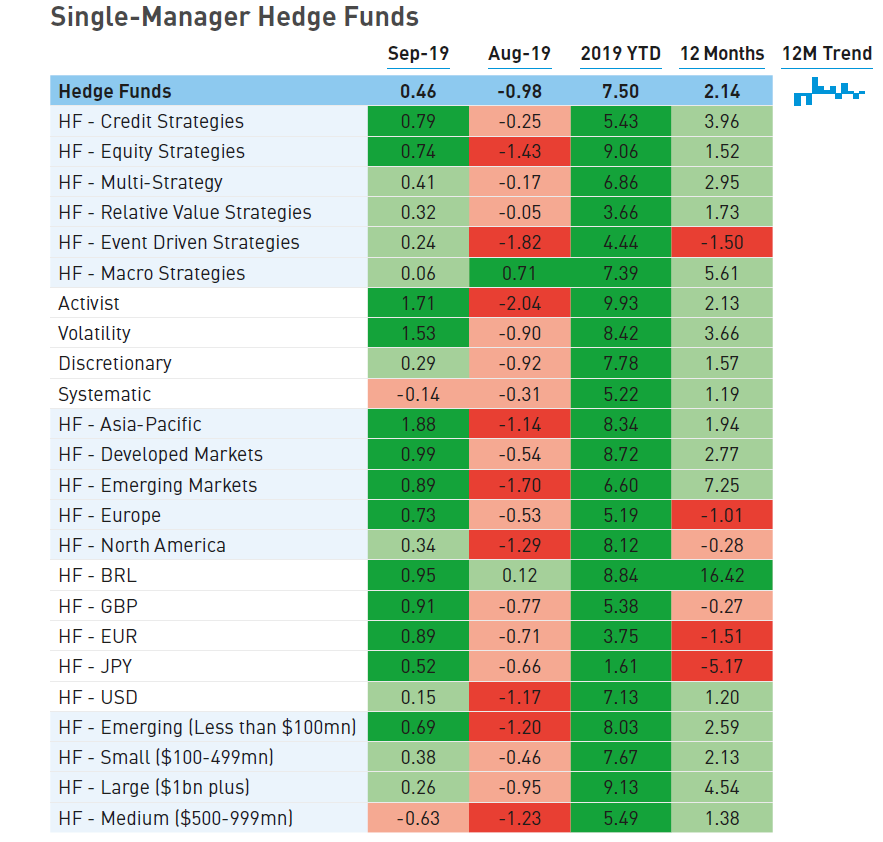

The Preqin All-Strategies Hedge Fund benchmark posted a return of +0.46% in September, recovering from the August return of -0.98% and pushing the 2019 YTD figure to +7.50% and the 12-month return to +2.14%. This coincides with the threat of a global downturn slightly easing.

Q3 2019 hedge fund letters, conferences and more

All top-level strategies tracked by Preqin made modest gains in September. Credit strategies (+0.79%) were the best performers, closely followed by equity strategies (+0.74%), which are the top performers so far this year at +9.06%. Event driven and macro strategies posted comparatively low returns of +0.24% and +0.06% respectively.

Hedge funds denominated in BRL generated a return of +0.95%, outperforming other currency denominations, and pushing their 2019 YTD return to +8.84% and their 12-month return to +16.42%. GBP-denominated hedge funds reversed losses in August (-0.77%) to post a return of +0.91%. Meanwhile, funds denominated in USD posted +0.15% as the weakest performing denomination.

Emerging hedge funds were the best performing size classification in September, posting a return of +0.69% and pushing their YTD return to +8.03%. Large hedge funds remain the best performing class in 2019, with a YTD return of +9.13%.

Article by Preqin