Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Q2 hedge fund letters, conference, scoops etc

If you think the Fed may only lower rates by 50 or even 75 basis points, you are grossly underestimating them.

Currently, the December 2019 Fed Funds futures contract implies that the Fed will reduce the Fed Funds rate by nearly 75 basis points (0.75%) by the end of the year. While 75 basis points may seem aggressive, if the Fed does embark on a rate-cutting policy and history proves reliable, we should prepare ourselves for much more.

The prospect of three 25 basis point rate cuts is hard to grasp given that the unemployment rate is at 50-year lows, economic growth has begun to slow only after a period of above-average growth, and inflation remains near the Fed’s 2% goal. Interest rate markets are looking ahead and collectively expressing deep concerns based on slowing global growth, trade wars, and diminishing fiscal stimulus that propelled the economy over the past two years. Meanwhile, credit spreads and stock market prices imply a recession is not in the cards.

To make sense of the implications stemming from the Fed Funds futures market, it is helpful to assess how well it has predicted Fed Funds rates historically. With this analysis, we can hopefully avoid getting caught flat-footed if the Fed not only lowers rates but lowers them more aggressively than the market implies.

Fed Funds versus Fed Funds futures

Before moving ahead, let’s define Fed Funds futures. The futures contracts traded on the Chicago Mercantile Exchange (CME), reflect the daily average Fed Funds interest rate that traders, speculator, and hedgers think will occur for specific one calendar month periods in the future. For instance, the August 2019 contract, trades at 2.03%, implying the market’s belief that the Fed Funds rate will be .37% lower than the current 2.40 % Fed Funds rate. For pricing on all Fed Funds futures contracts, click here.

To analyze the predictive power of Fed Funds futures, I compared the Fed Funds rate in certain months to what was implied by the futures contract for that month six months earlier. The following example helps clarify this concept. The Fed Funds rate averaged 2.39% in May. Six months ago, the May 2019 Fed Funds future contract traded at 2.50%. Therefore, six months ago, the market overestimated the Fed Funds rate for May 2019 by .11%. As an aside, the difference is likely due to the recent change in the Fed’s IOER rate.

I was surprised by the conclusions drawn from my long term analysis of Fed Funds futures against the prevailing Fed Funds rate in the future.

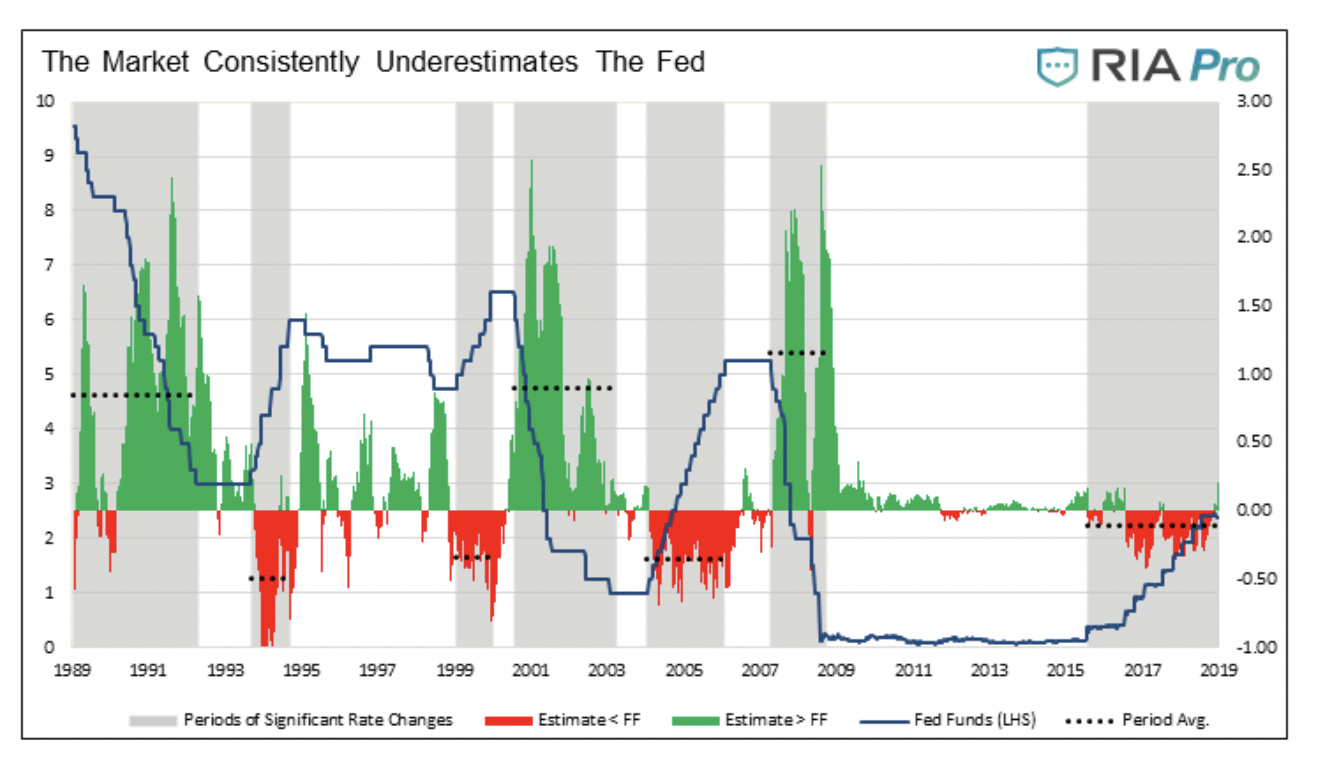

The graph below tracks the comparative differentials (Fed Funds vs. Fed Fund futures) using the methodology outlined above. The gray rectangular areas represent periods where the Fed was systematically raising or lowering the Fed funds rate (blue line). The difference between Fed Funds and the futures contracts, colored green or red, calculates how much the market over (green) or under (red) estimated what the Fed Funds rate would ultimately be. In this analysis, the term overestimate means Fed Funds futures thought Fed Funds would be higher than it ultimately was. The term underestimate, means the market expectations were lower than what actually transpired.

To further help you understand the analysis I provide two additional graphs below, covering the most recent periods when the Fed was increasing and decreasing the Fed Funds rate.

Data Courtesy Bloomberg

Read the full article here by Michael Lebowitz, Advisor Perspectives