The post was originally published here.

When Warren Buffett acts, the world listens

Download the full report as a PDF

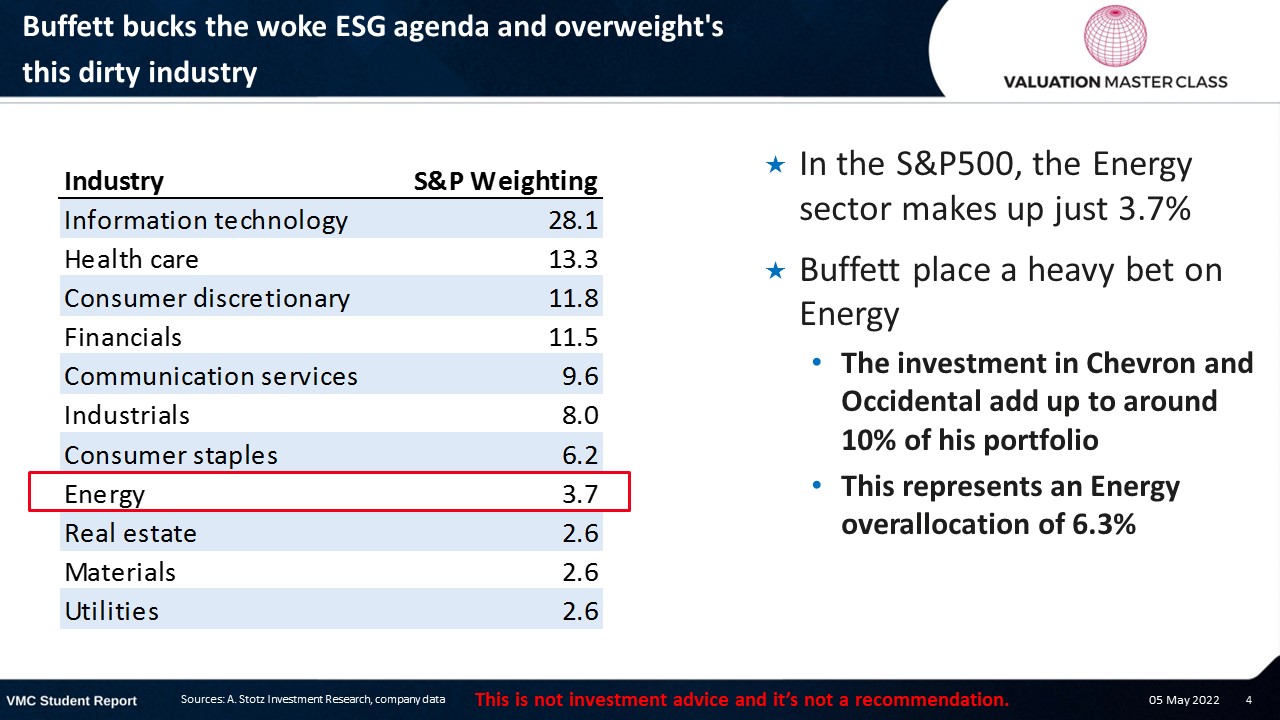

Buffett bucks the woke ESG agenda and overweight’s this dirty industry

- In the S&P500, the Energy sector makes up just 3.7%

- Buffett place a heavy bet on Energy

- The investment in Chevron and Occidental add up to around 10% of his portfolio

- This represents an Energy overallocation of 6.3%

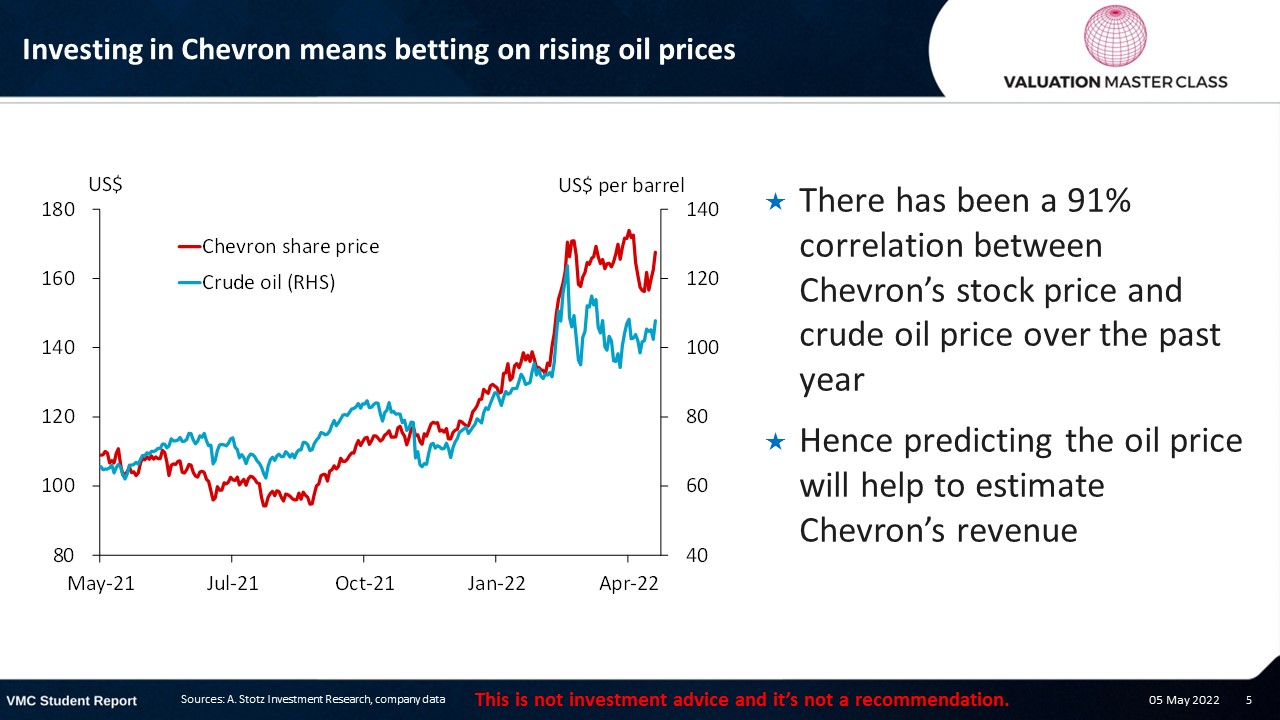

Investing in Chevron means betting on rising oil prices

- There has been a 91% correlation between Chevron’s stock price and crude oil price over the past year

- Hence predicting the oil price will help to estimate Chevron’s revenue

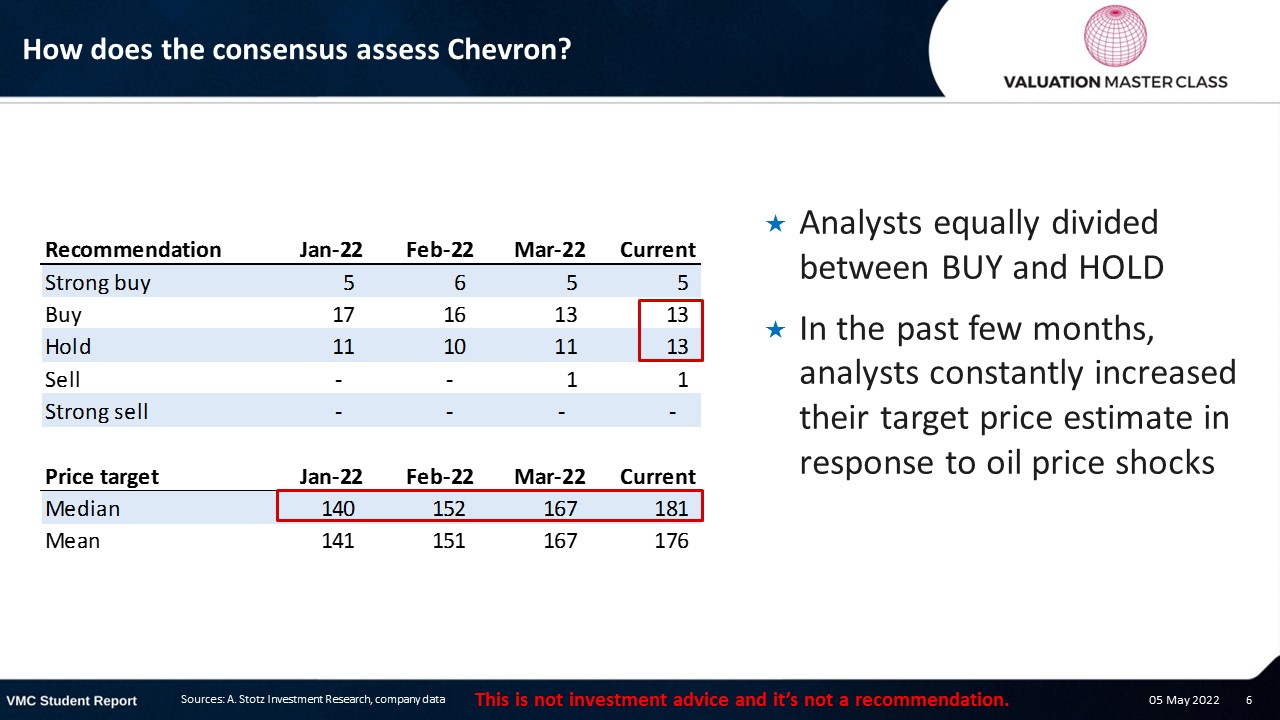

How does the consensus assess Chevron?

- Analysts equally divided between BUY and HOLD

- In the past few months, analysts constantly increased their target price estimate in response to oil price shocks

Download the full report as a PDF

Article by Andrew Stotz, Become a Better Investor.