Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Q1 2020 hedge fund letters, conferences and more

Is the market environment turning favorable for active equity managers? It seems a strange question to ask in the midst of a pandemic and heightened market volatility, but history tells us that it is during just such turbulent times that active managers excel. There is accumulating evidence that market conditions are growing more attractive for showcasing stock-picking skills.

Active versus Passive

It is well established that active equity mutual funds have underperformed their passive counterparts over the last 10 years or so. A significant portion of this underperformance can be attributed to the large percentage of closet indexers included in the “active” equity universe. Later on, I will discuss the impact of true indexing versus closet indexing on the performance of active equity funds.

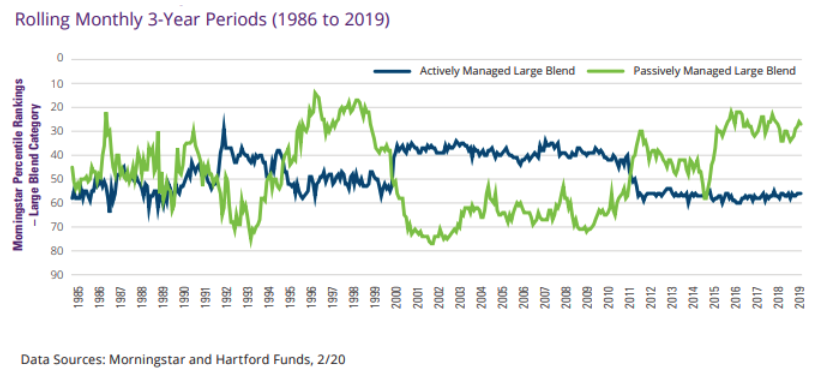

What is not well known is that active funds have gone through extended periods of under- and out-performance. The graph below, from a recent Hartford Funds study, reveals the cyclical nature of this performance. Since 2010, active funds, as measured by what is thought to be the most highly efficient market segment, Morningstar’s large-blend funds, underperformed their passively managed counterparts. However, for the 10 years prior to that, active funds outperformed. Looking back to 1985, there have been extend periods of both under- and out-performance.

The authors also found that, over the last 30 years, active bested passive in 19 of the 26 corrections (a 10% or greater market drop). The recent coronavirus market crash has been dramatic, resulting in a drop of more than 30%, producing the fastest descent into a bear market ever experienced.

Does the dramatic market turmoil of the last few months presage an extended period of active equity out-performance, similar to what we saw after the Dotcom bust and the 2008 Great Recession? There is good reason to believe so.

In recent years, we have not seen this level of uncertainty regarding individual stock valuations. The partial economic worldwide shutdown and massive governmental financial stopgap measures are historically unprecedented. They create difficult-to-decipher crosscurrents that will dominate the forthcoming economic and market recoveries.

It is in just such situations that skilled investment teams shine. It will be sometime before normal valuation ranges return. The resulting wide range of individual-stock returns will provide fertile ground for active equity.

Read the full article here by C. Thomas Howard, Advisor Perspectives