Pension funds’ performance figures have come under fire over the past few years. Most of these funds are struggling to hit their targeted annual return, despite strong equity markets. As a result, unfunded pension liabilities are blowing out.

Q3 hedge fund letters, conference, scoops etc

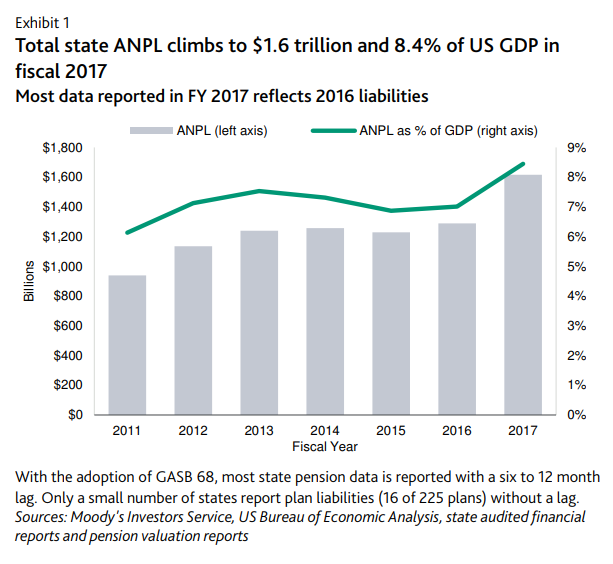

According to a recent update from the Federal Reserve, the total value of US states’ unfunded pension liabilities has now reached $4 trillion, which underlines the scale of just how big of a crisis this could become. This figure includes an estimate of future liabilities based on current employment trends. The actual value of current adjusted net pension liabilities spiked to $1.6 trillion dollars in fiscal 2017.

Adjusted net pension liabilities up 26%

According to a report from credit rating agency Moody’s, which has crunched the numbers on the state of the US pension industry, total state adjusted net pension liabilities grew by 25.5% year-on-year from fiscal 2016 and now represent a staggering 8.4% of US GDP and 147.4% of state revenues.

Some states are faring better than others such as Michigan, New York, Washington, and Utah. Moody’s highlights these four because they are the only four states where adjusted net pension liabilities group by less than 5% in fiscal 2017. At the other end of the scale, Delaware, Hawaii, Oregon in South Dakota all reported a rise in their net pension liabilities of more than 60%.