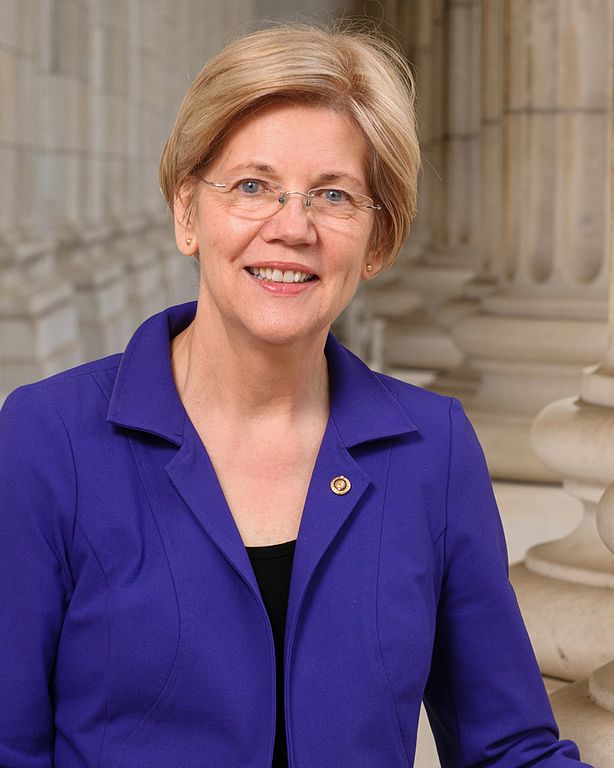

Sen. Elizabeth Warren’s proposal for drastic changes to corporate governance, which I wrote about in this space last week, continues to draw thoughtful responses from commentators. Colleague Ryan Bourne notes that one study “found that German firms were 27 percent less valuable to their shareholders” because of the workers-on-boards co-determination laws Warren would have us emulate. Moreover, the value given up was not merely transferred to the firms’ workforces but was in part dissipated through inefficiency.

[timeless]

Q2 hedge fund letters, conference, scoops etc

Now NYU law professor and Cato adjunct scholar Richard A. Epstein, a leading libertarian voice on law, tackles the Warren plan in a piece for the Hoover Institution’s Defining Ideas series. Epstein’s piece is worth reading in its entirety for his analysis of (among other topics) the “stakeholder” mystique, the efficiency-friendly role of share buybacks and executive incentive stock, and the constitutional infirmities of the overall Warren scheme (citing the unconstitutional-conditions doctrine), as well as his warning that large-scale capital flight from the U.S. could ensue if investors mistrust the whims of a new federal charter regulator.

In the passage I want to highlight, however, Epstein makes a point often overlooked in other critiques. Writing on the popular and populist Left these days often romanticizes the idea that business charters should be revocable by some central authority for misconduct (“corporate death penalty”), although it is often not spelled out whether the assets of a giant bank or oil or pharmaceutical company hit by scandal should be taken into the public sector by some sort of confiscatory state authority, allowed to revert to shareholders, or perhaps transferred to a successor entity that would maintain the same brands and facilities and headquarters as before (leaving the question of what exactly is being accomplished by charter revocation). Epstein takes the broad historical view:

…Warren wholly misunderstands the historical role and constitutional position of corporate charters. The last thing that any country needs for economic growth is a situation in which government officials decide which firms receive charters subject to what conditions. Does she really think that some public bureaucrat should have the power to refuse to issue Apple a corporate charter unless it puts community members or union members on its board, makes gifts to the Sierra Club, or adopts minimum minority hiring set-asides? And what should be done when thousands of firms balk at these conditions? Can they go to court, or does the federal board run the corporation directly?

Lest anyone forget, the great 19th-century corporate reform was the passage of general incorporation laws that allowed any group of individuals to form a corporation, with its attendant benefit of limited liability, so long as they met certain minimum conditions relating to their capital contributions, their ability to sue and be sued, and their board structures. The new legal regime ushered in sustained economic expansion by knocking out the political favoritism that had previously given some businesses corporate charters that gave them a huge edge over direct competitors denied similar authorization. It would be unsurpassed folly to re-open the doors to these abuses today.

Indeed, a key point about general incorporation laws was that they were egalitarian: you could launch an incorporated venture even if you were obscure, new in town, or out of favor with political influentials. Supporters of plans like Warren’s should be asked whether they really want some combination of political actors—very possibly appointees of Donald Trump or another President like him—to gain power to revoke Google’s or Amazon’s or Facebook’s charter to continue doing business unless the management agrees to cut a deal, perhaps involving private understandings with officialdom, to stave off such a penalty.

Reprinted from Cato at Liberty.

This article was originally published on FEE.org. Read the original article.

![]()