“Davidson” submits:

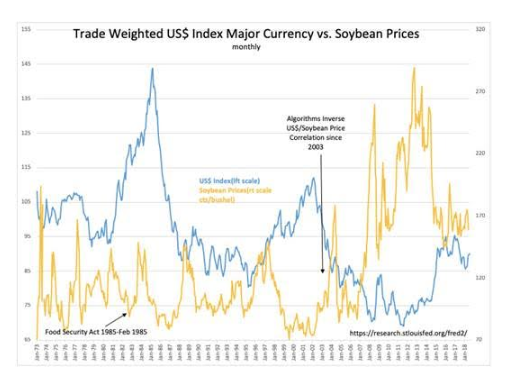

This article concerning a Farm Bill in 1985 and the outcome today reveals much of what we do not do, but should do, when learning and teaching others about developing investment perspective. The article bemoans the negative impact this government policy is having today and the accompanying US$/Soybean Price chart provides the long-term vs short-term economic context

[REITs]

Q3 hedge fund letters, conference, scoops etc

Much of new government policy is in response to previous poorly developed policy. The lack of historical perspective is driven by the political need to ‘do something’ in order to reelect politicians. The current over-planting of Southern Yellow Pine which proved such a loss to CALPERS recently is the product of government spending beyond its means of the 1960’s-1970’s which led to high inflation which in turn led to Paul Volcker raising rates sharply in response which in turn resulted in global capital rushing to invest in 18% Treasury obligations which drove the US$ higher by 50% and resulted in plunging agricultural prices in 1985. Plunging farm prices moved politicians to create the Food Security Act 1985(Feb 1985) which included the Southern Pine planting program thus taking some land out of agricultural production. This series of events came from a series of government policies attempting to engineer societal outcomes and now 30yrs+ later another poor outcome.

Only by connecting society’s perceptions and responses to market activity on a global basis and over the long-term can we truly develop investment common sense.

Man Who Steered Timber Subsidy Program Calls It His Biggest Regret

It ‘turned into a boondoggle,’ says Mike Gunn, who led efforts to add the Conservation Reserve Program to 1985 Farm Bill