distressed debt king, Howard Marks interview President Bush. On my wish list anyway… You’ll find a registration link immediately below. Please know I am not compensated in any way.

Confirmed speakers include:

- President George W. Bush

- Howard Marks, CFA and co-chairman at Oaktree Capital

- Dr. Lacy Hunt

- Carmen Reinhart, world-renowned economist and best-selling author

- Felix Zulauf, hedge fund manager and 30+ year Barron’s Roundtable member

- Jim Mellon, hedge fund manager and billionaire investor

- Bill White, former Executive Committee Bank for International Settlements

- Plus, long-time SIC favorites David Rosenberg, Grant Williams, Mark Yusko and more

You can register here. Agenda here. Speakers here. I hope to see you in Dallas in May.

Thank you for reading On My Radar. Please know how much I appreciate you and the time you spend with me each week. Have a great weekend.

♦ If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here. ♦

Best regards,

Steve

Stephen B. Blumenthal

Executive Chairman & CIO