Your money is unlikely to last you as long as most savings withdrawal calculators will tell you. That famous 4% withdrawal rule? Not so fast, especially not in the current environment. Before you entrust your retirement to some over-simplified rule of thumb, you should understand what’s really involved and what you need to know in today’s low-return investing climate.

Q1 hedge fund letters, conference, scoops etc

When most people ask how long their savings will last, they expect a simple answer, like “32 years.” The truth is more nuanced than that and depends on a number of factors:

- Are you looking to not deplete your savings so that you can pass on the principal to your heirs or charity while living off the returns? Or are you OK with an ending balance of zero?

- What rates of return are reasonable to expect over the long-term?

- What is the volatility of these returns?

- Will you get unlucky and have a large negative return in the early part of the period?

The only way to tell you how long your money will last is using probabilities, as in “there is an X% chance that your money will last you Y years.” Asking for more than that would get you the false precision that might cause you to make the wrong calls with your savings and retirement decisions.

Let’s start with the assumption that you are willing to spend your money until it is completely gone. That’s not to say that you don’t want to leave anything for posterity, but to keep things simple let’s assume that is coming out of your other funds.

Reasonable Rates of Return

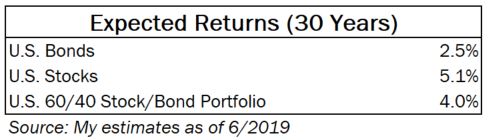

At the time of this writing the U.S. 30-year Treasury bond is yielding approximately 2.5%, the 10-year Treasury bond is yielding less than 2.2% and the 5-year Treasury bond is yielding 1.9%. Sure, you can get higher yields if you choose to accept credit risk and buy corporate bonds. Remember, there is a reason that those bonds offer slightly higher yields – some of these companies will not be able to repay their obligations and you won’t necessarily realize the higher yield.

What about U.S. equities? Warren Buffett recently said that he expects the U.S. stock market to do better than government bonds over the next decade. The information is not in what he said but in what he didn’t say. If that is the strongest statement he cares to make, all the while holding on to the $100B+ in cash waiting on the sidelines, that is not a very positive outlook for U.S. stock returns.

You might be wondering: what about those oft-quoted 9%-10% per year equity returns that you have frequently heard talked about? Well, those are the average rates over the last century or so. However, we are not starting from an average point in time. Consider that:

- We are starting from well above mid-cycle level of corporate profits

- Inflation, as implied by the bond markets, is at almost half the historical rate

- Real GDP growth going forward is likely to be lower than the average of the last century

- We are starting from above-average valuation levels

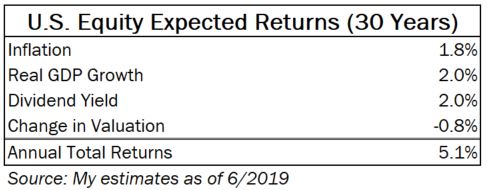

Feel free to disagree, but here is what you can reasonably expect from U.S. equities going forward if you choose the passive indexing approach:

The rationale for the assumptions is as follows:

- The inflation estimate above is based on the difference between regular 30-year U.S. Treasury bonds and inflation-protected 30-year U.S. Treasury bonds

- Real GDP growth of 2% assumes that we grow about 1% below the post-World War II growth rates due to moderating productivity growth and because we are starting above mid-cycle levels of profits

- The dividend yield is the current yield on the Russell 3000 index, which represents the vast majority of U.S. market by market capitalization

- The change in valuation assumes that we are starting at a Price-to-Earnings ratio of 19x and ending at the historical average of 15x

I am a fundamental value investor, and as such spend almost no time thinking about the market as a whole, choosing instead to focus on finding attractive investments on a bottom-up basis. So take the above with a grain of salt, or better yet come up with your own estimates. The point is, you are going to be hard pressed to reach the conclusion that the next 10-30 years will be anywhere close to the long-term history in terms of U.S. equity rates of return.

If you, following conventional wisdom, are planning to have your assets in a mix of 60% stocks and 40% bonds, here is what you can expect, before any impact of taxes.

I bet the above comes as somewhat as a shock, and is not what your financial advisor likely has led you to expect. However, whether these estimated returns are somewhat high or somewhat low, I don’t think you can realistically expect a whole lot more from the current environment by passively investing in the markets.

Volatility of Returns

Volatility of returns should not matter if you hold your investments for the whole period. However, most people who are asking the question about how long their money will last are likely in a phase of their life when they are making systematic withdrawals to use their savings to support their lifestyles.

Many online withdrawal calculators simply assume that your average return is what you will actually get every year. If only investing were that certain. For perspective, U.S. equity returns have had a historical annual standard deviation of approximately 17%. 5-year U.S. Bonds have had standard deviation of just under 5%, and a 60/40 portfolio has had a standard deviation of around 12%.

Sequence of Returns

With returns deviating so far from the expected returns for a typical portfolio, you are going to experience years much worse than and much better than the 4% estimate that I came up with for a 60/40 portfolio. That’s not all – sequence matters.

The last thing you want to have happen is for the large negative returns to come early in your retirement, since if you simply sell a fixed percentage of your portfolio every year, such as the frequently quoted 4% safe withdrawal rate, you will be locking in your losses.

Unfortunately, with the current valuation of the U.S. markets stretched far above historical levels, the risk of just such an event is higher now than it usually is. I have no idea if the market is going to decline precipitously or not in the next few years. I spend no time thinking about that, and all my efforts on finding deeply undervalued companies that offer attractive investment opportunities. However, the current environment, far into an economic expansion and with abundant market optimism, increases the likelihood of just such an event.

How Long Will My Money Last?

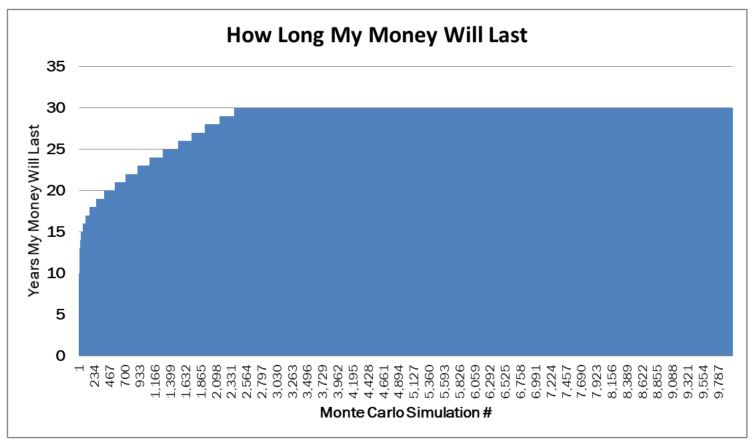

So if using simplistic calculators or outdated rules-of-thumb is not the answer, how should you go about answering this question? The right way to approach this is to simulate many possible futures drawn from the same distribution of returns. This is what is known in statistics as a Monte Carlo simulation.

Ultimately you should care about only one future – the actual one that you are going to experience. So what’s the problem? You don’t know what that future is going to be, and neither does anyone else. By simulating many possible futures you get to see how often you are likely to run into trouble with your savings.

What level of risk are you comfortable with? What percent of the time would you running out of money in retirement cause you to view your investment strategy as too risky? That’s for you to decide. Let’s take a look at that well-worn 4% withdrawal rule and see, given my return assumptions, how often you are likely to run out of money in retirement.

What this chart should tell you is that about a quarter of the time you will run out of money sometime during your 30 year retirement period. Do you disagree with my assumptions? Great. Request the free wealth simulation tool and put in your own assumptions, specific to your situation, to see how well you are likely to do. The point is not this specific set of numbers, but the overall process that you should use to answer this important question. After all, is this really something that you want to find out that you have made a mistake about once you it is too late and you have no other financial means to fix the error?

How long will your money last? Request the free wealth simulation tool to model your own situation.

What Should I Do To Have Enough Money?

There are three things that can lower the odds of your money running out when you need it:

- Start with more money

- Lower your annual withdrawal rate

- Increase your annual rate of return

Starting with more money is not always possible, but to the degree that you have control over that (e.g. choosing the amount you save prior to retirement), that can be a wise choice.

Lowering your annual withdrawal rate can be a great way to make your money last you longer. However, you need to be realistic about your needs and wants. Make sure you have a solid financial plan that takes into account both expected and unexpected expenses.

Finally, increasing your rate of return is hard. Doing so without taking an undue risk of permanent capital loss is even harder. Most people don’t have a realistic chance of doing better than the market. Many also lack the ability to pick out the few investment managers that will beat the market. So unfortunately for many the passive, low-cost indexing approach is the choice best suited to their expertise and abilities. If that is you, then the last thing you want to do is to try to do better than the market – most who try to do so end up doing worse, not better.

Since Benjamin Graham first wrote Security Analysis in the early 1930s, value investing has been the only approach that I know of that, when skillfully executed, has the potential to offer returns significantly better than the market without taking on more risk. This has baffled academics for decades, but as Warren Buffett explained in his famous speech that he gave in the 1980s, skillful value investing practitioners have generated superb returns even though they have invested in very different specific investments from one another. That path is long and hard, requiring the right temperament, a good investment process and years of sometimes painful experience. It’s not the right path for many who lack the time or those abilities, but for the few who choose to pursue it and become a good value investor for the right reasons it can offer a better alternative than many others available to them.

If you are interested in learning more about the investment process at Silver Ring Value Partners, you can request an Owner’s Manual here.

If you want to watch educational videos that can help you make better investing decisions using the principles of value investing and behavioral finance, check out my YouTube channel where I regularly post new content.

Article by Gary Mishuris, Behavioral Value Investing