The Travelers Companies (TRV: $143/share) – Closing Long Position – up 158% vs. S&P +131%

[activistinvesting]

Check out our H2 hedge fund letters here.

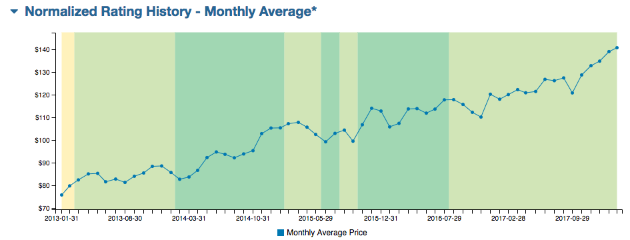

The Travelers Companies was originally selected as a Long Idea on 11/22/10 and reiterated on 11/18/14. At the time of both reports, the stock received a Very Attractive rating. Our investment thesis highlighted consistent after-tax profit (NOPAT) growth, strong free cash flow generation, and a low PEBV ratio that highlighted overly pessimistic expectations baked into the stock price.

During the 7-year holding period, TRV outperformed, rising 158% compared to a 131% gain for the S&P 500. TRV was downgraded to Neutral on 2/16/18 after our Robo-Analyst parsed the most recent 10-K. While TRV’s valuation remains attractive, the company’s ROIC fell from 10% in 2016 to 7% in 2017. This decline is the continuation of a downward decline in ROIC, which was as high as 13% in 2013. There is a strong correlation between improving ROIC and increasing shareholder value and due to this continued decline in ROIC, we are closing this position.

We hope investors were able to participate in the 158% rise in stock price since we first featured TRV.

Figure 1: TRV Stock Price and Risk/Reward Rating History

Sources: New Constructs, LLC and company filings

This article originally published on February 27, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Article by Kyle Guske II, New Constructs