I’m not sure what surprises me more. The fact that I’ve been writing a blog for over two years or that I haven’t fit America’s best rock band (according to Rolling Stone) into one of my posts. Of course I’m talking about R.E.M.

Q3 hedge fund letters, conference, scoops etc

I don’t remember exactly when I was introduced to R.E.M., but I remember the first song. It was “Radio Free Europe”. It was like nothing I’d ever heard. I went on to discover other R.E.M. gems such as “Gardening at Night”, “Driver 8”, and “So. Central Rain”. I was hooked and soon owned all their albums (or cassette tapes).

While R.E.M. was initially known as an alternative college band from Athens GA, after the release of their album Document, the band became more well-known. And after their albums Green and Out of Time were released, they became famous.

Their cycle of popularity likely peaked in the early 1990’s. As the band matured, they experimented with different sounds and song writing. Later albums such as Up, Reveal, Accelerate, and Collapse into Now, were all good in my opinion, but never caught a bid from the mainstream. It’s possible their newer music deviated too far from R.E.M.’s earlier and familiar sounds to please the masses.

While their later albums contained fewer top hits, it’s where many of my favorite songs are located. One of my favorites, and I believe most underrated R.E.M. song, is on their album Reveal. It’s called “I’ve Been High”. Unlike “It’s the End of the World as We Know It”, “Orange Crush”, and “Losing my Religion”, it’s not a particularly catchy or upbeat song. Nevertheless, I find its flow, vocals, and lyrics mesmerizing.

Similar to most R.E.M. songs, the lyrics are open to interpretation, but unlike their older songs, the lyrics are clear and can be understood! The last four verses below:

So what in the world does R.E.M. and their song “I’ve Been High” have to do with absolute return investing? Everything!

In order to achieve attractive absolute returns over a full market cycle, it’s very important to avoid permanent losses to capital. Based on my experience, an effective way to limit large mistakes is to generate accurate asset valuations.

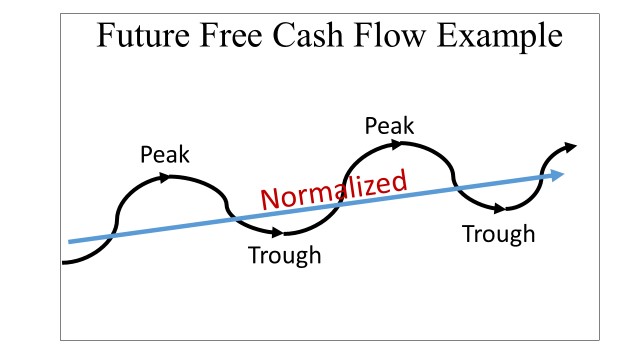

A common error made in business valuation is related to extrapolation, or assuming current operating conditions will persist far into the future. Instead of extrapolating and thinking of a company’s profit cycle as linear, I believe most business results are cyclical, with profit margins gravitating towards their mean.

To take the cyclical nature of business into consideration, I typically use a normalized cash flow assumption in my discounted cash flow model. In effect, I want to avoid being too optimistic during the peaks and too pessimistic during the troughs. In my opinion, a normalized cash flow assumption provides investors with a more accurate valuation than extrapolating current trends far into the future.

Similar to businesses, I view the economy and stock market through a cyclical lens. As is the case with many things in life, there are natural highs and lows. Despite the natural cyclical tendencies of the market and economy, a significant amount of effort and capital has been allocated towards maintaining the current cycle’s high.

In my opinion, the desire to maintain this cycle’s high originates from the 1999 stock market bubble. The high created from that cycle’s asset inflation was exhilarating. Record equity prices contributed to strong economic growth, rising wages, and a fiscal surplus. Unless you were a short seller or disciplined value investor, it was very easy to make money. All you needed was a brokerage account and a cash advance from your credit card!

Things were so good in 1999, some economists, including Alan Greenspan, were concerned the United States would eventually pay off its debt (concerned because the Treasury market would disappear)! It was truly an amazing and prosperous period few had ever seen – so unique, it was labeled the “New Economy”. Unfortunately for many, the boom couldn’t be maintained, the bubble popped, and reversion defeated extrapolation.

Ever since the 1999-2000 bubble peak, it appears to me that we, as a society, have been trying to relive that high. Policy makers in particular have increased their focus on the wealth effect and financial stability. Once used mainly as an economic indicator, the financial markets have become the go-to lever to pull when the economy needs a boost. Reflating asset prices has become synonymous with reflating the economy. If a stock market bubble pops, replace it with a housing bubble. If a housing bubble pops, cut rates to 0%, buy trillions of assets (global QE), and watch everything fly.

In my opinion, the tremendous amount of effort and resources used to sustain the current cycle stems from the desire of investors, corporations, and policy makers to live their lives on high. Unfortunately, as nice as it would be for profits and asset prices to remain near peak levels indefinitely, it’s not how the markets, or life for that matter, typically works. Eventually “the light washes over” and the cyclical nature of business, markets, and the economy is revealed.