Asia offers investors some of the biggest investment opportunities for the future. That was one of the key takeaways from the recent FundForum conference in Berlin, the largest gathering of investment management professionals in the world.

[timeless]

Q2 hedge fund letters, conference, scoops etc

The opening day of the conference explored the theme of ‘global power shifts’ with economist and broadcaster Linda Yueh, who outlined the shifting geopolitical factors driving China towards becoming the largest economy in the world.

Developing capital markets equals more fund managers

Asia matters to money managers for a number of reasons. First, its capital markets are quickly developing and opening up to international investors. According to CEIC, the total market cap of companies listed on the Shanghai Stock Exchange hit RMB 32 trillion on 1st May this year from less than RMB 16 trillion five years ago. In the last 12 months, authorities have announced lifting ownership caps for securities firms and funds, the rating of local bonds by international ratings agencies.

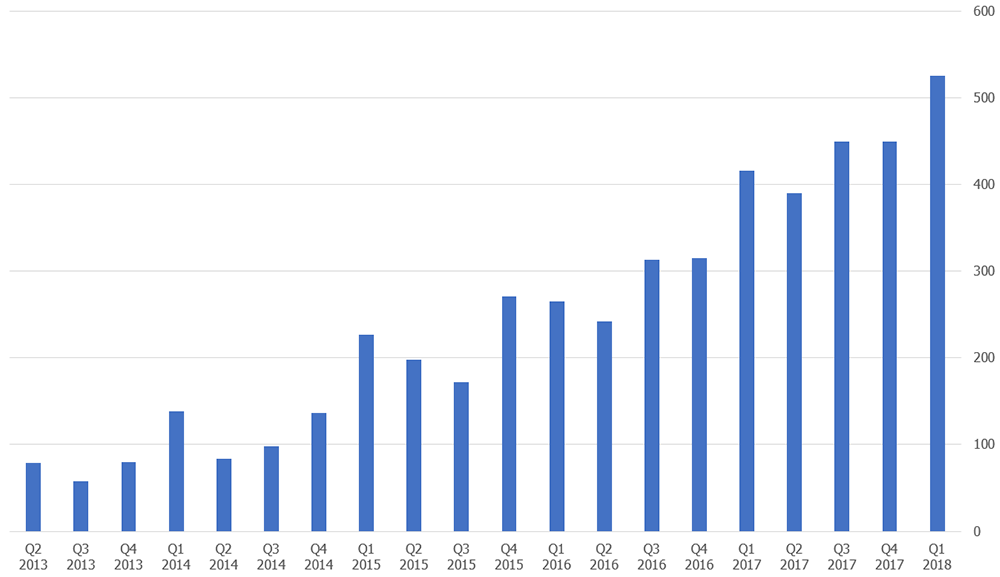

Unsurprisingly, more and more fund managers are coming to market with Asia or China-focused strategies. Today in eVestment, there are 525 products with greater than 25% exposure to China, compared with just 69 products five years ago. eVestment now tracks funds with nearly $30 billion invested in China A-Shares, compared with just over $10 billion five years ago. Moreover, almost every product has been viewed in the last three months – an unusual amount of interest for such a broad universe.

Number of Products on eVestment with 25%+ Exposure to China

Additionally, investors and manager selection professionals should note that in 2013, the only products with 25%+ exposure to China on eVestment were pure Chinese Equity products. Since then, global emerging markets and broad AsiaPacific products have been added to the mix.

Number of Products on eVestment with 25%+ Exposure to China by Category

China’s middle class need refrigerators

Beyond capital markets growth, increased market access, and more products offering China exposure, Asia’s developing middle class also matters.

Yueh highlighted in her FundForum address that global poverty is dropping dramatically and this has profound implications for markets. In 2009, one in three global citizens was below the line, as measured those that have a refrigerator according to the World Bank, but in 2030 it is projected to be just one in ten. According to Yueh, the global middle class will rise to 4.9 billion people in 2030 (compared to 1.8 billion in 2009). More than half the world will be middle class – with the bulk residing in Asia.

Huge swells in demand over time can be like manna from heaven for investors thinking about long-term portfolios. Unsurprisingly, eVestment data shows that emerging markets investors have significantly increased allocations in the last three years to companies like China’s home appliances and consumer electronics behemoth, the Haier Group, through its listed subsidiaries. eVestment data below shows that the percentage of portfolios holding Haier stocks has more than doubled in the last three years.

Emerging Markets Investors Increasing Allocations to Haier Group

America First?

In an age where Donald Trump’s ‘America First’ policy is promoting ‘Buy American, Hire American,’ there is no doubt that Asia offers an attractive investment alternative – particularly for nimble investors with good market access.

China may not be a new story to emerging markets investors, but the long-term growth trends continue to present new and intriguing opportunities for investors looking to screen for emerging markets managers and harvest returns in Asia.

Article by Stephen White, eVestment