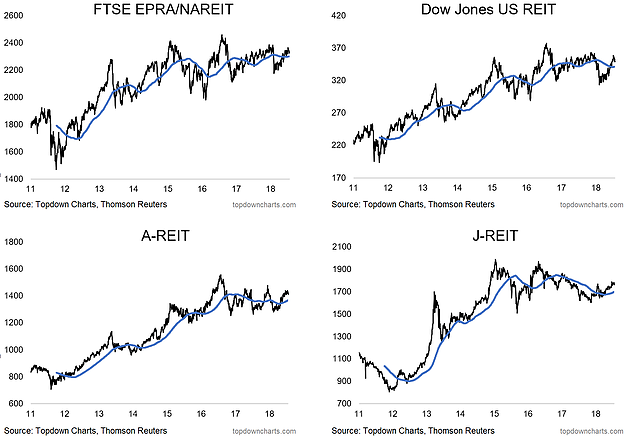

Global REITs were one of the key casualties of the initial leg of the global equity market correction this year (i.e. the part which was driven by spiking bond yields). The charts below provide a survey of some of the major global REIT markets, and come from the new weekly Global Cross Asset Market Monitor (get in touch for details). Since then REITs have rebounded along with global equities, but with bond yields struggling to push any higher, the more stable relative-value backdrop (reach for yield) has helped further.

[REITs]

Q2 hedge fund letters, conference, scoops etc

The way I think about REITs is that very short term they are quasi-fixed income assets given the duration risk/interest rate sensitivity aspect. On a more medium term basis I’ve found they are more akin to growth assets – trending higher during an expansion… and like the rest of equities falling into a recession/growth slowdown.

At the moment I’m still leaning bearish REITs, particularly following the rebound to the upper end of the range, as they remain sensitive to a possible further push higher in bond yields. The other thing is commercial property valuations have been inflated by the low yield environment, and these high valuations depend both on low yields and continued growth in rental income. We often cover REITs and property in our institutional research service, as there can be some very good opportunities to add value in this space through the cycle for active asset allocators.

Article by Top Down Charts