LONDON —January 12, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that the global ETF industry gathered US$69.37 billion in net inflows during December, bringing year-to-date net inflows to US$856.16 billion. During December 2022, assets invested globally in the ETF/ETP industry decreased by 2.7%, from US$9.48 trillion at the end of November to US$9.23 trillion, according to ETFGI’s December 2022 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Q4 2022 hedge fund letters, conferences and more

Highlights

- Global ETF industry gathered $856.16 Bn in net inflows in 2022. 2nd highest level of annual net inflows behind the $1.29 Tn gathered in 2021.

- Net inflows of $69.37 Bn during December.

- 43rd month of consecutive net inflows.

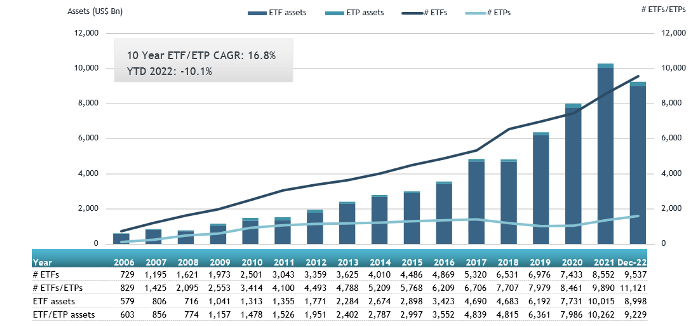

- Assets of $9.23 Tn invested in global ETFs industry at the end of December 2022.

- Assets decreased 10.1% YTD in 2022, going from $10.26 Tn at end of 2021 to $9.23 Tn.

If you like our research and events, please support us by nominating ETFGI in the Best ETF Research Provider category (No. 21) at the European ETF Awards for Service Providers 2023 here. Nominations close on Friday 27th January 2023.

“The S&P 500 decreased by 5.76 % in December and was down 18.11% in 2022. Developed markets excluding the US decreased by 0.46% in December and were down 16.06% in 2022. Israel (down 6.05%) and US (down 17.45%) saw the largest decreases amongst the developed markets in December. Emerging markets decreased by 1.07% during December and were down 17.75% in 2022. Qatar (down 10.21%) and Peru (down 7%) saw the largest increases amongst emerging markets in December.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of December 2022

The Global ETFs industry had 11,119 products, with 22,860 listings, assets of US$9.229 Tn, from 671 providers on 81 exchanges listed in 64 countries at the end of December.

During December, ETFs/ETPs gathered net inflows of $69.37 Bn. Equity ETFs/ETPs saw net inflows of $35.53 Bn over December, bringing 2022 net inflows to $479.59 Bn, lower than the $909.35 Bn in net inflows equity products gathered in 2021. Fixed income ETFs/ETPs gathered net inflows of $19.63 Bn during December, bringing 2022 net inflows to $238.21 Bn, lower than the $238.49 Bn in net inflows fixed income products had attracted in 2021. Commodities ETFs/ETPs reported net outflows of $1.75 Bn during December, bringing 2022 net outflows to $16.38 Bn, more than the $10.18 Bn in net outflows commodities products reported in 2021. Active ETFs/ETPs attracted net inflows of $12.67 Bn over the month, gathering net inflows of $121.91 Bn, lower than the 2021 net inflows of $131.08 Bn.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $31.07 Bn during December. iShares Core U.S. Aggregate Bond ETF (AGG US) gathered $2.78 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows December 2022: Global

| Name |

Ticker |

Assets |

NNA |

NNA |

|

| iShares Core U.S. Aggregate Bond ETF |

AGG US |

82,470.60 |

4,294.21 |

2,778.33 |

|

| Vanguard Total Stock Market ETF |

VTI US |

259,599.47 |

25,730.84 |

2,528.08 |

|

| Vanguard Total Bond Market ETF |

BND US |

85,171.39 |

14,358.04 |

2,279.88 |

|

| iShares Russell 1000 Growth ETF |

IWF US |

59,365.00 |

3,565.52 |

1,773.78 |

|

| Huatai-Pinebridge CSI 300 ETF |

510300 CH |

11,232.48 |

4,407.77 |

1,735.44 |

|

| NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

3,689.47 |

629.34 |

1,711.62 |

|

| iShares 0-3 Month Treasury Bond ETF |

SGOV US |

7,399.24 |

6,580.29 |

1,640.88 |

|

| Schwab US Dividend Equity ETF |

SCHD US |

44,725.95 |

15,564.87 |

1,638.99 |

|

| JPMorgan Ultra-Short Income ETF |

JPST US |

23,868.55 |

5,554.27 |

1,566.92 |

|

| Vanguard Value ETF |

VTV US |

99,491.11 |

11,121.26 |

1,474.55 |

|

| ProShares UltraPro QQQ |

TQQQ US |

10,559.55 |

11,374.57 |

1,474.17 |

|

| JPMorgan Equity Premium Income ETF |

JEPI US |

17,484.99 |

12,924.74 |

1,445.71 |

|

| ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

7,366.06 |

5,715.65 |

1,338.80 |

|

| iShares 7-10 Year Treasury Bond ETF |

IEF US |

22,829.26 |

8,825.29 |

1,243.47 |

|

| iShares Core MSCI World UCITS ETF – Acc |

IWDA LN |

44,799.43 |

6,324.92 |

1,137.23 |

|

| Hang Seng China Enterprises Index ETF |

2828 HK |

4,580.74 |

2,089.56 |

1,123.81 |

|

| Vanguard FTSE Developed Markets ETF |

VEA US |

101,056.65 |

10,277.75 |

1,097.08 |

|

| iShares Short-Term National Muni Bond ETF |

SUB US |

11,027.08 |

4,426.18 |

1,055.70 |

|

| SPDR Portfolio S&P 500 Value ETF |

SPYV US |

15,167.15 |

3,294.93 |

1,028.36 |

|

| iShares Russell 1000 Value ETF |

IWD US |

54,276.68 |

(155.73) |

999.89 |

The top 10 ETPs by net new assets collectively gathered $2.85 Bn over December. United States Oil Fund LP (USO US) gathered $304.8 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows December 2022: Global

Investors have tended to invest in Equity ETFs/ETPs during December.