According to The Vanguard Group website, the Vanguard Total World Stock Index Fund (also available as the Vanguard Total World Stock ETF), currently holds 9,045 stocks. We have yet to find an alternative that holds a more globally diversified portfolio.

Q2 2021 hedge fund letters, conferences and more

Diversification reduces risk

It is now common knowledge across the world that a seatbelt reduces the risk of death from accidents. It is also almost equally common knowledge that a diversified portfolio of stocks reduces the risk that anyone stock’s demise would kill a portfolio’s return.

Can you over diversify?

The marginal benefit of an auto manufacturer adding five additional seatbelts for the driver of a car is so small that it would not be worth the cost. Similarly, with stocks, there is some optimal point that adding additional stocks to a portfolio has only a very tiny ability to reduce risk. The main tradeoff is the cost. But advancements in the world of finance have allowed additional stocks to be added to a portfolio with almost no impact on cost. This can be witnessed by the fact that the Vanguard Total World Stock Index Fund, which owns more than 9,000 stocks, has fees of 0.10% (and the Vanguard Total World Stock ETF has fees of only 0.08%).

Footsie with Vanguard

The VT fund explains that it tracks the FTSE Global All Cap Index, as follows:

“The FTSE Global All Cap Index is a market-capitalisation weighted index representing the performance of the large, mid and small cap stocks globally. The index covers Developed and Emerging Markets and is suitable as the basis for investment products, such as funds, derivatives and exchange-traded funds.”

There are 9,231 stocks in the FTSE Global All Cap Index and there are 9,045 stocks in the VT fund. The average annual return of the VT fund over the past 5 years was 14.3%, while the benchmark was up 14.2% per year, implying that the tracking error is tiny enough that any analysis of the index data provided by FTSE can completely represent what’s happening in the VT fund.

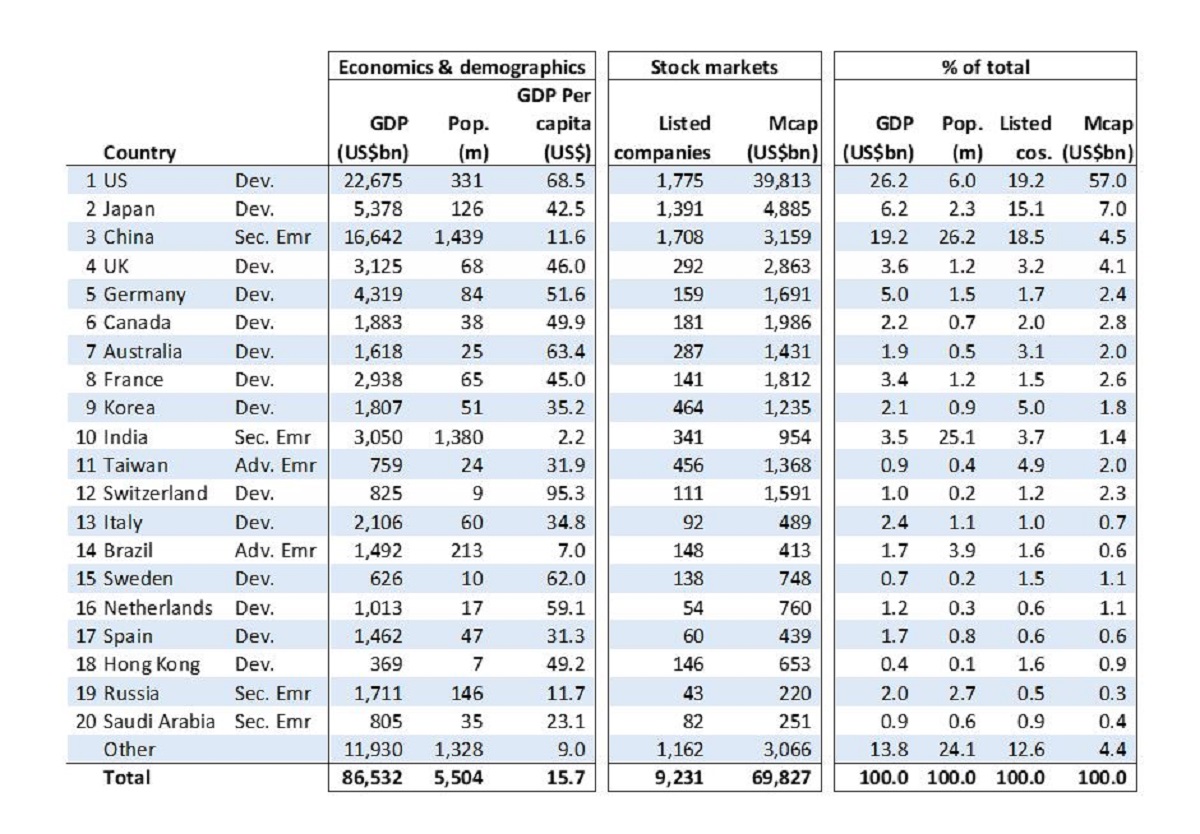

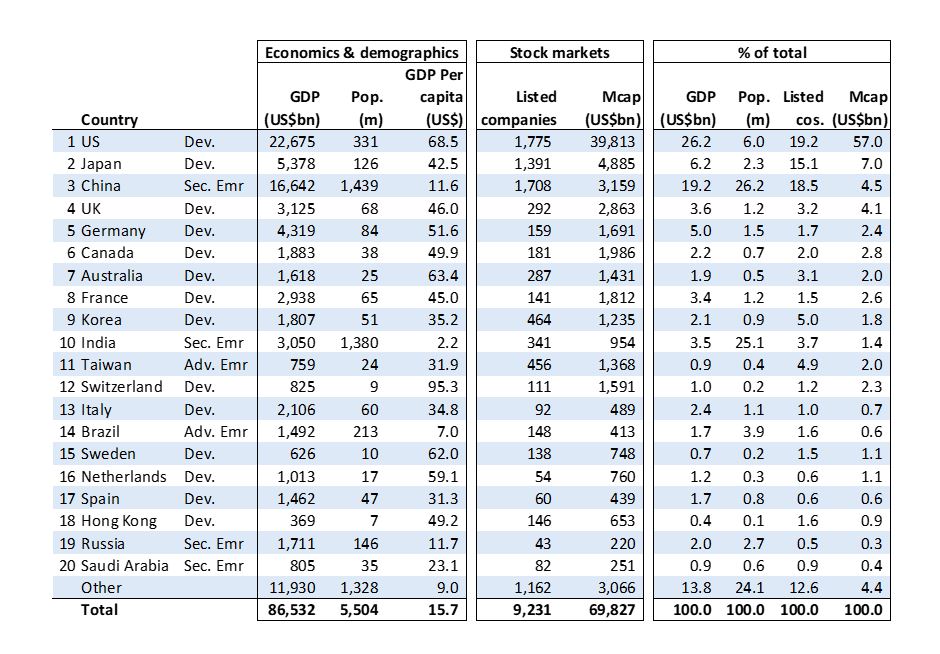

Diversification across economies and populations

Using the data provided by FTSE, we ranked the countries in their index by GDP, population, and per capita GDP with the goal of understanding each country’s contribution to the world. Of the 20 countries at the top of the list

- US, China, Japan, Germany, and the UK had the largest economies.

- China, India, US, Brazil, Russia, and Japan had the largest populations.

- Per capita GDP was highest in Switzerland, the US, Australia, Sweden, Netherlands, and Germany.

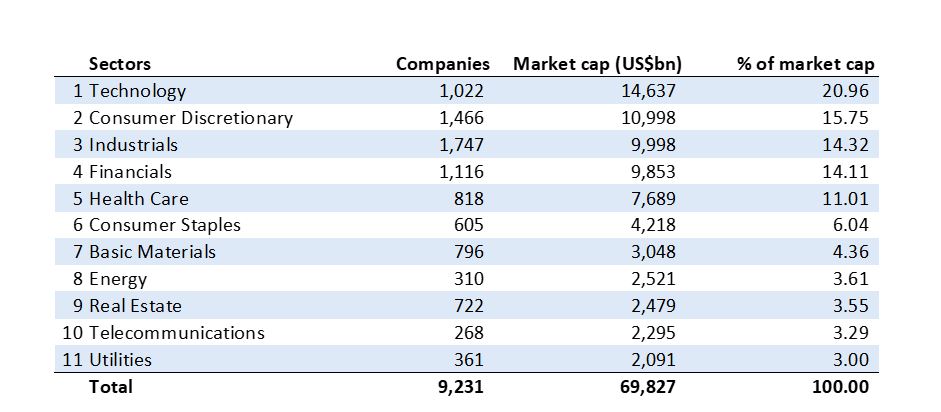

Sector diversification

FTSE also reveals the sector breakdown of its index, which we can assume is identical to the VT fund. The first thing that stands out is that 21% of the market capitalization of the 9,231 most investable stocks worldwide is in the Tech sector. A sector that was almost unheard of when I started working in the stock market in 1993.

The second-largest exposure was the Consumer Discretionary companies. These are the companies that sell mostly non-essential, but great stuff we buy like dryers, cars, TVs, etc. There is nearly an equal amount in Industrials and Financials sectors. The lowest representation is Energy, Real Estate, Telecommunications, and Utilities, each with 3-4%.

There are a tiny number of Telecommunications and Utilities companies because these tend to be granted the right to exist by governments and those governments generally limit the numbers of competitors they face.

But no matter how you slice the VT fund or the FTSE Index, an investor is not only geographically diversified but also diversified across the various sectors in the economies of the world.

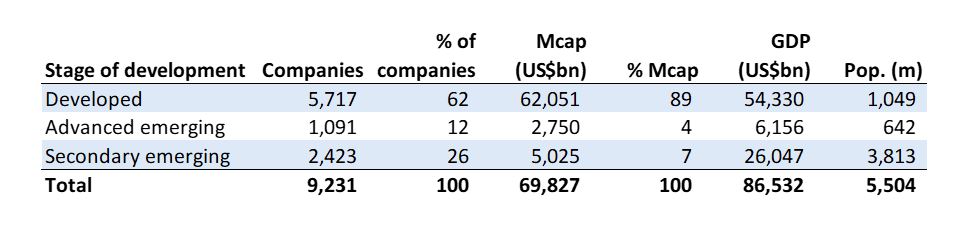

Diversification across stages of development

FTSE classifies countries by their stage of development. This classification is different than just ranking a country by its stage of economic development, as it also focuses on the development of that country’s capital markets. For example, a country such as Taiwan may be considered economically developed, but because of government policies related to things like restrictions on shorting stocks or not allowing off-exchange transactions, it might not be classified by FTSE as developed. The general principles FTSE considers are:

- Market and regulatory environment

- Foreign exchange market

- Equity market

- Clearing, settlement, and custody.

The largest markets of the developed markets are US and Japan. Taiwan and Brazil are the largest of the Advanced Emerging markets, while China and India are the largest of the Secondary Emerging countries.

The overall FTSE and the VT fund have about 89% of the capitalization in the Developed markets, 7% in Secondary Emerging markets, and 4% in Advance Emerging markets.

When considering global diversification, consider the VT fund

The Vanguard Total World Stock Index Fund (and Vanguard Total World Stock ETF) currently holds 9,045 stocks and covers every major stock market and economy in the world. Owners of this fund have the most globally diversified portfolio available at the lowest price.

Article by Andrew Stotz, Become A Better Investor

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.