The Lincoln Middle Market Index is a first-of-its-kind index that is a barometer of performance of private companies in the U.S., primarily owned by private equity firms. Given that private companies compose approximately 1/3 of the private sector’s GDP and traditionally do not report revenue figures, the index is a significant resource as it tracks changes in enterprise values over time, enabling private equity firms and other investors to benchmark private company investments against their peers and public markets (S&P 500).

[timeless]

Q2 hedge fund letters, conference, scoops etc

Below is the official announcement of the Lincoln MMI’s Q2 2018 results. Here are some highlights:

- Enterprise multiples in the middle market are at a peak.

- Middle market enterprise values are increasing faster than the S&P 500 year-to-date, though growth in the middle market was somewhat slower in Q2.

- Growth in private middle market companies was driven by both improved performance and multiple expansion, whereas growth in the S&P 500 was driven by only improved performance. S&P 500 multiples were flat.

- The Lincoln MMI continues to demonstrate that valuations of U.S. middle market companies are less volatile than the S&P 500 because of lower volatility in enterprise value multiples. In the long run, earnings remain the driver of enterprise value growth for all companies.

The index was developed by middle market investment bank Lincoln International, together with Professors Steven Kaplan and Michael Minnis of the University of Chicago Booth School of Business, to provide a yardstick for the measurement of private middle market companies, which Lincoln is uniquely situated to develop given its large valuation business. Lincoln conducts valuations of approximately 1,400 portfolio companies owned by leading private equity firms each quarter.

This index is differentiated from other indices in that it (1) tracks enterprise values of private middle market companies over time; (2) is based on valuations rather than executive surveys; and (3) covers a wide sampling of companies across a range of private equity firms’ portfolios.

Lincoln International’s Middle Market Index Shows Ninth Consecutive Quarter of Enterprise Value Growth

Middle market enterprise value multiples are at their highest level since the inception of the Lincoln MMI in Q1 2014

Lincoln International, a leading global, mid-market investment bank, today released the second quarter 2018 issue of its Lincoln Middle Market Index (Lincoln MMI). The Lincoln MMI is a unique index measuring middle market enterprise values. The first-of-its-kind index provides a useful benchmarking tool for investors in private companies and private equity firms, allowing them to track how comparable enterprise values change over time and correlate to the public stock market.

Key observations of the Q2 2018 Lincoln MMI include:

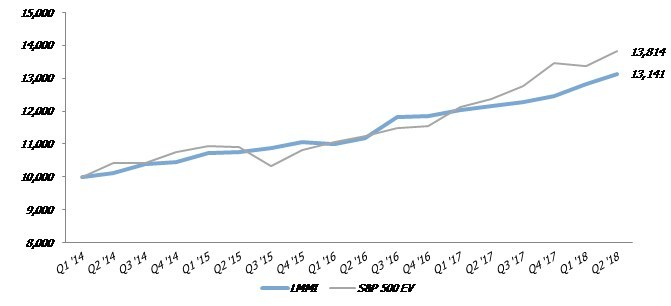

Graph: Relationship of the Lincoln MMI to the S&P 500 (Note: Both the Lincoln and S&P 500 EV returns above reflect enterprise values)

- Enterprise multiples in the middle market are at the highest level since the inception of the Lincoln MMI in 2014 Q1.

- In Q2 2018, middle market enterprise values increased 2.5% compared to 3.4% for S&P 500 companies; however, for the first six months of 2018, middle market enterprise value growth of 5.5% beat that of the S&P 500 of 2.5%.

- Steady growth in the Lincoln MMI was driven by both improved performance and multiple expansion whereas growth in the S&P 500 was driven by only improved performance as multiples were flat.

- The Lincoln MMI continues to demonstrate that valuations of U.S. middle market companies are less volatile because of lower volatility in enterprise value multiples compared to the S&P 500; in the long run, earnings remain the driver of enterprise value growth for all companies.

“Private equity-backed middle market companies showed steady enterprise value growth this quarter, continuing the trend of growth with low volatility. Much of this growth over the last year relates to the industrial and technology industries as both experienced double-digit growth since Q2 2017,” said Steve Kaplan, Neubauer Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business, who assists and advises Lincoln about the index.

“While improved earnings drove all of the growth in the S&P 500 this quarter, earnings improvement was aided by increases in market multiples for the middle market,” Ron Kahn, Managing Director and head of Lincoln’s Valuations & Opinions Group added, “Middle market multiples increased to their highest level since inception of this index, reflecting the market’s strong performance through mid-2018 as corporate earnings, employment and the U.S. economy remain strong. Additionally, we believe the earnings of all companies are increasingly showing the benefits of the December 2017 tax reform. Regardless, we are certainly aware that we continue to be in a period of strong stock market performance and declines for any reason, such as trade or monetary policy, are always possible.”

Kahn continued, “The Lincoln MMI enables investors in private companies and private equity firms the ability to compare or benchmark their investments against an index comprised of hundreds of privately held companies. It demonstrates that middle market companies generate returns comparable to major public stock market indices but with less volatility.”

Industry Sub-indices & Key Observations:

Lincoln breaks down the Lincoln MMI into six industries (business services, consumer, energy, healthcare, industrials, and technology) which provides unique insight into the performance of middle market companies by sector.

- Middle market industrial companies followed their record quarterly enterprise value growth in Q1 2018 of 4.9% with a new record quarterly enterprise value growth of 5.2%.

- Business services enterprise values in the middle market declined in Q2 2018 after five quarters of steady enterprise value growth.

- Middle market technology companies outperformed all other industries over the past year with quarterly enterprise value growth of over 5.0% in three out of four quarters.

- Although each industry showed enterprise value growth over the past year, industrial and technology companies grew 14.0% and 20.5%, respectively, compared to less than 3.0% for the four other industries.

About the Lincoln Middle Market Index

The Lincoln MMI is the only index that tracks changes in the enterprise value of U.S. privately held middle market companies, primarily owned by private equity firms.

The Lincoln MMI seeks to measure the variation in middle market companies’ enterprise values by analyzing the aggregate change in both company earnings as well as the prevailing market multiples of nearly 400 middle market companies each generating less than $100 million in annual earnings. The Index is calculated using anonymized data on an aggregated basis by Lincoln’s Valuations & Opinions Group, which has what we feel are unique insights into the financial performance of thousands of portfolio investments of financial sponsors, business development companies and private debt funds.

The methodology was determined by Lincoln in collaboration with Professors Steven Kaplan and Michael Minnis of the University of Chicago Booth School of Business. While other indices track changes to a company’s revenue or earnings, the Lincoln MMI is different in that it tracks the total value of these companies. Significantly, the large number of middle market companies used to create the Lincoln MMI helps ensure that the confidentiality of all company-specific information used in the Index is maintained.

Starting with a benchmark value of 10,000 as of March 31, 2014, the Lincoln MMI increased to 13,141 as of June 30, 2018, resulting in an annual compounded growth rate of 6.6 percent per year since inception.

For more information, visit www.lincolninternational.com/services/valuations-and-opinions/lincolnmmi