How Financial Advisors Can Survive The Low-Fee Apocalypse

ETFs and robo-advisors are killing the traditional financial advisory model. Those that want to survive need to overhaul their approach. The standard 1% AUM fee no longer works. The future success of financial advisors is through subscription-based, freemium business models. Advisors that change their model while going smaller (not larger) will thrive.

Q3 2019 hedge fund letters, conferences and more

Financial advisors must switch from an asset-gathering model to a tier-based subscription service. Cut fees for lower-end clients and offer exclusive, personal services to high-end clients. If the financial advisors want to contend with the machines they need to learn from their rivals in tech. Freemium, subscription-based business models can work.

History Rhymes: Robo-Advisers and Vanguard’s Playbook

Leading the destruction of traditional financial advisory models is Vanguard. This isn’t new to Vanguard. They’re the same company that destroyed the traditional mutual fund model. Their weapon? Cheaper ETF alternatives. The mega-asset manager is doing the same thing with financial advisors.

In his WSJ article The Rise of Ultra-Cheap Financial Advisors, Jason Zweig highlights this shift in Vanguard’s model (emphasis mine):

“Vanguard manages approximately $3 trillion in mutual funds and exchange-traded funds for a pittance of 0.19% in average annual expenses. The firm’s Personal Advisor Services unit, which provides investment management and financial planning for a flat 0.3% annual fee for most clients, has $3.6 billion in assets, up from just $755 million at the end of 2013.”

They come in and rip through the price floor. They’re able to absorb the lower cost due to their scale. Then they make up for the lower fees by growing AUM. If this makes you think about Amazon’s model, you’re on the right track.

But it’s not just Vanguard that’s challenging traditional financial advisors. It’s the robots. It’s automation. It’s everything we expected.

The Rise of the Robots

To say robo-advisors have changed the financial advisory industry is an understatement. They’ve forced advisers to do two things:

- Justify their high fees to their clients

- Feel pressure to offer more service to justify their fees

Technology-driven companies offer basement level expenses for portfolio management. On top of that, many robo-advisers are introducing high-yielding interest bank accounts. Lex Sokolkin thinks these high-yielding interest accounts are customer acquisition costs.

Meanwhile, Charles Schwab now offers $30/month unlimited financial planning for its clients. This is in contrast to their historical 28bps asset-based fee. How are they able to charge so little? Most of their smaller clients are in automated, AI-driven portfolios. These portfolios automatically rebalance and adjust based on individuals’ risk tolerances.

Cynthia Loh, VP of Digital Advice at Schwab, says clients are demanding this type of payment and transparency. She goes on to say, “Customers are used to engaging with subscription services.” The demand for this service is growing. Since launching the new subscription-based offering, the company’s seen a 40% increase in average household assets enrolled.

But, But, Muh Human Interaction

The rise in robo-advisor popularity coincides with one of the longest bull markets in history. I’m not saying there’s a direct correlation between stock market rise and a move towards AI-drive advice. Yet people tend not to worry about their assets if all they do is appreciate in value.

What happens during the next economic downturn? Will robo-advisors remain as popular? Will people crave the comfort of their personal advisor? A defense among advisors is that they’re not paid for out-performance. They’re paid to manage their clients’ emotions.

Fair enough. But if that’s the case, doesn’t it make more sense to price your services in the same manner as a clinical psychologist? Via an hourly/session rate? If a client calls once or twice a year, why should advisors be compensated for ‘managing’ automated portfolios driven by AI … for 1% a year?

Millennials Are Familiar with Subscription-Based Models

Netflix, Amazon, Hulu, Disney+ … I could go on. The number of subscription-based services grows every day. We’re no longer a society that buys and owns things. Rather we rent, lease and subscribe to products and services on a term-by-term basis.

This shift is important for the financial advisory space because future growth will come from a generation used to a different model. A model not based on assets under management. But a model based on flexibility, transparency and technology.

The growth in subscription-based services is mind-boggling. They’ve grown 100% a year for the last five years. 15% of all online shoppers subscribe to at least one subscription-based service.

If your goal is to capture the next largest market (millennials and Gen X’ers) it makes sense, then, to offer something of familiarity.

A Few Survival Ideas

Offer Subscription-based revenue model for younger clients

Younger clients may not have sizable assets yet, but over time they will. Offering a subscription-based solution now gets your foot in the door and share in their wallet. Then, as they grow and accrue more assets, your firm becomes the natural solution to their needs.

Ken Fisher is an out-spoken critic of the subscription-based model. In a Barrons.com article, Fisher says, “[it’s a] stupid model aimed at moneyless clients. Subscription fee-based models work great for advisors who want to stay tiny and accomplish very little.”

Fisher isn’t the only critic. Many advisors claim they spend most of their time as psychologists, not as investment decision-makers. A subscription-based service could result in hundreds of questions each month. After all, clients would try and squeeze out as much value per charge as they could.

Use The Machines

This model can work on existing clients with small accounts. Many advisors use low-cost ETFs that automatically rebalance. Instead of charging based on assets under management, you charge a monthly (or yearly) recurring amount until a certain AUM is reached.

The argument against this is that these small account clients will take up advisors time and energy. Then, if you charge a smaller, subscription-style service on that time and energy, you net a loss.

Combat that using an automated approach. Pairing a low-cost ETF with automatic rebalancing reduces the time and energy needed to monitor the portfolio. It’s also about setting realistic expectations between client and advisor. The advisor should make the client aware that with X amount of assets, you’ll get X amount of service.

And it’s not low-quality, bottom-of-the-barrel service, either. That’s a common misconception about this method. You’re simply not offering the full suite of services that you would a client with 50x more money. If anything, it gives smaller clients an incentive to stay and grow their assets with you.

Platform-type business or (Financial Wellness as a Service)

Financial advisors must ask themselves this question: “Do we integrate or separate?” The technology disruption will force advisors to make a decision. Do they want to be the aggregator or a specializer? The subscription model works for both decisions.

If you choose to specialize, focus on one area of wealth management or financial planning. Then do that better than anyone. An example of this would be an advisory firm that exclusively offers estate planning advice.

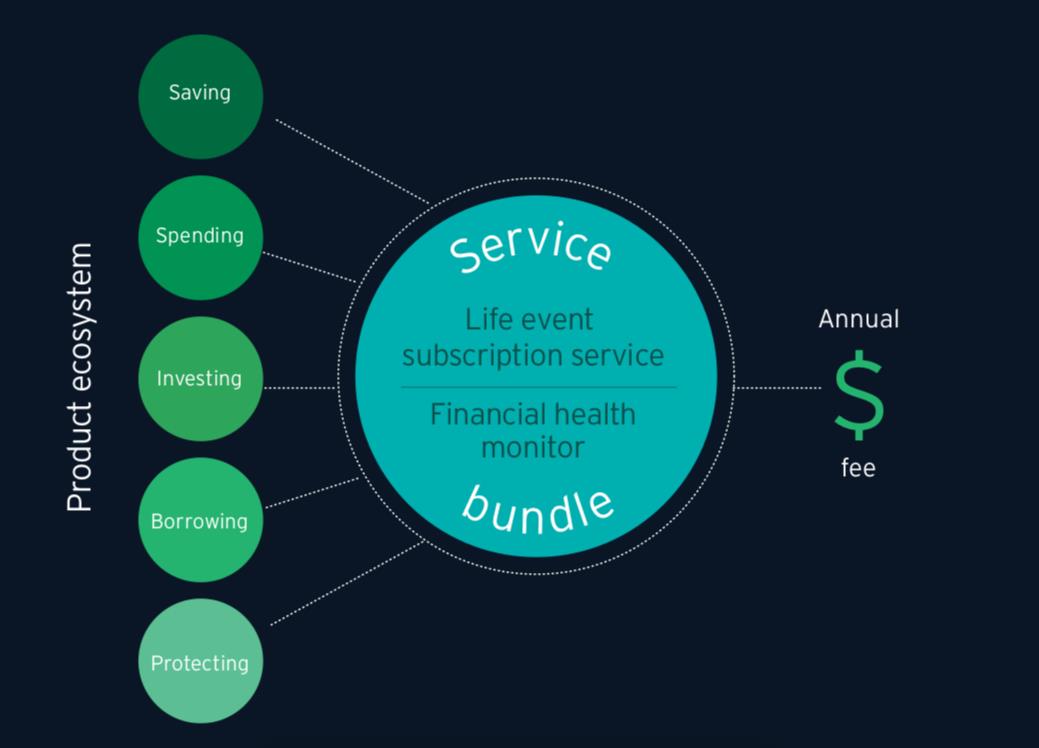

Then there’s the aggregator method (or dare I say) Financial Wellness as a Service (FWaaS). Like Disney+ or Netflix, a FWaaS model combines all areas of wealth management. You’d have investment management, financial planning, estate planning, tax advice, retirement planning, savings accounts, and more.

The goal with this service is to be the one-stop-shop for all your client’s financial wellness. Check out the picture on the right from the Earnst & Young report:

The Costco Model Applied to AUM

The secret to success could lie in Costco’s business model. If you’re not familiar, AK at Fallible has an incredible series on COST. In short, COST makes no money on the produce they sell. Instead, all the money is made on the annual membership service. Membership revenues drop straight down to the bottom-line in pure profit.

So how can financial advisory firms learn from Costco? Advisors can turn AUM fees into an at-cost charge. Like Costco buying and selling peanuts for the same price, investment firms could charge AUM fees at-cost of their back-end processes. For example, if you operate at 0.35% of AUM fees, charge 0.35%.

Sure, you won’t make money on these fees.

But that’s the point.

The goal is to get your foot in the door. From here, you charge a subscription-based service based on financial planning, wealth management, tax guidance, estate planning, etc. The service can be customizable and personalized. Unique to each individual.

Concluding Thoughts: The Real Winners

Advisors, now more than ever, are closet-indexing their client’s assets. Clients in firms that index should demand lower fees for asset management. After all, they can get the same management for fraction of the cost with robo-advisors.

A tiered service service (as opposed to fee-based) based on asset level will keep financial advisory firms relevant amongst the robots, automation and larger competitors.

The winners of the future will be the firms that integrate the younger, lower asset level clients with subscription-based models, while providing tailored, fee-based services for high-net-worth clients.

This combination captures the best of both technology and personalization. Advisors can focus their time and energy on serving their highest-priority clients. In turn, their lower tier clients receive adequate services for their current asset level.

AI, automation and ETFs drastically reduce the cost of acquiring (and keeping) smaller asset clients. In turn, you increase the probability of accruing more assets as your smaller clients gain wealth.

Main Source: NextWave Consumer Financial Services: financial subscriptions are coming, Ernst & Young LLP

Article by Brandon Beylo, Macro Ops