In their latest Weitz Quarterly Connection Webcast, the team discussed how they use their Weitz Quality Score Matrix to identify quality companies. Here’s an excerpt from the webcast:

Q2 2021 hedge fund letters, conferences and more

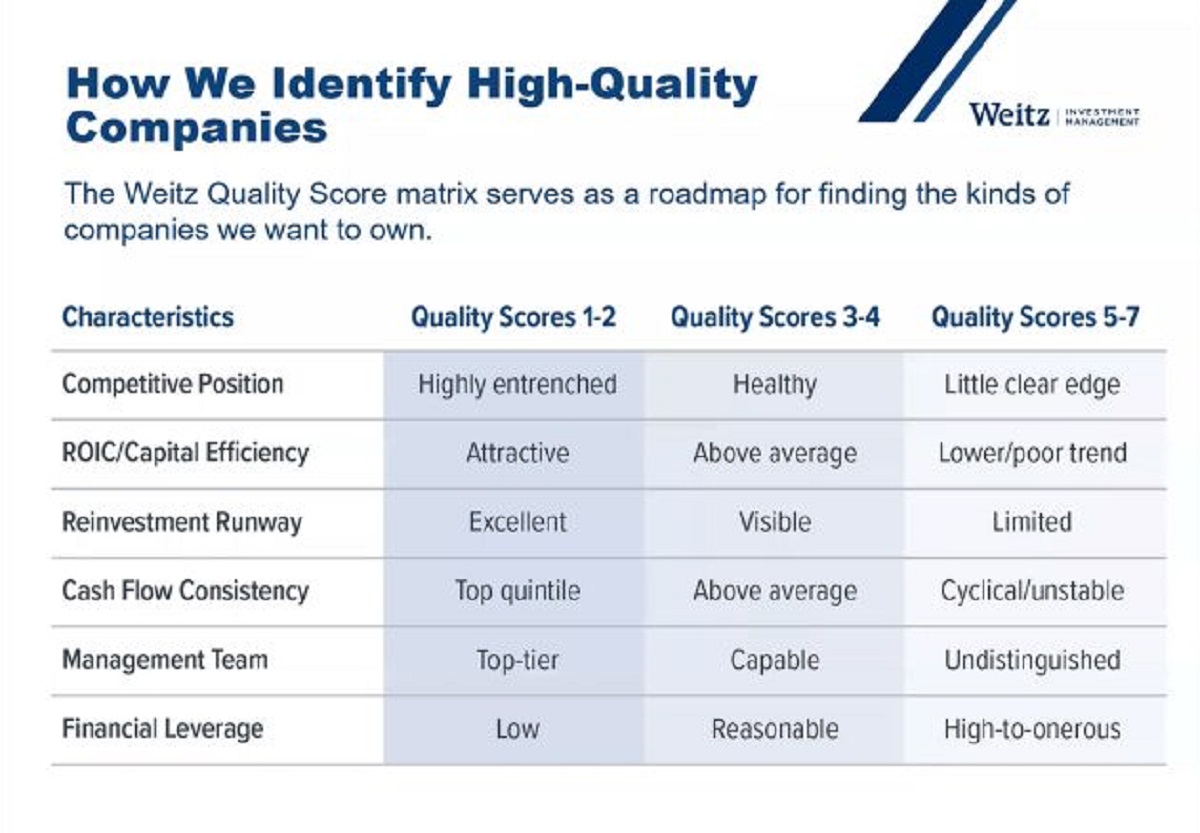

So, a question may be how do we identify quality companies? And, you know, we go about our process using both quantitative and qualitative analysis. The analysis that our investment team members undertake is certainly extensive, as you would expect it to be, and this slide provides a look at our proprietary quality score matrix and the six factors that the investment team focuses on when they’re researching a company.

So, we score each factor on a scale from one to seven, with one being the best and seven the worst. Then we roll up those scores to arrive at a total quality score for each company. We’re most interested in owning quality score one and two companies, but we’ll also own quality score three and a few quality score four companies, usually if we believe that there’s a clear pathway for that company to move higher in the months and years ahead. We’re really not interested in owning the stock of companies that we score at a five through seven.

Of course, you know, valuing companies is not an exact science. And some of the quality factors require, you know as Wally has often said, more art than science. But by evaluating each company based on the factors that you saw in that previous slide, we believe we have a process that works and is repeatable.

And on this slide here, you know, you can see a few of the companies among our current top holdings, depending on the fund.

And I think most of these companies, you probably recognize and know them as strong businesses. And our focus on quality businesses is because whenever the times come that the market corrects, we want to be sure that we own companies that can not only survive, but also take advantage of the distress. And we believe that sticking to our approach allows us to help grow investors’ capital over time.

You can find the webcast and transcript here:

Weitz Quarterly Connection Q3 2021

For all the latest news and podcasts, join our free newsletter here.

Article by The Acquirer’s Multiple