Pipelines (aka midstream equity) have better earnings stability, but the same dividend risk as REITs. The price volatility, measured by max drawdown, is the same also. But aren’t earnings what ultimately count?

Q3 hedge fund letters, conference, scoops etc

(Note: DCF is Distributable Cash Flow, cash flow available after all expenses and maintenance of buildings and pipelines. For a REIT, it is often called FAD, funds available for distribution)1

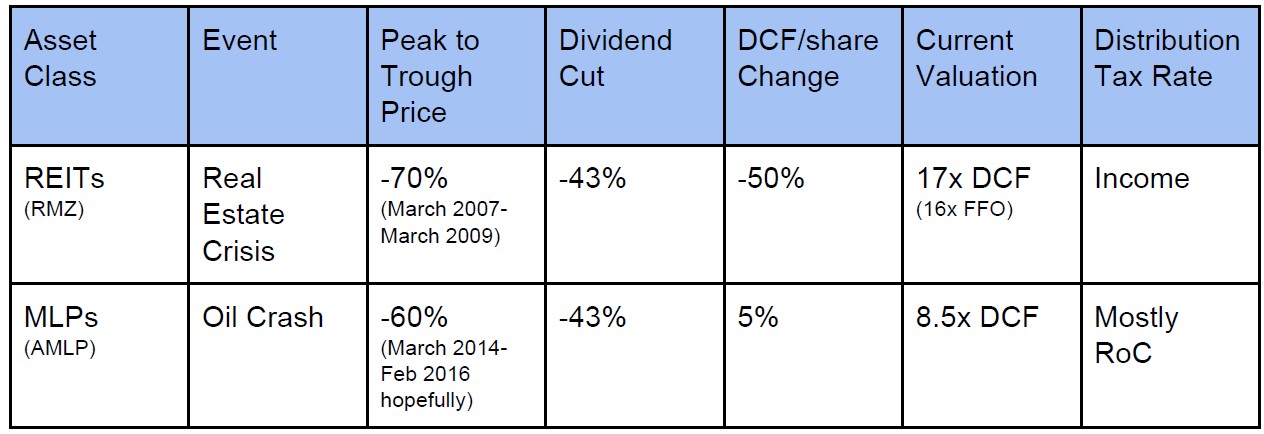

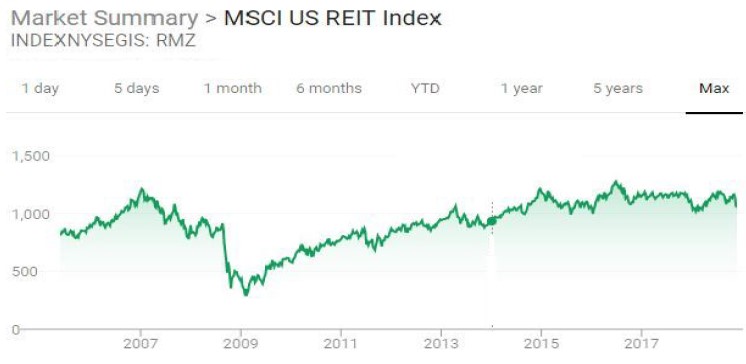

Figure 1: REITs crash and recovery

Figure 2: Midstream equity under immense pressure since 2015 but earnings are higher!?

1 Source for MLP data is Wells Fargo, source for REIT DCF is Deutsche Bank. Price charts from Google.

Article by Matt P